Gold Does Not Fear Interest Rate Hikes – Gold no longer fears or pays attention to Fed announcements regarding interest rates – Renewed interest in gold due to inflation fears and concern Fed won’t do enough to control it – Higher interest rates on horizon will make debt levels unsustainable – New Fed Chair warns “the US is not on a sustainable fiscal path” and could lead to an “unsustainable” debt load – Higher interest rates are good for gold as seen in the 1970s and 2000s – Gold markets aware that central banks are running out of financial weapons to deal with crises You wouldn’t believe it by looking in the financial news but the price of gold has had a stellar run over the last few years. Since the beginning of

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Gold Does Not Fear Interest Rate Hikes

– Gold no longer fears or pays attention to Fed announcements regarding interest rates

– Renewed interest in gold due to inflation fears and concern Fed won’t do enough to control it

– Higher interest rates on horizon will make debt levels unsustainable

– New Fed Chair warns “the US is not on a sustainable fiscal path” and could lead to an “unsustainable” debt load

– Higher interest rates are good for gold as seen in the 1970s and 2000s

– Gold markets aware that central banks are running out of financial weapons to deal with crises

| You wouldn’t believe it by looking in the financial news but the price of gold has had a stellar run over the last few years. Since the beginning of the year it is up nearly 10%, contributing to the near 30% rise since early 2016. Most recently it has been thanks to a weaker dollar, but longer-term it is due to the disbelief gold has in central banks.

Many commentators and market observers did not expect gold to rise as it has: the same period included interest rate rises from the Federal Reserve, something once considered to be the gold market’s kryptonite. But instead of driving the gold price down, US interest rate hikes have had little impact. One of the key factors supporting the gold price is the very same factor that has central bankers spooked – inflation. Gold investors have realised that whilst interest rate hikes are likely to continue, the factors they are trying to combat (namely inflation) are now so far beyond central bankers’ control that gold remains an attractive safe haven and asset class. |

|

Interest rate hikes are inevitable but gold sees past themInflation in the US is on the move — the PPI measured 2.2% in February. That might not seem like much but don’t forget that the markets are not prepared for higher inflation. Consider reactions back in January when it dawned on market participants that inflation could not stay this low forever. Higher inflation will inevitably mean even more interest rate hikes. Surely this is a good thing? Perhaps, but is it too little too late? Sadly central bankers seem to one step behind, rather than one step ahead when it comes to monetary policy. As we have seen since the financial crisis struck, central banks are reactors rather than actors when it comes to preventing seismic events. Those investing in gold recognise that central banks can increase rates as much as they like. But a rapid reaction such as this can lead to dangerous problems for the debt-laden side of the market. Interest rate increased will see unsustainable levels of debt“Everything is just very burdened with debt, and there’s no stopping it.” Ron Paul told CNBC this week. He’s not wrong. At the moment there are zero plans in place to reduce the debt burden across the financial world. What makes the debt so unsustainable? Interest rate hikes.

If central bankers react by increasing rates then it could make interest payments the US government’s largest single expenditure — bigger than Social Security ($916 billion in 2016), defense ($605 billion) or Medicare ($594 billion). |

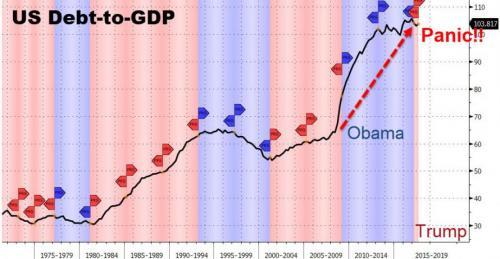

US Debt-to GDP, 1975 - 2018 |

One could argue that the world did not end the last time the yield on the 10-year U.S. Treasury note was at levels we have seen recently. That was back in 1996. But think back to that year. The US national debt was under $5 trillion, today it is $20 trillion and counting. If the cost of servicing this debt increases then the impact on financial markets could well be astronomical.

This year it is set to get worse thanks to Trump’s tax plans. They are expected to push the annual budget deficit above $1 trillion and expand the $20 trillion national debt.

