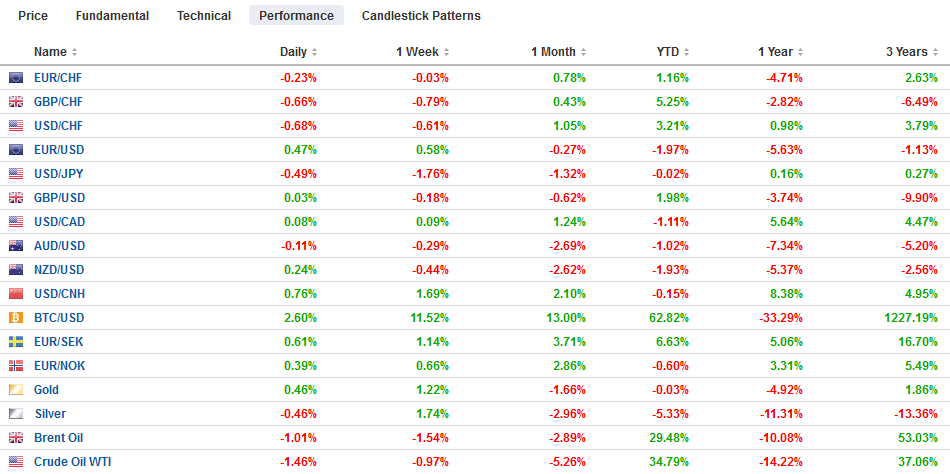

Swiss Franc The Euro has fallen by 0.25% at 1.1389 EUR/CHF and USD/CHF, May 09(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The end of the tariff truce between the US and China continues to dominate investment considerations. The truce was often cited in narratives explaining the recovery of equities from the Q4 18 slide. Ahead of the midnight US tariff hike, global equities are being smashed. Korea’s Kospi was off 3%, and Hong Kong’s Hang Seng was shed 2.4%. Shanghai lost 1.5%. Europe’s financials and consumer discretionary are the biggest drag on the Dow Jones Stoxx 600, which is down around 1% with not sector gaining. The S&P 500 is poised to gap

Topics:

Marc Chandler considers the following as important: 4) FX Trends, Brexit, China, China Consumer Price Index, China New Loans, Featured, newsletter, trade, U.S. Trade Balance, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.25% at 1.1389 |

