(I am in Mexico at the World Trade Center General Assembly, participating on a panel about USMCA–NAFTA2.0–for which approval remains elusive. It is possible that the US threatens to pull out of NAFTA 1.0 to force action by the US Congress. Mexico is due to pass legislation this week that may meet demands by the some in the US and Canada for stronger labor protections. However, with the steel and aluminum tariffs still...

Read More »FX Weekly Preview: Important Steps Away from the Abyss

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession. The economy previously contracted when the tech...

Read More »Income inequality declines in Switzerland

© Eziogutzemberg | Dreamstime.com In 2016, before the effects of taxes and welfare, the highest earning 20% of Swiss households made on average 40.8 times what an average household in the bottom 20 percent made, an inequality measure known as the S80/S20. However, after taxes and welfare, including low income support, health insurance subsidies, pensions and disability benefits, the same income ratio fell to 4.4....

Read More »China PMIs jump in March

Industrial gauges rebound on seansonality as well as policy easing. Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0. Details of the PMI survey report...

Read More »Swiss regulator fires warning over buy-to-let property lending

A FINMA stress test of 18 banks found that 70% of their investment property loans were at risk if conditions deteriorate. (© Keystone / Christian Beutler) The Swiss financial regulator has warned banks that rules on mortgage lending may be further tightened if they fail to control their appetite for dishing out real estate credit. Loans tipped the one trillion franc mark in 2017 and continue to swell, particularly in...

Read More »Switzerland continues to lure foreign companies

Switzerland would like to attract more Googles and fewer brass plate companies. (© Keystone / Christian Beutler) Switzerland attracted 282 foreign firms to set up shop in the alpine state, creating 899 jobs last year, according to cantonal economic chiefs. That’s an increase of 37 companies from 2017. Switzerland is in the throes of revamping its corporate tax system to keep it line with the competition rules of the...

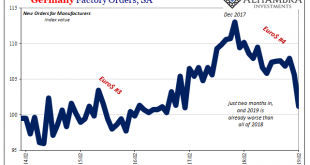

Read More »External Demand, Global Means Global

The Reserve Bank of India (RBI) cut its benchmark money rate for the second straight meeting. Reducing its repo rate by 25 bps, down to 6%, the central bank once gripped by political turmoil has certainly shifted gears. Former Governor Urjit Patel was essentially removed (he resigned) in December after feuding with the federal government over his perceived hawkish stance. Shaktikanta Das, a career bureaucrat with...

Read More »Raiffeisen Switzerland bank to cut 200 jobs

The Raiffeisen bank branch in Ernen, canton Valais, Switzerland in 2018 Switzerland’s third-largest bank says it will cut up to 200 jobs to save CHF100 million ($100 million) this year. Raiffeisen is reorganising and undertaking a cost-cutting programme. This follows a recent fraud allegation scandal involving its former chief executive. The co-operative bank said in a statement on Thursdayexternal link: “In addition to...

Read More »Steep drop in thefts in Switzerland

© Sabine Katzenberger | Dreamstime.com Comparing 2018 to 2012, thefts in Switzerland fell by nearly half, according to the Federal Statistical Office. In 2012, there were a record 219,000 thefts recorded in Switzerland. By 2018, the figure had fallen to 112,000, a drop of 49%. Over the same period, all categories of theft with the exception of fraud were down. Car theft (-13%), bike theft (-20%), break-ins (-51%) and...

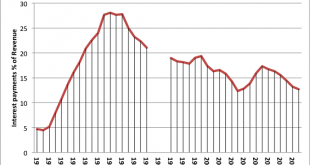

Read More »The Japanification of the World

Zombification / Japanification is not success; it is only the last desperate defense of a failing, brittle status quo by doing more of what’s failed. A recent theme in the financial media is the Japanification of Europe.Japanification refers to a set of economic and financial conditions that have come to characterize Japan’s economy over the past 28 years: persistent stagnation and deflation, a low-growth and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org