Summary:

Overview

The SNB earned 2 billion on negative interest rates, but lost nearly 17 billion CHF on FX investments, of which 5 bn on bonds and 12 bn on stocks.

The increasing volatility of SNB Earnings

Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, the results have huge swings that depends on the FX rate.

But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse.

Franc will rise again with crisis or inflation

With a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again.

And this at an exchange rate that is not digestible for the SNB.

We considered that after an inflationary

Topics:

George Dorgan considers the following as important:

1) SNB and CHF,

Featured,

newsletter,

SNB balance sheet,

SNB equity holdings,

SNB Gold Holdings,

SNB Press Releases,

SNB profit,

SNB results,

SNB sight deposits,

Swiss National Bank

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview

The SNB earned 2 billion on negative interest rates, but lost nearly 17 billion CHF on FX investments, of which 5 bn on bonds and 12 bn on stocks.

The increasing volatility of SNB Earnings

Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, the results have huge swings that depends on the FX rate.

But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse.

Franc will rise again with crisis or inflation

With a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again.

And this at an exchange rate that is not digestible for the SNB.

We considered that after an inflationary period the

- EUR/CHF could fall to 0.90

- and the USD/CHF to 0.75.

And this will lead to a massive SNB loss around 150 billion CHF. |

|

Some extracts from the official statement.

Annual result of the Swiss National Bank for 2018

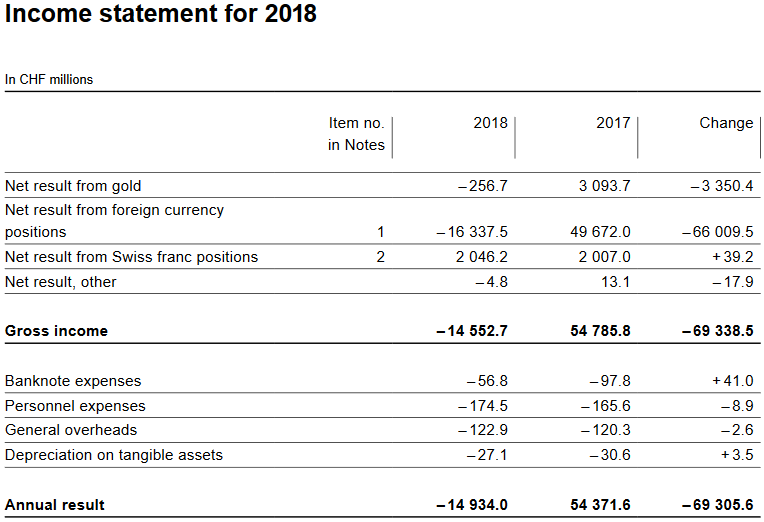

The Swiss National Bank (SNB) reports a loss of CHF 14.9 billion for the year 2018 (2017: profit of CHF 54.4 billion).

The loss on foreign currency positions amounted to CHF 16.3 billion. A valuation loss of CHF 0.3 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 2.0 billion.

For the financial year just ended, the SNB has set the allocation to the provisions for currency reserves at CHF 5.4 billion. After taking into account the distribution reserve of CHF 67.3 billion, the net profit comes to CHF 47.0 billion. This will allow a dividend payment of CHF 15 per share, which corresponds to the legally stipulated maximum amount, as well as a profit distribution to the Confederation and the cantons of CHF 1 billion. The Confederation and the cantons are also entitled to a supplementary distribution of CHF 1 billion as the distributionreserve after appropriation of profit exceeds CHF 20 billion. Of the total amount to be distributed (CHF 2 billion), one-third goes to the Confederation and two-thirds to the cantons. After these payments, the distribution reserve will amount to CHF 45.0 billion.

