The Swiss Agency for Development and Cooperation (SDC) has temporarily suspended payments to a civil society platform on migration issues. Financial conflicts of interest and accusations of pro-migration bias are being investigated. On Thursday, the Federal Department of Foreign Affairs (FDFA) confirmed that the Swiss Civil Society Platform on Migration and Developmentexternal link will not be receiving any further...

Read More »Monthly Macro Chart Review – March (VIDEO)

Alhambra CEO discusses the most important economic reports from the past month. [embedded content] Related posts: Monthly Macro Chart Review – March Monthly Macro Monitor – February (VIDEO) Monthly Macro Monitor – October 2018 (VIDEO) Monthly Macro Monitor – December 2018 (VIDEO) Monthly Macro Monitor – September 2018 Monthly Macro Monitor – January 2019 Monthly Macro Monitor...

Read More »Rothschilds To Take Swiss Bank Private In 100 Million Francs Bid

Benjamin de Rothschild’s family plans to take Swiss Bank Edmond de Rothschild (Suisse) S.A. private as it consolidates and simplifies the bank’s legal structure. According to Bloomberg, Edmond de Rothschild Holding SA will acquire all publicly held Edmond de Rothschild (Suisse) bearer shares at 17,945 francs per share, a 6.7% premium to Tuesday’s closing price, in a deal worth about $100 million. The Swiss bank, which...

Read More »Swiss health insurance deductibles to rise automatically

© Valeriya Potapova | Dreamstime.com Today, Switzerland’s parliament decided to bring in a system of regular increases in the deductibles for basic compulsory Swiss health insurance, according to the newspaper Le Matin. However, a plan to raise the the minimum deductible to CHF 500 was rejected by a clear majority. Between 1996 and 2004, the minimum deductible went from CHF 150 to CHF 300. Higher deductibles up to a...

Read More »There at the Beginning

Sometimes it is difficult to gain perspective. That is why it may be difficult to see the forest for the trees. It is as we spend most of our time climbing a mountain: One handhold and foothold at a time. Immediacy and urgency limit our peripheral and forward visions. The end of the first expansion since the Great Financial Crisis may be drawing close. There is a concern among officials and investors that the tools that...

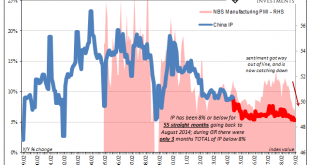

Read More »No Sign of Stimulus, Or Global Growth, China’s Economy Sunk By (euro)Dollar

Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before. Celebrating the milestone might’ve been the proposed purpose behind the state...

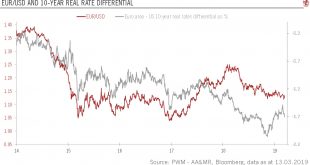

Read More »Euro slides against the dollar on ECB dovishness

The euro has declined further against the dollar but should strengthen over next 12 months The euro fell to a 20-month low against the US dollar following the European Central Bank’s (ECB) March policy meeting, given the revised forward guidance that suggests that the interest rate differential is unlikely to provide much upside to the euro in the next few months. That being said, recent euro area PMI surveys tend to...

Read More »Three Swiss cities ranked in world’s top 10 most livable

© Scanrail | Dreamstime.com Mercer’s 2019 livability ranking looks at 231 cities across the globe. Vienna comes top for the tenth year in a row, while Bagdad ranks last. Three Swiss cities are among the global top ten. Zurich is 2nd, Geneva 9th and Basel 10th. Bern, a fourth Swiss city, is not far behind in 14th place. No other Swiss cities were included in the survey so there is no way of knowing where Lausanne...

Read More »FX Daily, March 15: Euro and Yen Volatility Slips to New Five-Year Lows on the Ides of March

Swiss Franc The Euro has risen by 0.09% at 1.1354 EUR/CHF and USD/CHF, March 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are calm ahead of the weekend. Outside of Australia and Thailand, Asia Pacific equities advanced, while European shares are mostly little changed. The regional benchmarks, like the S&P 500 have recouped last week’s...

Read More »Pound to Swiss Franc Forecast: GBP/CHF rate hits near 1-year high

It is now very close to the best time to buy Swiss Francs with pounds since May 2018. The stronger pound and a reduced global risk appetite has seen the move on the GBP/CHF pairing. This is presenting a much improved opportunity to buy Swiss Francs with pounds. Any client wishing to buy or sell on this pairing might benefit from a quick review with our team to best understand what is next, and the potential outcomes....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org