The ECB’s decision on (T)LTRO will matter most to the euro area periphery banks who have been the biggest consumers of current TLTROs. Considering the weakness in most economic indicators the ECB should maintain an adequate degree of monetary accommodation. This will likely require delivering another longer-term refinancing operation (LTRO, targeted or not) to avoid any tightening in liquidity and credit conditions. We expect the ECB to send out a strong signal at its March meeting that it will soon offer a new (T)LTRO, with details likely to be announced in April or June. The ECB’s decision on (T)LTRO will, of course, matter to euro area banks, mostly for the periphery’s banks who have been the biggest consumers of

Topics:

Team Asset Allocation and Macro Research considers the following as important: 2) Swiss and European Macro, Featured, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

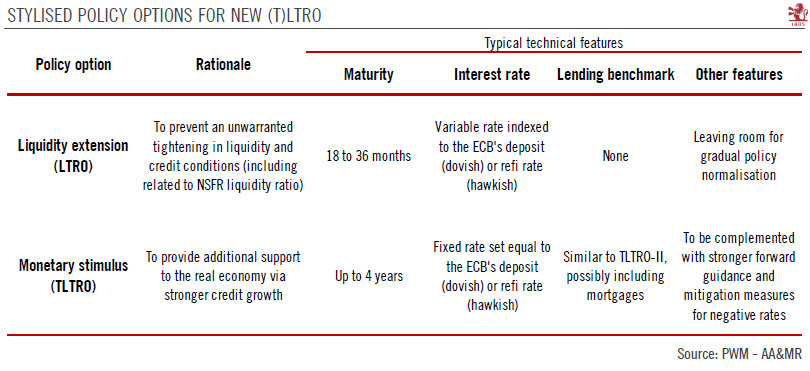

The ECB’s decision on (T)LTRO will matter most to the euro area periphery banks who have been the biggest consumers of current TLTROs. Considering the weakness in most economic indicators the ECB should maintain an adequate degree of monetary accommodation. This will likely require delivering another longer-term refinancing operation (LTRO, targeted or not) to avoid any tightening in liquidity and credit conditions. We expect the ECB to send out a strong signal at its March meeting that it will soon offer a new (T)LTRO, with details likely to be announced in April or June. The ECB’s decision on (T)LTRO will, of course, matter to euro area banks, mostly for the periphery’s banks who have been the biggest consumers of current TLTROs. |

Stylised policy options for new (T)LTRO |

Tags: Featured,Macroview,newsletter