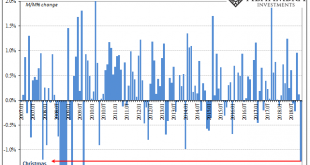

Swiss Franc The Euro has fallen by 0.31% at 1.1324 EUR/CHF and USD/CHF, March 07(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The ECB meeting is today’s highlight. A dovish signal is expected. The euro remains pinned near its lows ahead it. The global equity market rally in January and February is faltering this week. Asian equities were mixed, but the...

Read More »Labor Shortage America has been Canceled

The holiday season was shaping up to be a good one, perhaps a very good one. All the signs seemed to be pointing in that direction, especially if you were a worker. All throughout last year, beginning partway through 2017, there wasn’t a day that went by without some mainstream story “reporting” on America’s labor shortage. It was so ubiquitous, this economic boom idea, the media created several spinoffs. The...

Read More »Swiss National Bank releases new 1000-franc note

Fifth banknote in latest series showcases Switzerland’s communicative flair The Swiss National Bank (SNB) will begin issuing the new 1000-franc note on 13 March 2019. Following the 50, 20, 10 and 200-franc notes, this is the fifth of six denominations in the new banknote series to be released. The current eighth-series banknotes remain legal tender until further notice. The inspiration behind the new banknote series is...

Read More »FX Daily, March 6: The Dollar Index Extends Gains into the Sixth Consecutive Session

Swiss Franc The Euro has risen by 0.02% at 1.1353 EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are on edge. The week’s big events lie ahead. The Bank of Canada meets today and the ECB tomorrow, followed by US (and Canada) employment data on Friday. The equity markets are mixed. While Japan and Korean equities...

Read More »Thoughts about the ECB and Euro

Mario Draghi’s term at the helm of the ECB is winding down. He will step down in October. It has not been an easy job. The light at the end of the tunnel in 2017 turned out to be another train in 2018. The eurozone enjoyed 0.7% quarterly growth every quarter in 2017. The ECB was able to outline an exit from its asset purchases. The debate began over sequencing and when the first rate hike could be delivered. But alas,...

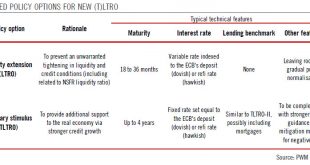

Read More »ECB: to LTRO, or not LTRO, what is the question?

The ECB’s decision on (T)LTRO will matter most to the euro area periphery banks who have been the biggest consumers of current TLTROs. Considering the weakness in most economic indicators the ECB should maintain an adequate degree of monetary accommodation. This will likely require delivering another longer-term refinancing operation (LTRO, targeted or not) to avoid any tightening in liquidity and credit conditions. We...

Read More »GBP/CHF exchange rates: A good start to the year, but what next for Brexit?

Since the start of the year GBP/CHF exchange rates have increased from 1.2377 to 1.3212 at the time of writing this report. To put this into monetary value, a client that converts £200,000 into CHF could now achieve an additional 16,700 Swiss Francs. Sterling strength as no deal Brexit outcome fades The pound has been gaining momentum across the board as the market prices in the fact that the UK is less likely to depart...

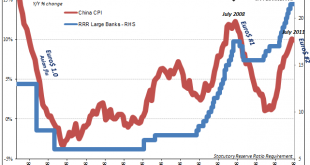

Read More »China Has No Choice

China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China. This was amended in...

Read More »Bitcoin Bottom Building

Defending 3,800 and a Swing Trade Play For one week, bulls have been defending the 3,800 USD value area with success. But on March 4th they had to give way to the constant pressure. Prices fell quickly to the 3,700 USD level. These extended times of range bound trading are typical for Bitcoin Bottom Building in sideways ranges. This 60 minute chart of Bitcoin shows (represented by the yellow candlestick wicks) how the...

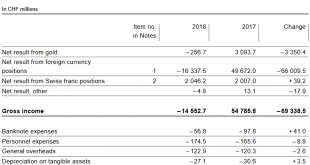

Read More »SNB loses 15 billion in 2018

Overview The SNB earned 2 billion on negative interest rates, but lost nearly 17 billion CHF on FX investments, of which 5 bn on bonds and 12 bn on stocks. The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, the results have huge swings that depends on the FX rate. But the SNB may lose 50 billion in one year and win 60...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org