The holiday season was shaping up to be a good one, perhaps a very good one. All the signs seemed to be pointing in that direction, especially if you were a worker. All throughout last year, beginning partway through 2017, there wasn’t a day that went by without some mainstream story “reporting” on America’s labor shortage. It was so ubiquitous, this economic boom idea, the media created several spinoffs. The successful reception of the domestic production led to a Tales from a European Labor Shortage, followed then by China, A Labor Shortage Chronicle, and even Labor Shortage: Japan. Globally synchronized growth was a pliable script. As to the original, the Wall Street Journal “reported” last September: The holiday

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, China, Featured, Markets, newsletter, The United States

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

| The holiday season was shaping up to be a good one, perhaps a very good one. All the signs seemed to be pointing in that direction, especially if you were a worker. All throughout last year, beginning partway through 2017, there wasn’t a day that went by without some mainstream story “reporting” on America’s labor shortage.

It was so ubiquitous, this economic boom idea, the media created several spinoffs. The successful reception of the domestic production led to a Tales from a European Labor Shortage, followed then by China, A Labor Shortage Chronicle, and even Labor Shortage: Japan. Globally synchronized growth was a pliable script. As to the original, the Wall Street Journal “reported” last September:

According to both the Census Bureau and BEA, they needn’t have worried so much, assuming they actually did. |

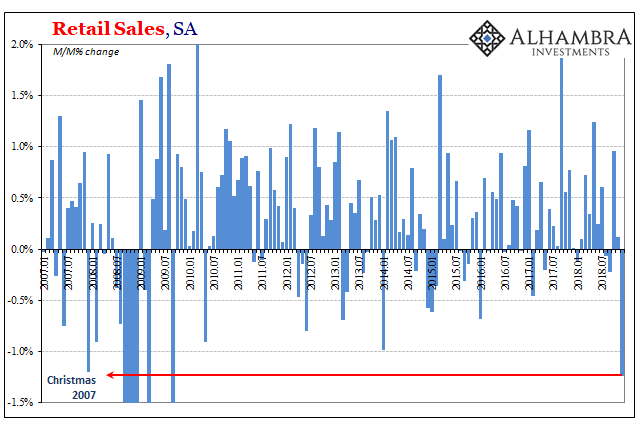

U.S. Retail Sales, Jan 2007 - 2019(see more posts on U.S. Retail Sales, ) |

| The really weird thing is the LABOR SHORTAGE has quietly been shelved, just like some badly thrown together TV offshoot that never came close to attracting any audience of its own. Anecdotally, there may still be the occasional article written about it from time to time, but somehow there’s less of a rush to write about the employment rush.

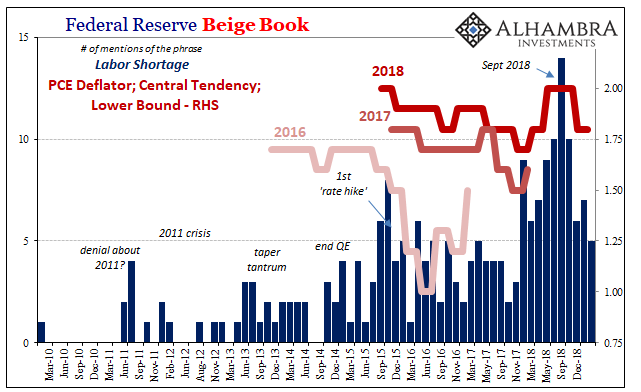

Even the Federal Reserve has lost its appetite for this. The central bank’s Beige Book is a unique window into the minds of these empty suits. Written as a compendium of compiled local district anecdotes, all it does is reflect the biases of those responsible for adding these stories to the volume. As such, in September 2018 the thing mentioned “labor shortage” a record 14 times. It would mark the zenith of its popularity. The number would plummet to just 7 in January, small wonder what had rudely interrupted these fantasies in between (reality). |

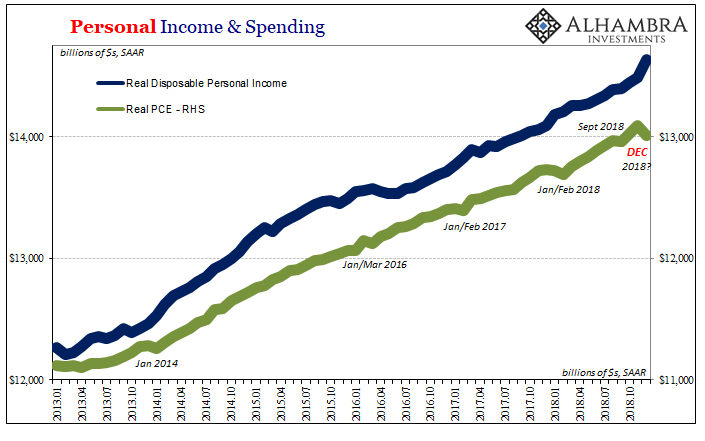

US Income and Spending, Jan 2013 - 2019 |

| In the latest update for March 2019, the Beige Book mentions “labor shortage” only five times; the lowest number since November 2017.

Where did it go? There are really only two possible answers. One, there actually was a labor shortage despite the lack of corroborating evidence for it, but the economy really, really fell apart late last year. Two, there never was a labor shortage, merely the hopes for one being recorded as anecdotal evidence of a fairy tale. Given what happened at the end of 2018, as implausible as it had been before it was no longer even minimally plausible as 2019 began. Neither of those options makes the Beige Book, and by extension the people responsible for it (the same who vote at the FOMC), look very good. When the chief economic claim for a boom just quietly goes into hiatus. Here’s why this sad episode matters. It does tell us something important about where things stand right now, and by extension in which direction the economy might actually be heading in reality. If the very people most invested in the fantasy, those perfectly willing to conjure up an unsupported narrative out of thin air and then give it official imprimatur and gloss, if they are no longer willing to believe nearly as much in it then that’s not a good sign for what just happened. If the most optimistic among us no longer feel safe to write out and include their most fervent economic hopes right where they have been, then “something” substantial must have changed between now and then. When even the Fed gets nervous, it’s already a big problem. |

Federal Reserve Beige Book, Mar 2010 - Jan 2019 |

It can’t have been simply the S&P 500, either; though it plunged into December it has retraced more than enough for March’s Beige Book to have resurrected the LABOR SHORTAGE!!! to a small degree if that was all there was to it.

Anecdotally, the Fed really does seem to have lost its nerve. Jay Powell truly is a chicken hawk, all the hard confidence of a marshmallow in his past economic predictions.

September: the economy is so damn good it is running out of workers.

March: “Economic activity continued to expand in late January and February, with ten Districts reporting slight-to-moderate growth, and Philadelphia and St. Louis reporting flat economic conditions.”

Sorry folks, LABOR SHORTAGE!!! The Sequel has been canceled.

Tags: Featured,Markets,newsletter