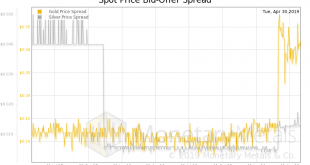

The bid-ask spread of both (spot) gold and silver has blown out. Both, on March 1. In gold, the spread had been humming along around 13 cents—gold is the most marketable commodity, and this is the proof, a bid-ask spread around 1bps—until… *BAM!* It explodes to around 35 cents, or two and half times as wide. On the same day, silver went from half a cent to 1.5 cents, or about triple. We zoomed out far enough—it does...

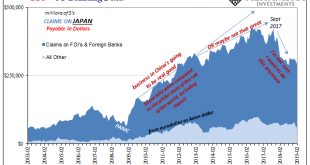

Read More »What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective. Before the...

Read More »FX Daily, May 01: No Help on May Day, which is also Fed Day

Swiss Franc The Euro has fallen by 0.23% at 1.1401 EUR/CHF and USD/CHF, May 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The May Day holiday has shut most markets in Asia and Europe, making for subdued market action. Equity markets that are open, like Australia and the UK, advanced and US shares are trading higher helped by Apple’s upbeat forecasts and...

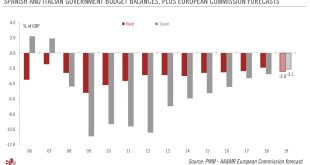

Read More »Peripheral bonds after the Spanish election

We remain underweight peripheral euro area bonds in general due to continued political uncertainty, which will feed volatility. On April 28, Spain held its third general election in less than four years. As was expected, the centre-left Socialists (PSOE) emerged the largest party, but it does not have an absolute majority, so negotiations with other parties will be needed. But the political fog in Spain is unlikely to...

Read More »Swiss president strengthens economic ties with China

Xi and Maurer (centre) during the welcome ceremony in Beijing on Monday. Swiss President Ueli Maurer has been received by the Chinese president, Xi Jinping, for a state visit at the end of a week-long visit to China. The talks on Monday focused on strengthening relations, notably on economic and finance matters, according to a government statementexternal link. Bilateral ties are at a “historic high in terms of...

Read More »The Erosion of Everyday Life

Working hard and doing what you’re told is no longer yielding the promised American Dream of security, agency and liberty. Volume One of Fernand Braudel’s oft-recommended (by me) trilogy Civilization & Capitalism, 15th to 18th Century is titled The Structures of Everyday Life. The book describes how life slowly became better and freer as the roots of modern capitalism and liberty spread in western Europe, slowly...

Read More »FX Daily, April 30: Dollar Pares more Gains as EMU GDP Surprise

Swiss Franc The Euro has risen by 0.31% at 1.1437 EUR/CHF and USD/CHF, April 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 set a new record high and close yesterday, but the lift to global markets was not strong enough to overcome the disappointing Chinese PMI. Although Chinese equities traded higher on ideas that the news will spur additional...

Read More »Pound to Swiss franc forecast – Brexit impasse means a fragile pound

Brexit Limbo At present Theresa May is in talks with Jeremy Corbyn in order to try and come up with a mutually acceptable deal to put to Brussels. The problem is May can’t even get a deal that is acceptable within her own party let alone Labour as well. Her deal has been rejected three times and Brussels are stone walling us on the Irish border. Brussels have reiterated there will be no changes to the deal on the table...

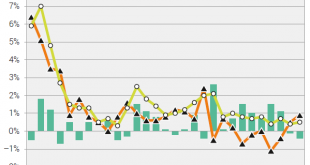

Read More »Swiss wage index 2018: Nominal wage increase of 0.5 percent in 2018, real wages decrease by -0.4 percent

30.04.2019 – The Swiss nominal wage index rose by +0.5% on average in 2018 compared with 2017. It settled at 101.6 points (base 2015 = 100). Given an average annual inflation rate of +0.9%, real wages registered a decrease of -0.4% (100.5 points, base 2015 = 100) according to calculations by the Federal Statistical Office (FSO). Development of nominal wages to the consumer prices and real wages 1990-2018 Source:...

Read More »More asylum seekers find work in Switzerland

Asylum seekers clean a park in Biasca, canton Ticino, in 2017 Over one-third of all asylum seekers and refugees in Switzerland are currently employed, according to State Secretariat for Migration (SEM) figures. But most of the jobs are precarious and the vast majority continue to receive state benefits. In one year, the employment rate for asylum seekers in Switzerland rose from 27% in March 2018 to 32% today, according...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org