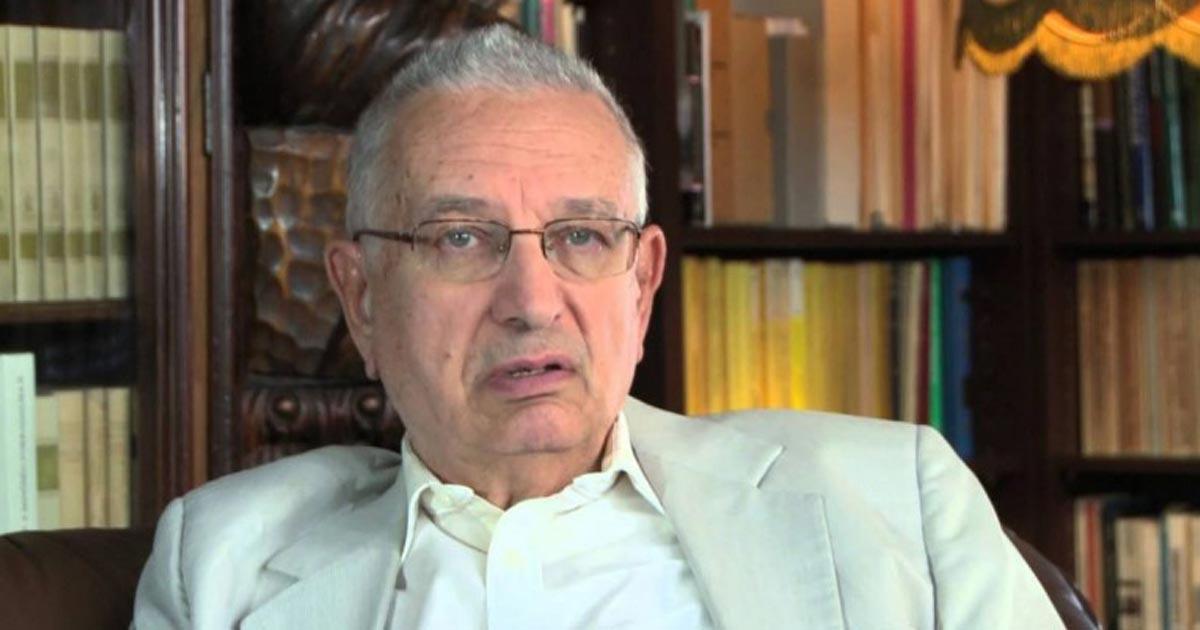

On the fourteenth of October 2020, Antal E. Fekete, the Hungarian-Canadian economist who saw himself as a monetary theorist following the tradition of Carl Menger, died in Budapest. Behind him was an eventful and fruitful life which was quite typical of the crazy last century. His experiences eventually filled Fekete with dark forebodings for the current century. We can only hope that this crazy year won’t become characteristic of an entire era, as his year of birth did. Antal Endre Fekete was born on the eighth of December 1932 in Budapest. Mass unemployment was rife in the midst of a deep global economic crisis. Hungary was heading towards National Socialism on the back of a severe banking crisis. The totalitarian, anti-Semite Gyula Gömbös had taken over the

Topics:

Rahim Taghizadegan considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

On the fourteenth of October 2020, Antal E. Fekete, the Hungarian-Canadian economist who saw himself as a monetary theorist following the tradition of Carl Menger, died in Budapest. Behind him was an eventful and fruitful life which was quite typical of the crazy last century. His experiences eventually filled Fekete with dark forebodings for the current century. We can only hope that this crazy year won’t become characteristic of an entire era, as his year of birth did.

On the fourteenth of October 2020, Antal E. Fekete, the Hungarian-Canadian economist who saw himself as a monetary theorist following the tradition of Carl Menger, died in Budapest. Behind him was an eventful and fruitful life which was quite typical of the crazy last century. His experiences eventually filled Fekete with dark forebodings for the current century. We can only hope that this crazy year won’t become characteristic of an entire era, as his year of birth did.

