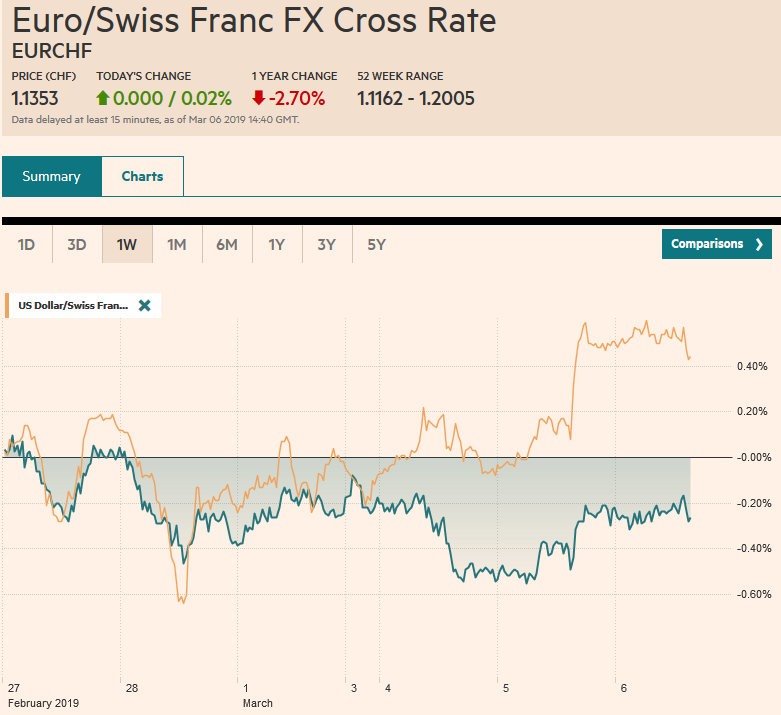

Swiss Franc The Euro has risen by 0.02% at 1.1353 EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are on edge. The week’s big events lie ahead. The Bank of Canada meets today and the ECB tomorrow, followed by US (and Canada) employment data on Friday. The equity markets are mixed. While Japan and Korean equities eased, China’s markets continue their tear. The Shanghai Composite rose 1.5%, the fourth consecutive advance, and closing in on its ninth weekly rise. Yes, it has risen every week this year. European stocks are narrowly mixed, and the Dow Jones Stoxx 600’s four-day rally is at risk. It has moved higher