|

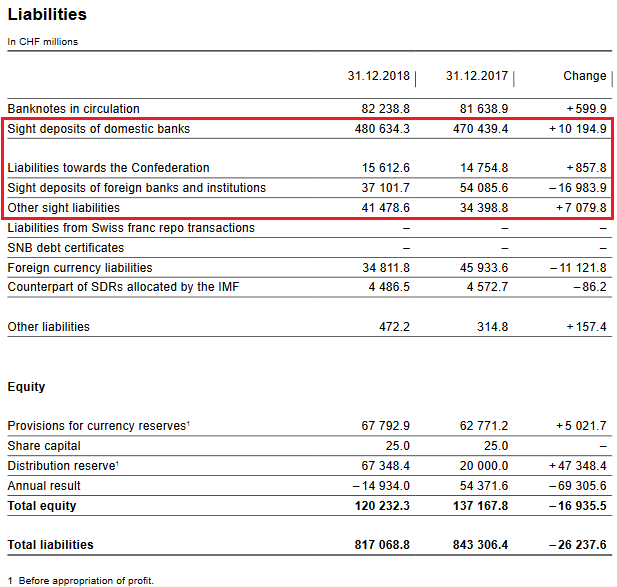

Income Statement for 2018 Source: snb.ch - Click to enlarge |

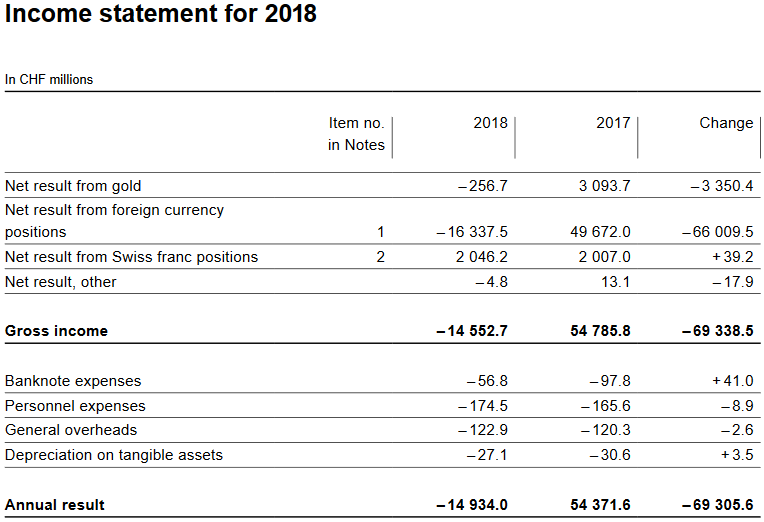

Loss on foreign currency positions

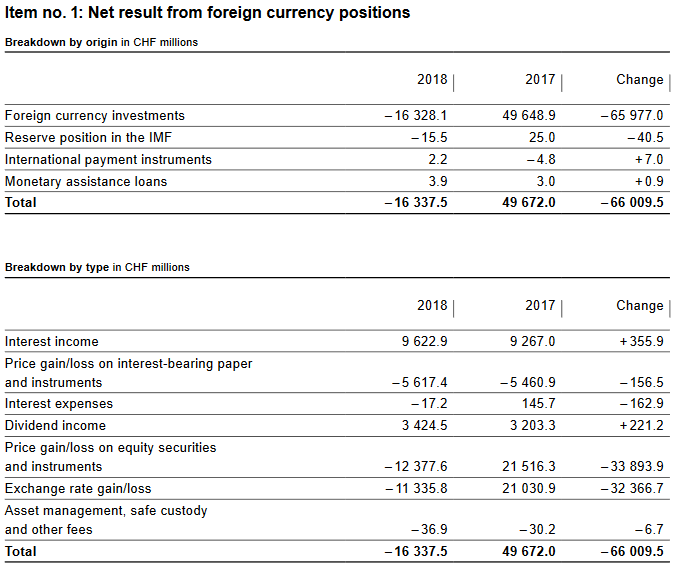

The loss on foreign currency positions was CHF 16.3 billion (2017: profit of CHF 49.7 billion).

Price losses of CHF 5.6 billion were recorded on interest-bearing paper and instruments. Furthermore, the unfavourable stock market environment led to a loss of CHF 12.4 billion on equity securities and instruments. Exchange rate-related losses totalled CHF 11.3 billion. This was offset by interest income amounting to CHF 9.6 billion and dividend income amounting to CHF 3.4 billion.