Antal Endre Fekete was born on the eighth of December 1932 in Budapest. Mass unemployment was rife in the midst of a deep global economic crisis. Hungary was heading towards National Socialism on the back of a severe banking crisis. The totalitarian, anti-Semite Gyula Gömbös had taken over the government shortly before Fekete’s birth. All around, belief in the omnipotence of politics was leading to a spiral of interventionism and polarization which would ultimately lead to the old Europe being destroyed by totalitarianism and war. Monetary policy played a role in this that is underestimated to this day.

Fekete was one of the few old Europeans to recognize the central role of money, on the positive side as a means of amicable division of labor, on the negative side as a casualty and lever of political intervention spirals. This led the mathematician to monetary theory, in which he sought to expand and update the old Austrian school of economics. As with all original contributions, it is too soon to definitively assess whether he introduced new errors and what these errors were. Yet his prominence as a sharp thinker who combined theory with profound historical knowledge is undervalued. This is partly due to his quarrelsome personality, which came between him and almost all of his comrades in arms and companions. But it is also partly because economics touches on questions of existence which hardly allow for objective sobriety. Even the representatives of the Austrian school of economics have to show their colors again and again in the madness of time, and the discourse is influenced by ideology, fears, and wishful thinking.

History provided Fekete with drastic and life-threatening lessons. In 1932, Hungary was still using the gold standard, a pengö was defined as just over a quarter of a gram of gold (around fifteen euros today). When the forint was introduced in 1946, it replaced 400 octillion (twenty-nine zeros!) pengös, after the worst hyperinflation in history. Prices had been tripling every day. Today a forint is worth just over quarter of a euro cent.

In light of this development, it is astonishing that Hungary has not produced more great monetary theorists. This is probably because the intellectual consequences of such socioeconomic disruption are always dramatic. Among the consequences are a declining aptitude for learning and a growth in escapism, whereby, paradoxically, the perception of the damage dwindles as the damage increases. This is why monetary policy is so popular, so formidable, and so underestimated.

The misfortune that drove Antal Fekete from his homeland until his later return turned out to be lucky for economics. This was also the case for other representatives of the old Austrian school. This tradition would not have survived in Europe. The legacy of Menger and Mises was mainly preserved in North America.

Fekete emigrated along with almost all of the other Hungarian fans of freedom in 1956, when a people’s uprising was bloodily crushed by the Soviet army. He first went to Vienna, just on the other side of the Iron Curtain, and then quickly on to Canada. There he began his academic career as a university professor in mathematics. He wrote a textbook on linear algebra and a handful of specialist articles. He considered his greatest contribution to be his proposal for a numbering system which expresses numerical values, however high, with the least digits possible—i.e., as economically as possible. The system of “stepnumbers” received no recognition and is typical of Fekete’s idiosyncratic approach, which also limited his impact in the field of economic sciences.

His real interest and prominence lay in the field of economics. Just like his stepnumbers system, his economic approaches are potentially highly significant, but sketchy and characterized by peculiarities. In spite of these peculiarities, Fekete never adorned himself with borrowed plumes; he preferred to mention the authors of good ideas or wise thoughts by name too often rather than too little. He also always encouraged his comrades in arms to check arguments and make any necessary improvements or corrections.

Unfortunately Fekete did not succeed in completing his life’s work. But the wealth of different insights and schemata proves to be a gold mine for any economist who struggles with the most difficult questions surrounding the theory of money, interest, and capital, and is sensitive to the devastating social consequences of heading down the wrong economic track. Fekete’s motivation to show the inhuman consequences of the history of money permeates his work in economics. It was his empathy for the casualties of war and inflation that formed the basis of his work. His mathematical training revealed itself in stringent logic, which, however, always remained humble before the unpredictability of human uniqueness.

Fekete first came to prominence as an economist when he was invited to share his knowledge of monetary history at Paul Volcker’s seminar in 1974. Volcker was soon to become chairman of the Federal Reserve System. Ten years later, Fekete was invited to the American Institute for Economic Research as a visiting researcher. Finally, in 1985, he received his calling to politics—Congressman William E. Dannemeyer brought Fekete on board as a consultant for money reform.

