The feedback loop has reversed: by saving more, people will spend, borrow and speculate less, draining the fuel from any broadbased expansion. In eras of confidence and certainty, people save less and spend more freely. When we’re confident that good times are not only here but will continue, we not only spend more freely, we’re more inclined to borrow money and speculate on the shimmering promises of more good times ahead. In eras of uncertainty, people save more and spend, borrow and speculate less. There is an obvious feedback loop here: if people feel confident about their future prospects and have a measure of certainty about the general economic trend, they spend more, borrow more and speculate more, all of which feed the expansive mood that then encourages

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The feedback loop has reversed: by saving more, people will spend, borrow and speculate less, draining the fuel from any broadbased expansion.

In eras of confidence and certainty, people save less and spend more freely. When we’re confident that good times are not only here but will continue, we not only spend more freely, we’re more inclined to borrow money and speculate on the shimmering promises of more good times ahead.

In eras of uncertainty, people save more and spend, borrow and speculate less. There is an obvious feedback loop here: if people feel confident about their future prospects and have a measure of certainty about the general economic trend, they spend more, borrow more and speculate more, all of which feed the expansive mood that then encourages further spending, borrowing and speculating.

If their confidence collapses and the future is deeply uncertain, people save more as a hedge against bad things happening in the economy that could trigger hardships in their own household.

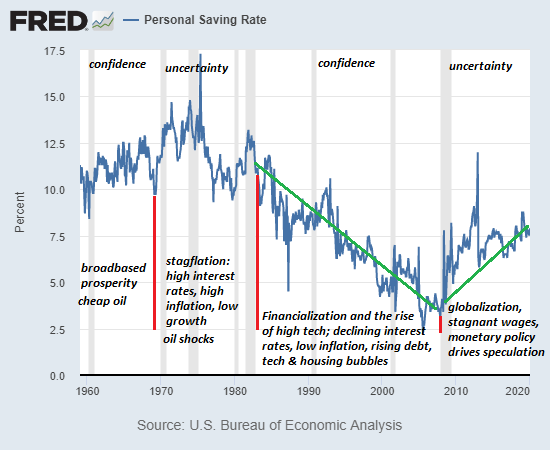

With this in mind, it’s interesting to look at a long-term chart of the U.S. savings rate, courtesy of the St. Louis Federal Reserve database (FRED). It’s easy to discern the waxing and waning of confidence / certainty in the decline or expansion of savings.

The broadbased prosperity of the 1960s is reflected in the high savings rate as cheap oil and real-world growth (as opposed to financial trickery and speculation) fattened paychecks while real-world inflation (cost of living) remained low.

The uncertainties of stagflation–oil shocks, recessions and soaring inflation and interest rates– pushed savings higher in the early 1970s. As purchasing power and speculative gains fell, so did the savings rate as households struggled to keep up with soaring costs of living.

Once inflation and speculative excess were wrung out, the stage was set for a 25-year expansion of “good times” powered by the financialization of the entire economy, the rise of high tech and the first stages of de-industrialization and offshoring, a.k.a. globalization.

Note that the savings rate popped higher after the 1991 oil-shock / Desert Storm recession and again after the dot-com bubble burst in 2000-02.

But the trend to save less and spend/speculate more continued until the the housing bubble burst, triggering the Global Financial Meltdown of 2008-09. When the dot-com bubble burst, the effects were largely confined to the tech sector and those who had speculated in the frenzy. But the housing bubble bursting had far wider consequences, as housing is the bedrock of household wealth and mortgages are the largest category of household debt.

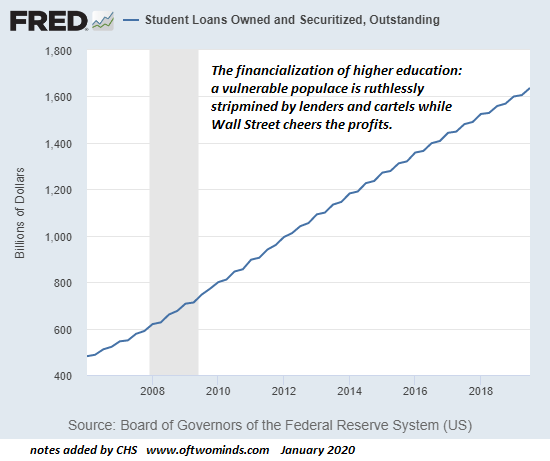

The primary trick of financialization is to turn previously low-risk assets such as home mortgages into high-risk financial instruments that can be traded globally as “low-risk” assets. This fiction–greased by rampant fraud and institutionalized misrepresentation of risk–nearly brought down the global financial system when it finally unraveled.