SNB results 2018

(in bn CHF) |

Profit |

BalanceSheet |

Profit in % |

| Total Profit on foreign currencies |

-16.3 |

817.1 |

-1.99% |

| Interest income (coupons) |

-5.6 |

817.1 |

-0.69% |

| Dividend income |

3.4 |

817.1 |

0.42% |

| Price changes in bonds |

9.6 |

817.1 |

1.17% |

| Price changes in equities |

-12.4 |

817.1 |

-1.52% |

| Exchange Rate Gains |

-11.3 |

817.1 |

-1.38% |

|

SNB Profit on Foreign Currencies for 2018 Source: snb.ch - Click to enlarge |

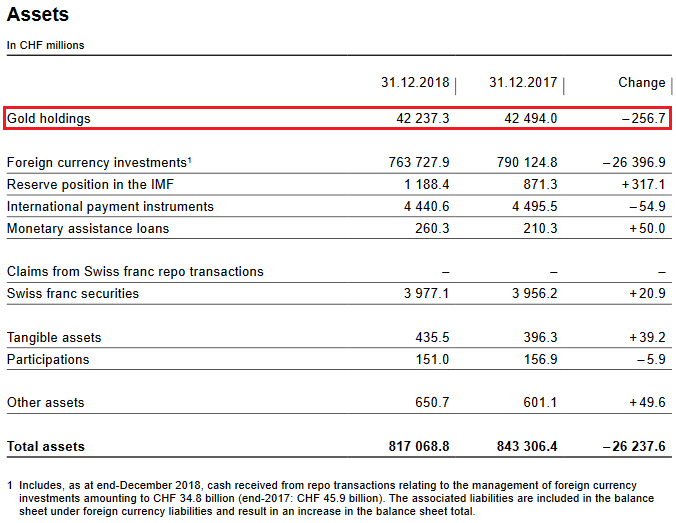

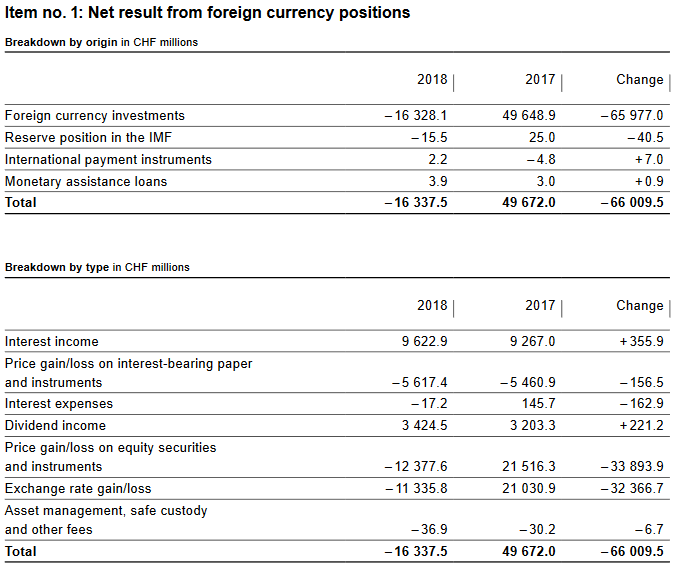

Valuation loss on gold holdings

At CHF 40,612 per kilogram, the price of gold was 0.6% lower than at the end of 2017 (CHF 40,859). This gave rise to a valuation loss of CHF 0.3 billion on the unchanged holdings of 1,040 tonnes of gold (2017: valuation gain of CHF 3.1 billion).

SNB Results 2017

(in bn CHF) |

Profit |

Balance Sheet |

Profit in % |

| Total Profit on Gold………………………….. |

-0.3 |

817.1 |

-0.04% |

Percentage of gold to balance sheet

The percentage of gold compared to the total balance sheet is falling.

