Swiss Franc The Euro has risen by 0.04% at 1.1328 EUR/CHF and USD/CHF, March 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is an eventful day, but the capital markets are taking it in stride. Equity markets are mixed. Asia may have been weighed down by China’s shaving its growth target and announced around CNY2 trillion (~$300 bln) in tax cuts to support...

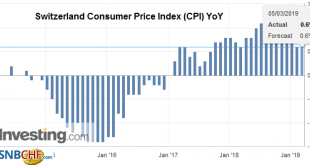

Read More »Swiss Consumer Price Index in February 2019: +0.6 percent YoY, -0.3 percent MoM

05.03.2019 – The consumer price index (CPI) increased by 0.4% in February 2019 compared with the previous month, reaching 101.7 points (December 2015 = 100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.4% increase compared with the previous month can be explained by several factors including rising prices for air transport and...

Read More »Mit Negativzinsen die Wirtschaft ankurbeln? Nächste Irrlehre der SNB

Seit Jahrzehnten geistert die Illusion in den Köpfen der Oekonomen herum, man könne mit Zinssenkungen eine Wirtschaft ankurbeln. Den Vogel schiesst der vermeintliche „Starökonom“ von der Harvard University, Kenneth Rogoff, ab. Er prophezeit, dass künftige Wirtschaftskrisen mit Negativzinsen von bis zu minus 6 Prozent bekämpft würden. In der jüngsten Sonntagspresse nimmt sich die NZZ, die „externe Public Relations...

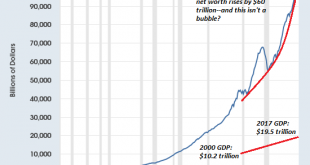

Read More »The Fed’s “Wealth Effect” Has Enriched the Haves at the Expense of the Young

The Fed is the mortal enemy of the young generations, and thus of the nation itself. “The wealth effect” generated by rising stock and housing prices has long been a core goal of the Federal Reserve and other central banks. As Lance Roberts noted in his recent commentary So, The Fed Doesn’t Target The Market, Eh?(Zero Hedge), Ben Bernanke added a “third mandate” to the Fed – the creation of the “wealth effect”–in 2010,...

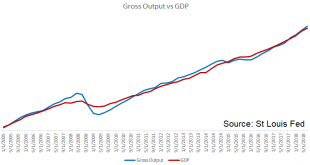

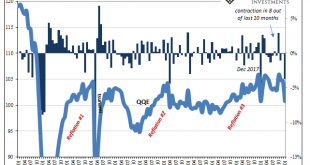

Read More »Is Capital Creation Beating Capital Consumption? Report 3 Mar

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP). What Is Capital At the same time, of course entrepreneurs are creating new capital. Keith...

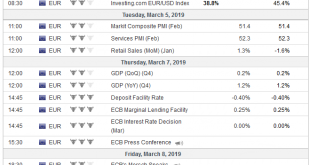

Read More »FX Weekly Preview: Dovish Hold by the ECB and Uptick in US Wages will Underscore Divergence

The important events take place in the second half of the week ahead: the ECB meeting and the US employment report. A dovish hold by the ECB is the most likely outcome. US jobs growth is bound to slow from the heady 304k gain in January, but there won’t be anything in it that lends credence to ideas that the world’s largest economy is on the precipice of a recession. The Brexit drama could be moving into its...

Read More »Brexit looms over Geneva motor show

Car manufacturers are bracing for the potential of a no-deal Brexit in three weeks, which experts predict could lead to sudden tariffs that could disrupt supply chains. The Geneva International Motor Show opens this week amid growing concerns about the impact of Brexit on car manufacturers in the UK and across Europe. Experts expect that a no-deal Brexit could lead to sudden tariffs that could disrupt the auto industry...

Read More »What Killed the Middle Class?

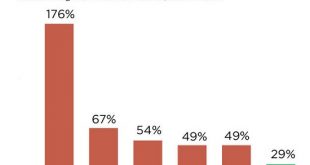

Rounding up the usual suspects won’t restore a vibrant middle class. What killed the middle class? The answer may well echo an Agatha Christie mystery: rather than there being one guilty party, it may be that each of the suspects participated in the demise of the middle class. If you doubt the middle class has expired, please consider the evidence: The Middle Class Is Shrinking Everywhere — In Chicago It’s Almost Gone...

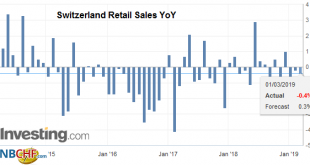

Read More »Swiss Retail Sales, January 2019: -0.3 percent Nominal and -0.4 percent Real

01.03.2019 – Turnover in the retail sector fell by 0.3% in nominal terms in January 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.3% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.4% in January 2019 compared with the previous year....

Read More »Meanwhile, Over In Asia

While Western markets breathed a sigh of relief that US GDP didn’t confirm the global slowdown, not yet, what was taking place over in Asia went in the other direction. There has been a sense, a wish perhaps, that if the global economy truly did hit a rough spot it would be limited to just the last three months of 2018. Hopefully Mario Draghi is on to something. Therefore, Q4 US GDP wasn’t as bad as feared, cushioning...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org