© Sebnem Ragiboglu | Dreamstime.com The Swiss bank UBS estimates there could be a shortfall of 500,000 workers in Switzerland in the coming 10 years as the baby boomer generation retires. However, the bank predicts the shortfall will not be even across all industries. Some sectors are expected to stagnate. Workers in these industries might find it harder to find work. Demand for workers is expected to be high in the...

Read More »FX Daily, July 17: Back to the Well Again

Swiss Franc The Euro has risen by 0.22% at 1.1095 EUR/CHF and USD/CHF, July 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After slapping punitive tariffs on structural from China and Mexico last week, US President Trump threatened to end the tariff truce with China because it is not stepped up its purchases of US agriculture products. Trump said the tariff...

Read More »China: Q2 growth lowest in decades

Downward pressure on growth persists amid ongoing trade tensions. Chinese real GDP growth came in at 6.2% year-over-year (y-o-y) in Q2, down from 6.4% in Q1, and the lowest quarterly growth in over two decades. The tertiary sector (mainly services) continued to lead growth, expanding by 7.0% y-o-y in Q2, the same as in Q1. In comparison, growth in the secondary sector (mainly manufacturing) declined to 5.6% y-o-y, from...

Read More »Survey: one in ten Swiss jobs is ‘low paid’

Hairdressers are among the lowest paid workers in Switzerland, according to OFS Around 320,000 jobs in Switzerland are considered low paid, earning a gross monthly salary of under CHF4,335 ($4,400), according to the most recent nationwide statistics. In 2016, 12% of Swiss workers earned such a low monthly salary, the Federal Statistical Office (OFS) reported on Mondayexternal link. The OFS uses the Organisation for...

Read More »Swiss fuel-related CO2 emissions remained stable in 2019

Last year, average new car emissions reached 137.8 grams of carbon dioxide per kilometre – while the national limit is 130g CO2/km. Despite an increase in the use of biofuels and electric vehicles, fuel-related carbon dioxide emissions remained unchanged in 2018 in the country. The stagnation was due to the increase in road traffic. Owing to a rise in the average number of kilometres Swiss residents travelled last year,...

Read More »FX Daily, July 16: Sterling Weakness Punctures Subdued Session

Swiss Franc The Euro has fallen by 0.05% at 1.1078 EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Summer in the northern hemisphere contributing to the subdued activity in the global capital markets. The MSCI Asia Pacific index stalled after a four-day advance, with Japanese, Chinese, and Australian equities offsetting gains in Taiwan,...

Read More »Is the Fed too focused on corporates?

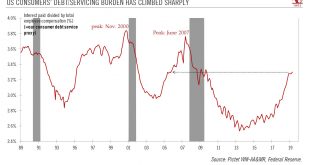

Fed dovishness is helping to curb financing costs for corporates but does not seem to be percolating down to the US consumer, whose debt-servicing costs are rising. This could be something to watch. The Federal Reserve (Fed)’s leading priority now is to help sustain the US business cycle, hence the concept of ‘insurance’ rate cuts put forward by Fed chairman Jerome Powell, with some echoes of Alan Greenspan’s philosophy...

Read More »How to Fix GDP, Report 14 Jul

Last week, we looked at the idea of a national balance sheet, as a better way to measure the economy than GDP (which is production + destruction). The national balance sheet would take into account both assets and liabilities. If we take on another $1,000,000 debt to buy a $1,000,000 asset, then we have not added any equity. This is so, even though assets have gone up. But unfortunately, as a consequence of assets going...

Read More »FX Daily, July 15: Marking Time on Monday

Swiss Franc The Euro has fallen by 0.10% at 1.108 EUR/CHF and USD/CHF, July 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed...

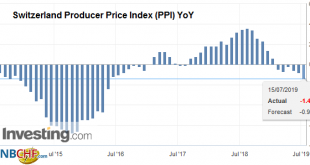

Read More »Swiss Producer and Import Price Index in June 2019: -1.4 percent YoY, -0,5 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org