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.02% at 1.1353 |

EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

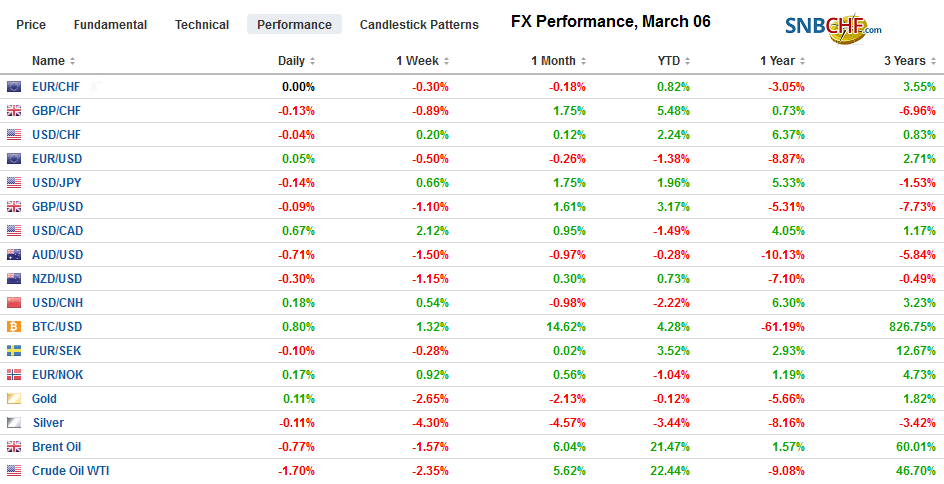

FX RatesOverview: The capital markets are on edge. The week’s big events lie ahead. The Bank of Canada meets today and the ECB tomorrow, followed by US (and Canada) employment data on Friday. The equity markets are mixed. While Japan and Korean equities eased, China’s markets continue their tear. The Shanghai Composite rose 1.5%, the fourth consecutive advance, and closing in on its ninth weekly rise. Yes, it has risen every week this year. European stocks are narrowly mixed, and the Dow Jones Stoxx 600’s four-day rally is at risk. It has moved higher in all but one week this year. The S&P 500 is consolidating around 2800 but has failed to close higher in five of the past six sessions. Benchmark 10-year bond yields are lower across the board. Australia’s 10-year yield tumbled 6 bp after the disappointing GDP, leading today’s move. European benchmarks are mostly around two basis points lower. The US dollar enjoys a firmer tone against the major currencies, except the yen, where it is stalling around JPY112. The euro continues to straddle $1.13. The Australian dollar is the weakest of the majors, off around 0.8% to about $0.7025, the lowest level since January 4, while the lack of progress in Brussels is pushing sterling lower for the fifth session. |

FX Performance, March 06 |

Asia Pacific

Australia’s economy expanded a disappointing 0.2% in Q4 18. The median forecast was for a 0.3% increase. The year-over-year pace slowed to 2.3% from 2.7% (revised from 2.8%) and below expectations. Reserve Bank Governor Lowe is stuck to his neutral stance, though the market continues to move toward discounting a rate cut. The RBA’s optimism, like we will hear from the ECB tomorrow, rests on the traditional relationship between employment and wages, which many suspect has broken down. Lowe argues the strong employment may lift wages boost consumption and offset the decline in property prices.

The Bank of Japan meets in the middle of the month, but there is talk that it may downgrade its output and export outlook. Exports fell 8.4% year-over-year in January, and exports to China fell twice as much. Last month, Governor Kuroda threatened to consider additional measures if the yen’s strength weakened the economy. The economy has softened, but Kuroda is likely to repel any attempt by the dovish members to easy policy now. It is difficult for Prime Minister Abe to back away from the October sales tax increase. Although the government is trying to offset it with some other consumer incentives, past hikes have disrupted the economy, and as the implementation draws close, there will be more concerns expressed about its likely impact.

First, there was a clause in the new NAFTA agreement about minimizing and making transparent intervention in the foreign exchange market. We argued at the time, it was really unnecessary for Canada and Mexico, but it established a precedent that would be repeated. The US reportedly seeking a pledge from China to keep the yuan stable. We argue that this sounds good to Americans now, but it could very well hamper future efforts to devalue the dollar against the yuan. After the US-China trade talks are resolved (we suspect the eventual outcome will keep some of the current tariffs in place), the trade focus will shift to Japan and Europe. Reports suggest the US is asking Japan to minimize and make transparent foreign exchange intervention. A US-UK post-Brexit trade agreement, if that is not getting too far ahead of the game, will reportedly have a similar clause.

The Australian dollar has approached the 50% retracement mark of the rally since the flash crash low on January 3 (~$0.6740), which is found near $0.7020. There is an option for nearly A$800 mln at $0.7050 that expires today and an A$1.2 bln strike that rolls off after the US jobs data on March 8. Although the next retracement target is near $0.6950, we suspect that the flash crash low will be revisited in Q2. The dollar is confined to a narrow range against the yen. So far today is the first session in four that it has not traded above JPY112.00. There is a roughly $540 mln option at JPY111.80 and another for around $500 mln at JPY112.00 that expire today. The JPY112 strike is popular, and more expire ahead of the weekend. Our next upside target is near JPY112.60. On the downside, initial support is seen in the JPY111.65-JPY111.80 area.