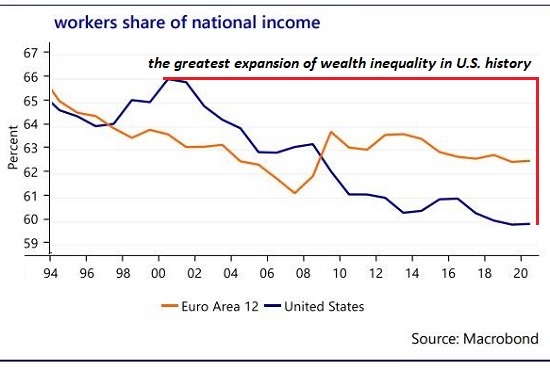

This globalization of financialization went hand in glove with the rapid expansion of offshoring and the hollowing out of real-world economies as the purchasing power of labor (wages) stagnated for all but the top tiers (top 5% and to a lesser degree, the top 10%) of technocrats, managers and entrepreneurs who rode the wave of globalization and technology.

|

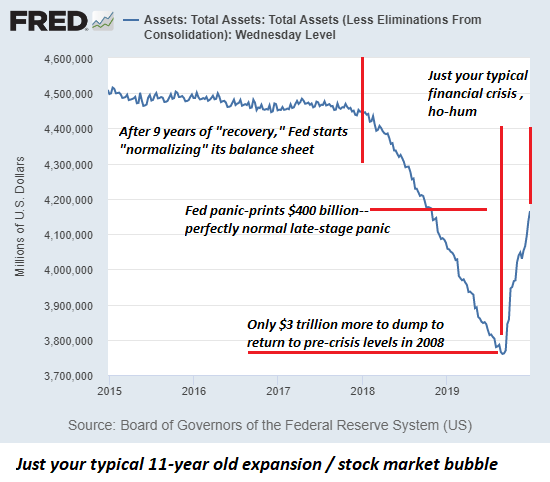

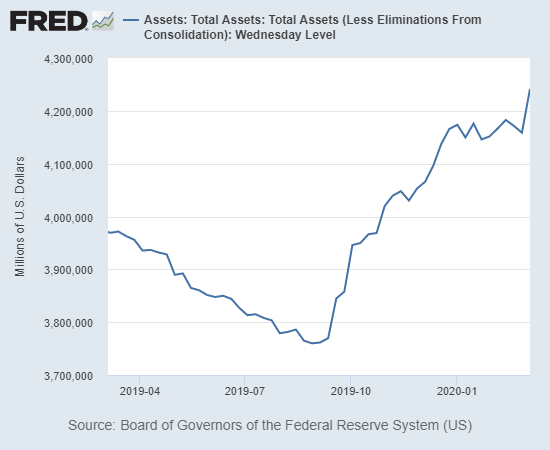

To save the financial system from a well-earned collapse, central banks pushed monetary policies to unprecedented extremes, lowering interest rates and flooding the system with liquidity / stimulus. These extraordinary monetary policies boosted assets while leaving the real-world economy in decline as globalization stripmined local economies that could not compete with global corporations feasting on low interest rates, a steady decline in quality and quantity designed to increase profits and cheap overseas labor. Despite the thin gloss of “growth” this hyper-financialization generated, the stagnation of wages and real-world economy are reflected in the savings rate which has been steadily rising since 2009. The erosion of the real-world economy and the purchasing power of wages has sapped confidence in future prospects and ushered in an era of rising uncertainty. The economic-financial fallout from the Covid-19 pandemic is accelerating the loss of confidence and the rise of uncertainty that has been trending higher for over a decade. The feedback loop has reversed: by saving more, people will spend, borrow and speculate less, draining the fuel from any broadbased expansion. This is one reason why monetary policy extremes won’t revive growth, real or fictitious: the uncertainty that was launched in 2009 is only deepening. |

Personal Savings Rate, 1960-2020 |

Tags: Featured,newsletter