Recency bias is one thing. Back in late 2006/early 2007 when the eurodollar futures curve inverted, for example, it was a textbook case of mass delusion. All the schoolbooks and Economics classes had said that it couldn’t happen; not that it wasn’t likely, it wasn’t even a possibility. A full-scale financial meltdown was at the time literally inconceivable in orthodox thinking. A global panic, some sort of unserious...

Read More »Apple, China, Yen, and US Jobs: Welcome to 2019

The New Year is off to an auspicious start. The Japanese yen, the third most actively traded currency behind the dollar and euro, got caught in a vortex of a retail short squeeze, algos, and who knows what else. The US dollar plunged from around JPY109 to a slightly below JPY105 in a few minutes a little more than an hour after US markets closed yesterday. Japanese markets were still closed for the holiday, which may...

Read More »One in two Swiss is happy with personal finances

Swiss men are happier than women on the financial front. One Swiss in two is satisfied with the state of their financial situation, according to a study. Just under a third (28%) expect their finances to improve in 2019. The French-speaking population is feeling much more positive than last year. In 2018, one fifth of French-speaking Switzerland still believed that their financial situation was deteriorating, according...

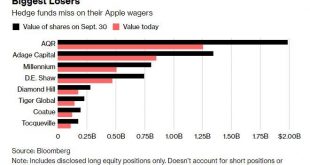

Read More »Hedge Funds, ETFs, Central Banks Suffer Billions In Losses On Apple

It wasn’t that long ago that Apple was the most beloved stock by the hedge fund community, and although in recent months the company’s popularity faded somewhat among the 2 and 20 crowd it is still one of the most popular names among the professional investing community. Which on a day that saw AAPL stock tumble as much as 10% is clearly bad news. As Bloomberg notes, eight hedge funds that own large stakes in Apple have...

Read More »Nothing To See Here, It’s Just Everything

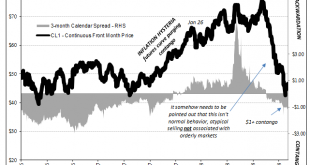

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal. In May, the Trump administration formally withdrew from the...

Read More »Insane Repo Reminds Us

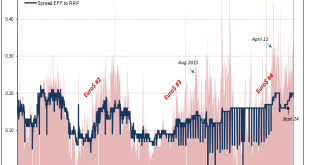

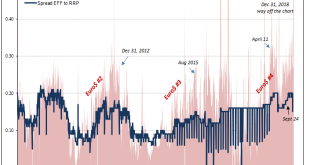

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps. We also have to keep in mind...

Read More »GBP/CHF Forecast: Swiss Franc at Best Level against the Pound in over a year

GBP/CHF forecast: Brexit uncertainty causes Swiss Franc to gain vs the Pound The Pound is now trading at its lowest level to buy Swiss Francs in over twelve months as the political uncertainty surrounding the UK is continuing to negatively affect the value of Sterling exchange rates. Clearly the uncertainty of what may happen in the next three months before the end of March is causing investment in the UK to drop off...

Read More »Visitors flock to Swiss ski resorts over Christmas and New Year

Skiers at the top of the La Berneuse mountain above Leysin in western Switzerland on December 26 Ski resorts have reported a busy period over Christmas and the New Year with numerous visitors enjoying the sunny weather and good snow conditions. The chic resort of Verbier in canton Valais registered over 20,000 skiers a day over the Christmas period, Laurent Vaucher, director of the Téléverbier lift company, told...

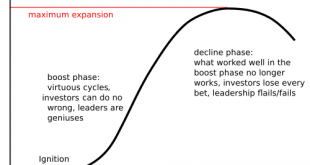

Read More »The Crisis of 2025

This is the predictable path because it’s the only one that’s politically expedient and doesn’t cause much financial pain until it’s too late to stave off collapse. While many fear a war between the nuclear powers or the breakdown of civil order, I tend to think the Crisis of 2023-26 is more likely to be financial in nature. War and civil breakdown are certainly common enough in history, global/nuclear war has been...

Read More »The Bear Market Hook

Has a Bear Market in Stocks Begun? The stock market correction into late December was of approximately the same size as the mid 2015/early 2016 twin downturns, so this is not an idle question. Moreover, many bears seem quite confident lately from an anecdotal perspective, which may invite a continuation of the recent upward correction. That said, there is not much confirmation of said confidence in data that can be...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org