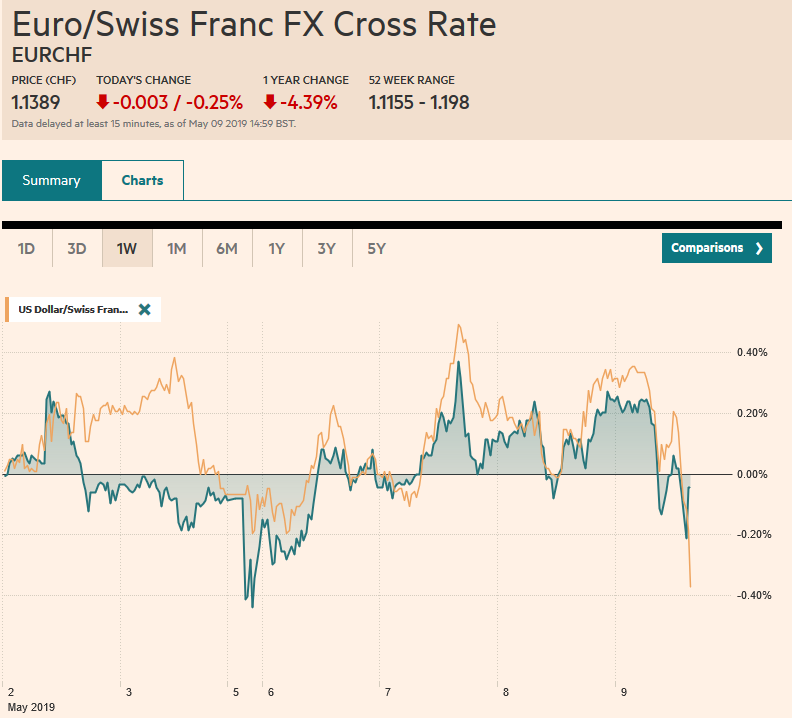

EUR/CHF and USD/CHF, May 09(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The end of the tariff truce between the US and China continues to dominate investment considerations. The truce was often cited in narratives explaining the recovery of equities from the Q4 18 slide. Ahead of the midnight US tariff hike, global equities are being smashed. Korea’s Kospi was off 3%, and Hong Kong’s Hang Seng was shed 2.4%. Shanghai lost 1.5%. Europe’s financials and consumer discretionary are the biggest drag on the Dow Jones Stoxx 600, which is down around 1% with not sector gaining. The S&P 500 is poised to gap lower, and possibly into the old gap from April 1 (~2836-2869.4). Bonds are mostly firmer, with benchmark 10-year yields two-three basis points lower. The 10-year Bund yield is pushing beyond minus six basis points. It had bottomed near minus 10 bp at the end of March. Italy and Greek bonds are treated like risk assets with yields spiking higher. Blackrock was had been interested in a trouble Italian band (Carige) has pulled back. The Japanese yen and Swiss franc are firmer, but safe haven may be a misnomer. They are used as funding currencies, and as risk comes off, the asset is liquidated, and the funding currency bought back. Some speculative flows trying to front-run the unwinding of these structured trades may also play a role. Norway’s central bank indicated that a hike in June is likely and this is helping the krone resist the dollar’s strength. |

FX Performance, May 09 |

Asia Pacific

What was expected to be the last round of US-Chinese trade talks will begin today, a day later than initially intended, and the Chinese delegation is smaller. In the well-choreographed world diplomacy, these subtleties are important. The critical question that followed Trump’s tweets was the reaction from China and investors. Investors have sold some risk assets, and Chinese shares were among the biggest losers. Investors also boosted the risk of a Fed cut after having trimmed the odds after Powell talked about the transitory factors that that may be behind the soft inflation in recent months and unexpectedly large drop in the unemployment rate to 3.6%, a nearly half-century low. Now the attention turns to China’s response.

China’s Commerce Minister was being quoted on the news wires acknowledging that “counter-measures” would be adopted if the US went forward with its tariffs. If China were going to detail their response, they would have done so. That they didn’t, increases the uncertainty and makes whatever they do a surprise. US markets will be closed, but Shanghai and Hong Kong will be open.

Reports indicate that Lighthizer has been preparing legislators for no deal and confirming that the tariffs will, in fact, be raised as threatened. Mnuchin is reportedly arguing that Vice Premier Liu He will likely come with new offers in hand to close the deal.

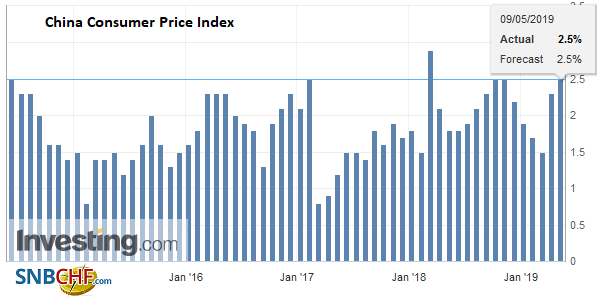

ChinaSeparately, China reported increased price pressures and less lending in April. Consumer prices rose 2.5% in April after a 2.3% pace in March. It was driven by food prices, where swine fever has seen pork prices soar. Food inflation rose to 6.1% year-over-year. Producer prices rose 0.9% year-over-year, more than double the 0.4% rate seen in March. Lending slowed more than expected after the March surge. |

China Consumer Price Index (CPI) YoY, April 2019(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

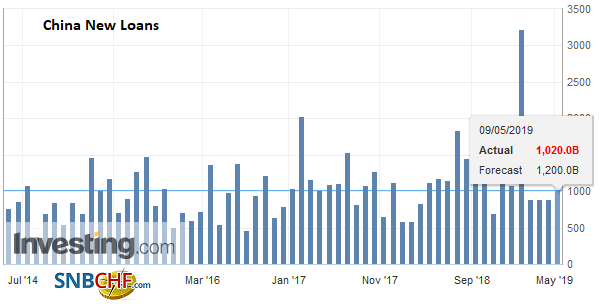

| New CNY loans, which represent the state-owned banking sector, rose by CNY1.02 trillion after increasing by CNY1.69 trillion in March. Aggregate financing picks up the shadow banking activity, and it rose by CNY1.36 trillion in April. This is less than half the CNY2.86 trillion lent in March. |

China New Loans, March 2019(see more posts on China New Loans, ) Source: Investing.com - Click to enlarge |

The dollar gapped lower on Monday against the yen and has not looked back. It traded JPY109.60 for the first time in three months. JPY109.50 corresponds to the (38.2%) retracement of the greenback’s rally from the flash crash low (~JPY104.80). There is an option there (JPY109.50) for about $620 mln that expires today. The $580 mln option at JPY109.75 is also in play. The next retracement objective (50%) is found by JPY108.65. The Australian dollar closed below $0.7000 yesterday for the second time this week. It tested the $0.6965 area seen earlier in the week, which is the low from the flash crash. The $0.6950 area corresponds to the (61.8%) retracement objective of the rally from the flash crash low (~$0.6740). The dollar spiked higher against the Chinese yuan. Above CNY6.82, the greenback is at its best level since January against it. The Korean won is the hardest hit emerging market currency, losing almost 0.9%, as foreign investors liquidated nearly half the Korean stocks bought this month today. The Philippine peso came under a little pressure after the central bank shaved interest rate corridor by 25 bp to 4.00%-4.50%.