SNB Balance Sheet items

(in bn CHF) |

2018

|

2017 |

2016 |

2015 |

| Gold……………………………………… |

42.2 |

42.5 |

39.4 |

35.5 |

| Total Balance Sheet |

817.1 |

843.3 |

746 |

640 |

| Gold in % of Balance Sheet |

5.16% |

5.04% |

5.28% |

5.55% |

Balance Sheet

For the first time in years the balance sheet has contracted: by 3%.

|

2018

|

2017 |

Increase in % |

| SNB balance sheet in CHF………………. |

817.1 |

843.3 |

-3.11% |

| Swiss nominal GDP in CHF |

689.9 |

659 |

4.69% |

| % of GDP |

118.44% |

127.97% |

|

|

SNB Balance Sheet for Gold Holdings for 2018 Source: snb.ch - Click to enlarge |

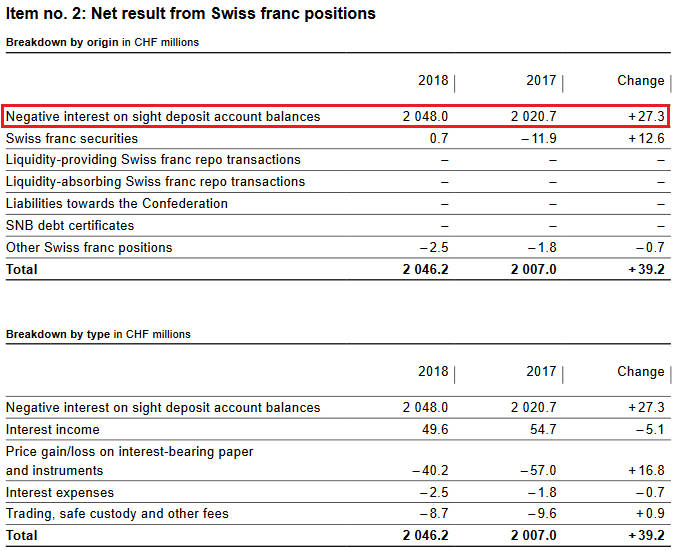

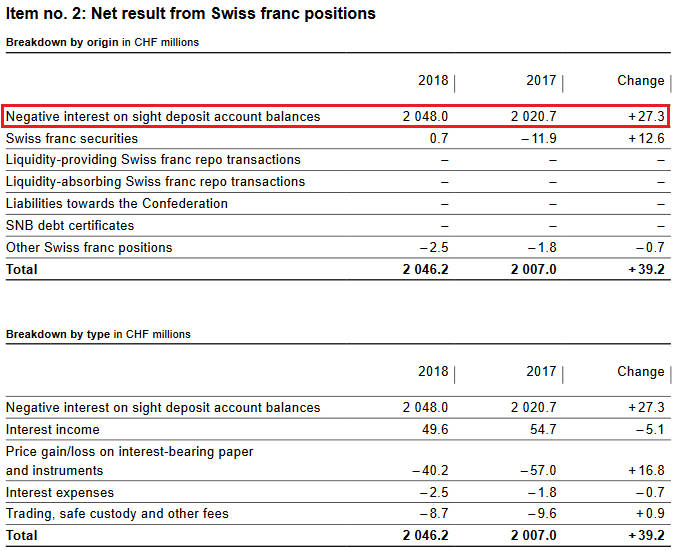

Profit on Swiss franc positions

The SNB maintains its profitability, last but not least, thanks to the reduction of the profitability of banks. When too many funds arrive on their accounts, they must deposit them on their sight deposit account at the SNB.

The profit on Swiss franc positions, which stood at CHF 2.0 billion (2017: CHF 2.0 billion), largely resulted from negative interest charged on sight deposit account balances.