Its not just unsustainable levels of government debt that interest rates will trigger. Consider the huge levels of indebtedness we see for individuals across the Western world. For example, US consumer non-mortgage debt has never been higher. At the end of 2017 US households had a record $1.0 trillion of credit card/revolving loans, $1.3 trillion of auto loans, and $1.5 trillion of student loans.

Just a brief look at the US economy alone and one can see why an uptick in inflation and higher interest rates could easily flip us into the next recession. Gold remains an attractive asset as rate setters are running out of tools to control the markets with.

Central bankers have no more tools in the armoury

Back when the last recession took hold central banks could get (somewhat of) a grasp on the situation thanks to monetary policy. They slashed rates and the markets responded accordingly.

Today, interest rates remain very low but another recession is on the horizon. This is something that keeps many Fed bods awake at night.

As Reuters reports:

Federal Reserve policymakers are fretting that they could face the next U.S. recession with an arsenal of policies little different from that used in the last downturn but robbed of much of their punch because interest rates are still low.

“The thing that keeps me up at night is that when that next recession happens, and hopefully not for a long time, I don’t think we have as strong a toolkit as we would like to have to respond to that,” San Francisco Federal Reserve Bank President John Williams said Friday at a Town Hall Los Angeles event.

To pull out of the 2007-2009 recession, the Fed slashed short-term interest rates to near zero and bought $3.5 trillion in bonds to push down longer-term borrowing costs.

Since late 2015 it has gradually reversed course. Its key rate is now in the range of 1.25 to 1.5 percent, and the Fed expects to end this year with rates between 2 percent and 2.25 percent.

With an aging population slowing the economy’s growth potential, the Fed projects it can raise rates only to about 2.75 percent before borrowing costs will really start to brake the economy.

Are higher interest rates bad for gold?

Even with the dire consequences for the financial markets, one could think that there would be an opportunity cost to holding gold over keeping cash in the bank as interest rates are rising.

Not so, rapidly rising rates against a backdrop of struggling financial markets make gold an even more attractive prospect. As Mark O’Byrne explains:

“…You see the media saying rising interest rates is bearish for gold. But if you look at the history and look at the data, interest rates rose continuously throughout the 1970s from below at the 10-year US Treasury, 10-year bonds below 5% in 1970, to up above 15% in 79-80 and gold prices went up from $35 to $ 850 in those nine years. So, rising interest rates weren’t a negative for gold whatsoever.

“Same thing happened again more recently. Obviously some people might say; “Oh well that’s ancient history and we’re a long way from the 1970s.

“Okay, fair enough well let’s look from 2003 to 2007. I think interest rates went from roughly 3/3½% to 5/5½ %and the gold price went up from $ 400 to $700/800. So, the narrative is incorrect. Rising interest rates are actually bearish as you can imagine for assets that are bought with debt and with leverage.” Mark O’Byrne, The Goldnomics Podcast

As Mark explains on the podcast, raising interest rates are bad news for those assets ‘bought with debt and with leverage’. Within this consider the scenario if both the Federal Reserve and the ECB respond to runaway inflation with accelerated large interest rate increases. This (combined with removal of monetary stimulus) it could very easily turn current ‘all-time-highs’ in the stock market to years of lows in a very short period of time.

You can hear more of Mark’s thoughts on this in our podcast.

Gold looks beyond the short-term

Unlike the financial media, gold looks beyond the short-term moves and commentary. Whilst gold is often dismissed in a higher interest rate environment those investing in it realise that monetary policy changes are not a sign of a healthier economy.

This explains why they have failed to react negatively to past-hikes and declarations by banks that more are on the horizon.

As briefly demonstrated above, one can see that interest rate hikes are unlikely to come at a time with either the US or global economy can handle them. The problem is, the central banks just don’t know what else to do.

Once higher hikes take hold the Federal Reserve will be back to their old game of catch-up and there is little indication that that will bode well for the financial system.

Gold has held its own in this financial crisis and particularly in the face of bearish central bank policies. Combine the likely outcome of these policies with flashpoints in the geopolitical system. This provides you with an even stronger case for gold bullion and bars as a safe haven.

Tags: Daily Market Update,Featured,newsletter