Fekete developed a solution for public financing after a debt crisis—the gold bond. Fekete’s attention was always focused on alternatives for financing a modern economy without creating unlimited amounts of money. A reduction in relation to physical gold seemed insufficient to him—if banks didn’t create money, bonds and especially bills of exchange would once again have a major role to play.

Fekete received his first European recognition in 1996 when he received an award from the Swiss bank Lips for an essay on the role of gold in a monetary system (“Whither Gold?”). Even back then, he strongly criticized the monetary policy, and many aspects of his critique proved to be prophetic. His detailed definition and further development of Menger’s concept of Absatzfähigkeit (marketability) can be considered one of his greatest contributions to monetary theory. The essay has lost none of its topicality and reveals Fekete’s encyclopedic knowledge of the history of currency and ideas.

After his retirement, Fekete worked—as Ludwig von Mises once did—at the Foundation for Economic Education in Irvington-on-Hudson, New York, and taught at the Francisco Marroquín University in Guatemala and the Romanian Sapientia University. He advised the Mexican entrepreneur and philanthropist Hugo Salinas Price on his reform plans to monetize a silver coin as a more stable savings alternative. Salinas Price provided an important assessment of some of the contradictions between Fekete and Mises, whom he admired: “I knew Mises personally and have no doubt that he would have generously accepted the refreshing ideas of Antal E. Fekete.”

Since 2002, Antal Fekete had been teaching a growing number of interested people via the internet and in regular seminars, especially in Hungary and Spain, where he attracted a competent economist, Juan Ramón Rallo, as his comrade in arms. He appeared on various occasions under the imprimatur of the Gold Standard Institute, Gold Standard University, and most recently the “new Austrian school of economics.” Unfortunately, setting up institutions always proved unsustainable because of personal disagreements.

Fortunately, Fekete distributed his writings largely freely over the internet. So, little by little his influence grew. Fekete’s sharp intellect allows us to overlook his sometimes overly sharp manner. He noted that intellectual development was lacking in the modern Austrian school in contrast to its old Austrian predecessor. Admittedly, remedying this shortcoming is too broad a task for one person’s shoulders to bear, even if this person is standing on the shoulders of giants.

Fekete saw the huge contradiction in his advocacy of Adam Smith’s so-called real bills doctrine, which views gold-backed bills as a legitimate form of monetary expansion as they are in line with the market and self-adjusting. Those who interpret the theory of money more strictly, such as Mises’s most prominent American student, Murray N. Rothbard, saw here a gateway to the arbitrary creation of money. Can these exchange banks be trusted? Would they in turn engage in political lobbying with any seigniorage profits and thus gradually—as a protected cartel—push through the increasingly generous creation of money? Can only the strictest money supply restrictions, which do not allow lending beyond the sum of deposits, avoid these incentives for the creeping dispossession of the population? Neither Fekete nor Rothbard can conclusively answer this type of question. But we should be grateful to thinkers of this caliber that they did not shy away from clarity of speech, did not seek false harmony, but arguably stood up for the pursuit of the true and good.

In personal contact, Antal E. Fekete was a touchingly charming and generous person whose spirit was unusually sharp right up to a very old age. The spirit of old Europe radiated from his whole personality. Towards the end of his life, he became darker and darker, just as Carl Menger once did. The last handwritten note of his that I saw sent icy shivers down my spine. In a few words, he outlined the consequences of the looming debt collapse. It is better to keep quiet about them so as not to set a self-fulfilling prophecy in motion.

He experienced the craziness of the last century at first hand, which shrouded his being with a characteristic melancholy. I hope it is just the Hungarian in him, that echo of the cruel and paradoxical history of the most melancholic nation in Europe. But perhaps Fekete was a sensitive person like Roland Baader. At least it is encouraging that Fekete was looking for solutions, for alternatives for new institutions for when the existing ones fall apart amid great disappointment.

Tags: Featured,newsletter