Negative Interest rates

Furthermore, the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. But with this measure she maintains her own profitability.

|

2018

|

2017 |

Change in % |

| Income through negative interest rates |

2.05 |

2.02 |

1.49% |

| SNB balance sheet |

817.1 |

843.3 |

-3.11% |

| in % of balance sheet |

0.25% |

0.24% |

|

|

SNB Result for Swiss Franc Positions for 2018 Source: snb.ch - Click to enlarge |

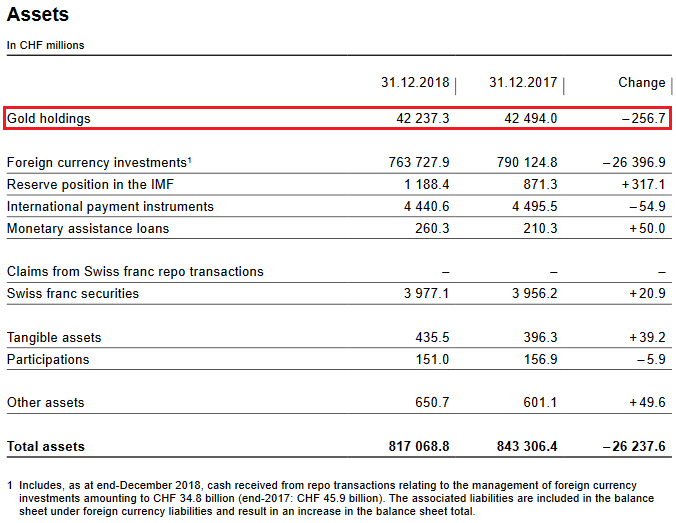

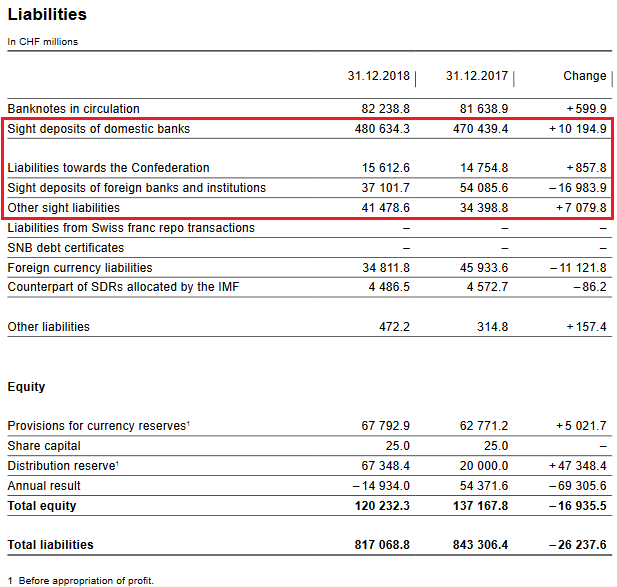

SNB Liabilities

Electronic Money Printing: Sight Deposits

Sight deposits is the biggest part of SNB interventions.

|

2018 |

2017 |

Change in% |

| Total Sight Deposits |

574.8 |

573,7 |

0.19% |

| Balance Sheet |

817.1 |

843.3 |

-3.11% |

| % of balance sheet |

70.35% |

68.03% |

|

Paper Printing

Banknotes in circulation: -2.6 bn francs to 79 bn. CHF

The old form of a printing press, today a less important form of central bank interventions.

Provisions for currency reserves

In principle, given the high market risks present in the SNB balance sheet, the percentage increase in provisions is calculated on the basis of double the average nominal GDP growth ratefor the previous five years. In addition, a minimum annual allocation of 8% of the provisions at the end of the previous year has applied since 2016. This is aimed at ensuring that sufficient allocations are made to the provisions and the balance sheet is further strengthened, even in periods of low nominal GDP growth.

Since nominal GDP growth over the last five years has averaged just 1.2%, the minimum rate of 8% will be applied for the 2018 financial year. This corresponds to an allocation of CHF 5.4 billion (2017: CHF 5.0 billion). As a result, the provisions for currency reserves will grow from CHF 67.8 billion to CHF 73.2 billion.

|

SNB Liabilities and Sight Deposits for 2018 Source: snb.ch - Click to enlarge |

Tags:

Featured,

newsletter,

SNB balance sheet,

SNB equity holdings,

SNB Gold Holdings,

SNB profit,

SNB results,

SNB sight deposits,

Swiss National Bank