When Mario Draghi’s tenure was approaching its end, I argued for a sterner governor for the European Central Bank (ECB); hence, I was not even slightly enthusiastic when Draghi’s successor turned out to be Christine Lagarde—a patent dove, as can be inferred from her ideological proximity to a famous Keynesian like Olivier Blanchard. However, I am here to defend the stance she took with her March 12 speech—in which, addressing the economic turmoil spurred by the coronavirus crisis, she declared that it was not a central banker’s job to prevent the occurrence of spreads on financial markets—which has been fiercely attacked both by Italian media and politicians, and even by Italian president Sergio Mattarella. There are three reasons why I deem, for once,

Topics:

Fabrizio Ferrari considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

When Mario Draghi’s tenure was approaching its end, I argued for a sterner governor for the European Central Bank (ECB); hence, I was not even slightly enthusiastic when Draghi’s successor turned out to be Christine Lagarde—a patent dove, as can be inferred from her ideological proximity to a famous Keynesian like Olivier Blanchard.

However, I am here to defend the stance she took with her March 12 speech—in which, addressing the economic turmoil spurred by the coronavirus crisis, she declared that it was not a central banker’s job to prevent the occurrence of spreads on financial markets—which has been fiercely attacked both by Italian media and politicians, and even by Italian president Sergio Mattarella. There are three reasons why I deem, for once, Lagarde’s viewpoint to be right. These reasons are based in monetary policy theory, in the institutional framework of European Union, and in the current situation of the Italian economy.

The Limits of Monetary Policy

First, we need to understand that what Lagarde stated—that it is not her job to prevent government bonds’ prices in the European Monetary Union (EMU) from diverging—is absolutely correct from a technical perspective. Indeed, if we consider the theoretical approach to the role of the central bank as a lender of last resort as conceived by both Walter Bagehot and Henry Thornton (both recognized and respected even by mainstream neoclassical economists), we find that actually there should be no room for monetary policy to be influencing assets’ relative prices. In fact, the role of a central bank (i.e., of a lender of last resort in a fiat money and fractional reserve banking system) should be to grant liquidity to temporarily illiquid—but solvent, i.e., structurally sound—commercial banks. In no way should monetary policy be involved in steering (and messing with) asset prices—as has regrettably been occurring in the EMU since the beginning of QE in March 2015—since central banks’ interferences distort the natural market formation of prices, bringing about Cantillon effects and spurring both malinvestment and excessive risk taking (through generally lowering returns on assets and pushing savers to invest in riskier ones).

It is evident that the ECB has already been a hugely interventionist central bank; suffice it to mention that currently the ECB’s balance sheet is roughly 40 percent of the EMU’s GDP and that the European banking system is already flooded with €1.5 trillion in excessive reserves. Hence, it is also frankly hard to see how further room for monetary policy interference in a market capitalist economy could be justifiable—even conceding to hardened shortsighted Keynesians that the current coronavirus shock is a purely demand-side one, which it absolutely is not.

The Institutional Framework of the European Union

Here the argument is pretty simple and straightforward. First of all, we need to remember that EMU is a monetary union in which European national states retain fiscal sovereignty. The problem with such a framework is that Italian monetary nationalists, Keynesian and MMTer (modern monetary theory) pseudoeconomists, and national socialist politicians interpret this international deal as follows: “burdens should be shouldered together and addressed with a common tool (i.e., the currency we all share, the euro), whereas benefits should be enjoyed privately by member states.” Indeed, they do not see (or pretend not to see) that the only way—even under a Keynesian paradigm—whereby monetary policy could be helpful in such a crisis would be if the fiscal policy decision level were the same as the monetary policy one.

This is exactly why the current EMU’s institutional framework—developed in the unideal world we live in, i.e., with fiat money, fractional reserve, and Keynesian macroeconomics—already provides OMT (outright monetary transactions), that is, a safety net for those governments (such as the current Italian one) begging for a monetary policy shield to cover their debt costs. Obviously enough, however, given that the euro is the currency of all Europeans (and not only of Italians), the regulatory framework of OMT requires the applying state to sign a Memorandum of Understanding, which basically transfers its fiscal sovereignty at the European level. So, it is evident that the tool available to the Italian government in order to reduce its financing costs already exists and can be triggered whenever Italian politicians would like to do so.

