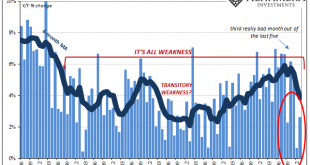

You just don’t see $4 billion monthly retail sales revisions, in either direction. Advance estimates are changed all the time, each monthly figure will be recalculated twice after its initial release. Typically, though, the subsequent revisions are minor rarely amounting to a billion. Four times that? Last month, the Census Bureau reported that retail sales during the Christmas holiday were a disaster. It was Christmas...

Read More »FX Daily, March 12: Wave of Optimism Sweeps through the Capital Markets

Swiss Franc The Euro has fallen by 0.03% at 1.1361 EUR/CHF and USD/CHF, March 12(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Last minutes statements meant to clarify what many MPs find to be the most odious part of the Withdrawal Bill, the backstop for the Irish border is goosed global equity markets even though it does not seem as if the Withdrawal Bill...

Read More »Downturn Rising, German Industry

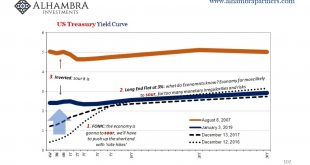

You know things have really changed when Economists start revising their statements more than the data. What’s going on in the global economy has quickly reached a critical stage. This represents a big shift in expectations, a really big one, especially in the mainstream where the words “strong” and “boom” couldn’t have been used any more than they were. If you read nothing other than Bloomberg, it’s as if some alien...

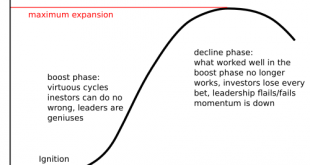

Read More »Here’s The Problem: The Pie Is Shrinking

At that point, the only way to enable debt-serfs to service their debts is too give them free money, i.e. Universal Basic Income (UBI). Scrape away the churn and distraction and the problem is simple: the pie of prosperity is shrinking, and the “fixes” are failing. The status quo arrangement is based on the endless expansion of “growth” and debt, which is the monetary fuel of more, more, more of everything: money,...

Read More »Swiss-German venture aims to build blockchain trading marketplace

The German stock exchange has been experimenting with DLT solutions for some time. (Keystone / Arne Dedert) A consortium of Swiss firms has joined forces with Germany’s main stock exchange to create a distributed ledger technology (DLT) trading system that would rival one being built by the Swiss stock exchange. The alliance is between Deutsche Börse, Switzerland’s state-owned telecoms company Swisscom, budding Swiss...

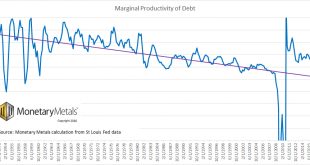

Read More »The Duality of Money, Report 10 Mar

This is a pair of photographs taken by Keith Weiner, for a high school project. It seemed a fitting picture for the dual nature of money, the dual nature of wood both as logs to be consumed and dimensional lumber to be used to construct buildings. Last week, in Is Capital Creation Beating Capital Consumption, we asked an important question which is not asked nearly often enough. Perhaps that’s because few even...

Read More »FX Daily, March 11: Greenback Starts New Week Decidedly Mixed, with Brexit Anxiety Weighing on Sterling

Swiss Franc The Euro has risen by 0.19% at 1.1347 EUR/CHF and USD/CHF, March 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asian shares recovered from opening losses to finish mostly higher, with the Shanghai Composite up nearly 2% and India tacking on 1% after the election was called, starting April 11. European markets, led by energy, communication, and...

Read More »FX Weekly Preview: Brexit Comes to a Head, and while Europe and US Data Rebound, the Equity Rally Falters

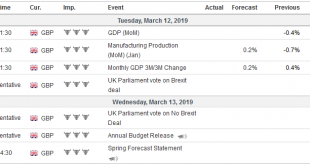

Brexit comes to a head. By nearly all reckoning, the Withdrawal Bill will be resoundingly defeated in the House of Commons on March 12. The margin of defeat may not match the first rejection, but it will be the death knell to the path that had been negotiated for a year and a half. On March 13, the House of Commons will vote on leaving the EU without a withdrawal agreement. Most, except the most extreme partisans, think...

Read More »Report proposes third-class rail tickets for budget travellers in Switzerland

Before 1956, Swiss Railways (SBB/CFF) offered third-class rail tickets in so-called ‘wooden class’ Swiss railway companies should introduce a third-class category for passengers on a budget, a report commissioned by the Federal Office of Transport has recommended. The NZZ am Sonntag newspaper said on Sunday that a recent federal government report, commissioned by an external expert group, had recommended introducing...

Read More »The Source of Killer Inflation: Services

The soaring cost of services is driven by a number of factors. What will the future bring: fire (inflation) or ice (deflation)? The short answer: both, but in very different doses. Goods that are tradeable and exposed to technologically driven commodification will decline in price (deflation) while untradeable services that are difficult to commoditize will increase in price (inflation), generating a self-reinforcing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org