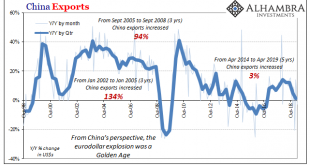

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging. Even Japan was looking forward to a substantial QQE-based pickup – after the...

Read More »FX Daily, May 09: De-Risking as US-China Trade Talks Resume

Swiss Franc The Euro has fallen by 0.25% at 1.1389 EUR/CHF and USD/CHF, May 09(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The end of the tariff truce between the US and China continues to dominate investment considerations. The truce was often cited in narratives explaining the recovery of equities from the Q4 18 slide. Ahead of the midnight US tariff...

Read More »New Federal Legislation Requires Full Audit of America’s Gold Reserves

Congressman Alex Mooney (R-WV) Washington, DC (May 8, 2019) – U.S. Representative Alex Mooney (R-WV) introduced legislation this week to provide for the first audit of United States gold reserves since the Eisenhower Administration. The Gold Reserve Transparency Act (H.R. 2559) – backed by the Sound Money Defense League and government accountability advocates – directs the Comptroller of the United States to conduct a...

Read More »Swiss teachers stretched thin with unpaid overtime work

Switzerland invests heavily in public education in terms of spending per student and as a share of public expenditure. (Keystone) Swiss teachers are still working too much unpaid overtime, particularly in German-speaking Switzerland, according to a new survey by two major teachers’ associations. “Swiss teachers have the highest number of working hours of all OECDexternal link countries and work unpaid overtime for...

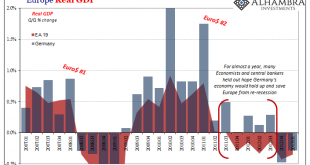

Read More »What’s Germany’s GDP Without Factories

It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of...

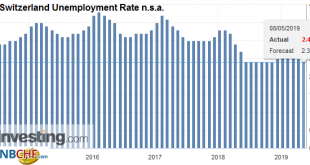

Read More »Switzerland Unemployment in April 2019: Unchanged at 2.4percent, seasonally adjusted unchanged at 2.4percent

Unemployment Rate (not seasonally adjusted) Registered Unemployment in April 2019 – According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of April 2019, 107,298 unemployed persons were registered at the regional employment agencies (RAV), 5,043 fewer than in the previous month. The unemployment rate fell from 2.5% in March 2019 to 2.4% in the month under review. Compared to the same...

Read More »FX Daily, May 08: Markets Trying to Stabilize

Swiss Franc The Euro has fallen by 0.06% at 1.14 EUR/CHF and USD/CHF, May 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is taking investors a bit more than two sessions to find its footing after being the unexpected end of the tariff truce between the US and China struck last December. Asia Pacific equities tumbled after the S&P 500 shed nearly 1.7%...

Read More »Brexit to drive pound to Swiss franc exchange rates

Yesterday the PM’s deputy David Liddington confirmed that the UK will be taking part in European elections, therefore in my view the cross-party talks between Theresa May and Jeremy Corbyn are over. If the Prime Minister thought that they would be able to come to an agreement in the upcoming days Mr Liddington would not have made the announcement yesterday. Over the last 24 hours the pound has lost some value against...

Read More »Gun law and corporate tax reforms set to be approved

Opponents of restrictions on gun ownership in Switzerland have not been able to win substantial additional support over the past months, according to an opinion poll ahead of a nationwide vote on May 19. The No camp lags more than 30 percentage points behind the supporters, a survey published by the Swiss Broadcasting Corporation on Wednesday as found. The planned corporate tax reform is aimed at putting Swiss...

Read More »A spanner in the works

While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed. At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org