Europe

The UK-Brussels meeting looking for some way to make the Withdrawal Agreement more acceptable to the House of Commons failed, which should hardly come as a surprise. The UK insisted on formally limiting the backstop, which the EC has repeatedly refused and would seem to contradict the very nature and purpose of the backstop. Still, lower level talks continue. We continue to think that a postponement of the March 29 Brexit date is the most likely scenario. Sterling’s rally so far seems to be largely about reduced risk of a no-deal exit. However, a postponement solves only the immediate problem without resolving the larger issues. Uncertainty will continue to overhang business and investment decisions. It will paralyze the government and distract from other challenges.

The euro has thus far been confined to 10 ticks on either side of $1.13 as it consolidates ahead of tomorrow’s ECB meeting. The market expects a dovish bias after the risk assessment was cut in January. There is an option for 680 mln euros at $1.1275 and a little more than 960 mln euros at $1.1300, both of which expire today. On each of the next two sessions, there is a large (1.7-1.8 bln euro) option at $1.1250 that expires. On the tops side, tomorrow sees a 1.2 bln euro strike at $1.1360 roll off and on Friday the higher strike is at $1.1425 for 1.7 bln euros. Resistance today is seen in the $1.1320-$1.1360 area.

Sterling is lower for the fifth consecutive session. The mood toward sterling has soured a bit, and some participants are eager to take profits. Sterling had rallied more than five cents since the middle of February. The softer and later Brexit scenario had been discounted. Something that increases the prospects of a second referendum or the possibility that the UK remains in the customs union could renew sterling’s climb. Initial support is seen in the $1.3050-$1.3060, which houses the 20-day moving average, congestion in late-February, and the 50% retracement of the last leg up.

America

The Bank of Canada meets. There is little doubt that the overnight rate will be left alone at 1.75%. The issue today is the extent to which the central bank acknowledges the economic slowdown (0.4% annualized Q4 GDP). Many economists expect it to stick with its tightening bias; that it still intends to remove accommodation or normalize rates. Market participants appear to be leaning the other way. The Canadian dollar is just above the year’s low and the implied yield on the BA futures have fallen around 25 bp since mid-January.

The ADP estimate of US private sector jobs growth is closely watched. A rise of around 190k (January 213k) would seem to remove the risks of a downside surprise in the official data on Friday. Many market participants already seem to have discounted this, and it is one of the reasons the Dollar Index is up for the sixth consecutive session. The twin deficit challenge is back in the news and may take some of the employment’s thunder. With the budget balance for January reported yesterday, we know now that the deficit for the first four months of the fiscal year is about $310 bln. The main cause of the widening appears to be the decline in revenue associated with the corporate tax cut. Today, December and therefore the 2018 trade deficit will be announced. Despite the incredible improvement in the energy trade balance, the overall trade deficit has swelled around 20% over the past two -years to about $600 bln in 2018. The exchange rate is an easy target, but growth differentials, extenuated by US fiscal stimulus when the economy was already growing in excess of what the central bank thinks is its long-run non-inflationary rate, may offer a more robust explanation. Remember the US exports around 15% of GDP.

The Beige Book will be released in the afternoon of the US session. Although it typically does not move the market, its anecdotes will help shape sentiment. Our base case is that the crosscurrents that Fed Chief Powell cites will be cleared up over the next couple of months. The warmer weather will help. Another government shutdown can be avoided. Investors and policymakers will have a better sense of whether what we see as preliminary greenshoots in China and Germany catch hold. The Brexit mess may be a little clearer. The US and China may strike an agreement, or at least not escalate the trade tensions further. Under this scenario, the resilience of the US economy will be manifest again, and this could still set the stage for a Fed rate hike mid-year/Q3.

The US dollar is pushing through the late January highs against the Canadian dollar (~CAD1.3375). This area corresponds to a 50% retracement of this year’s pullback. The next technical target is near CAD1.3440. The highs are being recorded just before the start of the North American session, and the intraday technical readings are stretched, warning of the risk of “buy the rumor, sell the fact” behavior. Its sixth consecutive advance has brought the Dollar Index to 97.00. The next important level is the high for the year, recorded on February 15 near 97.35, from which it recorded a key reversal lower (traded on both sides of the previous day’s range, making a new high for the move, and then finishing below the previous day’s low).

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Featured,newsletter