The problem is that Italian politicians want to squander the dowry of every European (i.e., the euro, which would be inflated and/or whose massive unbalanced injection would cause price distortions) without agreeing to implement those fiscal and institutional reforms that by themselves would suffice to better their public finance lot and to reduce the funding cost of their debt. In other words, Italians want to be saved by the EU without being subject to any conditions. Secondly, we ought not to forget that the ECB has already helped Italian governments a lot: the Public Sector Purchasing Program, indeed, has so far (December 2019) bought roughly €370 billion in Italian bonds and €530 billion in German ones; however, German GDP is now (2019) almost twice as much as Italy’s—meaning that in terms of the proportion of government bond purchases to national GDP Italy has been hugely privileged (530/370 = 1.4) through disproportionate monetary policy support for its public debt funding cost.

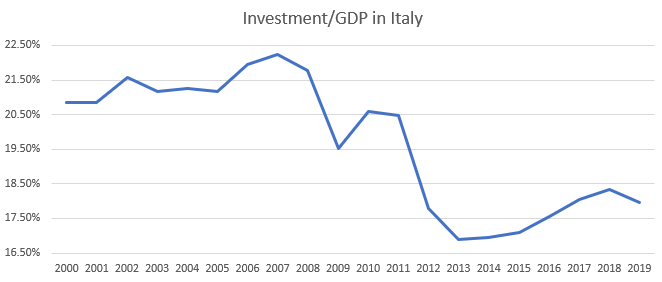

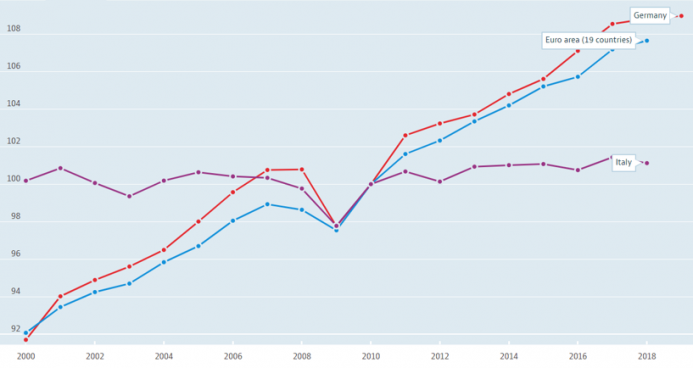

The Current Situation of the Italian EconomyTo put it bluntly, there is nothing monetary policy could do now for the Italian situation. Italy is a paramount example of a capital-consuming economy, where the investment level has plummeted (Figure 1) and labor productivity stagnates (Figure 2). Moreover, unfavorable demography (almost one Italian in four is older than 65) and decreasing natality (on average roughly half as many children as were born in the 1950s and ’60s are born annually) put further stress on the frail pension system—which has was very poorly devised in the 1970s and ’80s. In other words, there exists no magic monetary or financial trick that can save Italy now: the only available path is to reduce pension expenditures (which are the second highest in proportion to GDP among Organisation for Economic Co-operation and Development (OECD) members, immediately after Greece’s) and employ these resources in healthcare and tax reductions. However, those are all policies that do not (or should not) at all concern a central banker, and they are exactly the policies that other European partners would request Italy to enact in order to apply for OMT. |

Investment/GDP in Italy, 2000-2019 |

| Concluding, Lagarde might have been untoward in her timing and the form of her speech; nonetheless, the substance is ironclad and sound. Italy cannot keep whining and hoping for external help: it needs to handle its fate and must take the courageous—and socially and politically tough—path that it has avoided so far. Economies grow—as Hayekian business cycle theory teaches—only if agents are willing to forego consumption today and save and invest in order to deliver higher output (thanks to increased productivity) tomorrow. There is no shortcut. |

GDP per hour worked (Germany, Italy, EMU), 2010 = 100. |

Tags: Featured,newsletter