Europe

The Tory panel did not change the rules as it had threatened to do to try to force Prime Minister May out after failing to do so in a vote of confidence at the end of last year. May is said to appear before the 1922 Committee of backbenchers to ostensibly discuss her future next week. Both the government and Labour are claiming progress in their cross-party talks, which had seemed doomed yesterday.

Norges Bank, Norway’s central bank, did not hike rates today but gave a nod to speculation that saw a follow-up hike after the March move. It said a hike in June was likely. In March, the central bank had signaled that it was not a one-off move and it had anticipated another move within six months. While the market had been leaning toward a June move, the issue now is whether there could be a third move this year.

The euro and sterling are little changed in narrow ranges, but a softer bias is evident. The euro’s low for the week is about $1.1160. There is a one billion euro option at $1.1150 that expires today and 1.5 bln euros at $1.1175 and at $1.12. There are 2.2 bln euros in expiring options $1.1245-$1.1250.Sterling has traded in a quarter-cent range on either side of $1.30. It has fallen in the first three sessions this week and is threatening to extend the streak today. A move above $1.3055, where a GBP273 mln option is struck that gets cut today and a retracement objective of this week’s decline is found, would lift the technical tone. Note that there is a 1.1 bln euro option at NOK9.80 that is very much in play ahead of its expiry today. There may be no specific trigger today, but the Turkish lira is suffering in the risk-off environment. The US dollar is at new eight-month highs around TRY6.25. The lira has fallen about 4.5% this week.

America

The increase in the US deficit has mostly been absorbed by domestic names. The new supply has been easily absorbed, which makes yesterday’s dismal reception to at the US 10-year note sale jump out at you. At 2.17, the bid-cover ratio was the lowest since mid-March 2009 as the stock market and the economy were bottoming. Indirect bidders, which include large asset managers as well as foreign central banks, took down a little more than half of the supply (53.3%), which is the lowest in a year, whereas recently it has been absorbing closer to 2/3 (64%) of the new 10-year supply. Primary dealers had to take down 35.2% of the offering. The recent average is near 27.5%. Today, the Treasury returns to conclude the quarterly refunding with $19 bln 30-year bonds. It is yielding about 2.86%. On March 1, the yield was near 3.12%.

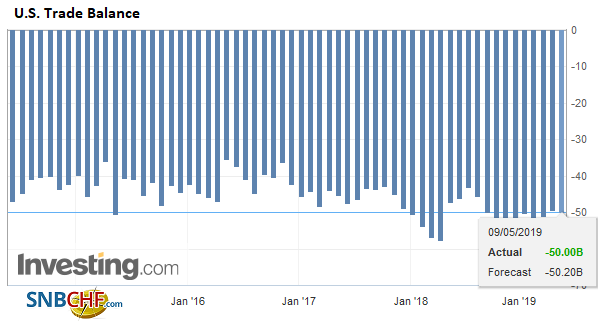

United StatesThe US economic diary is full today, with PPI, trade balance, and weekly jobless claims on tap as well as three Fed officials, including Powell (Bostic and Evans too). A tick up in producer prices and a small widening of the trade deficit are unlikely to distract participants from their trade talk focus. Yesterday, Trump tightened the embargo against Iran to include industrial metals (iron, steel, aluminum, and copper). Metals are Iran’s third largest export category after oil and petrochemicals. Petrochemicals could be next as Iran is threatening to resume enriching uranium. It wants Europe to continue to respect the agreement that the US broke away from. |

U.S. Trade Balance, March 2019(see more posts on U.S. Trade Balance, ) Source: Investing.com - Click to enlarge |

Canada reports March trade figures today ahead of April jobs data tomorrow. Non-oil exports have been weak, and that is the area that investors and policymakers may be most interested in today. The US dollar is knocking on CAD1.35, which has held it in check in recent days. The greenback did reach a high near CAD1.3520 at the end of April, which was its best level since early January. Canada typically does poorly in a strong risk-off. Recall that the Canadian dollar rose only in one week in Q4 amid the equity meltdown. Mexico is likely to report a small increase in inflation today, and this will keep the central bank’s hand steady at next week’s policy meeting. The US dollar is bumping against the upper end of its recent range that extends toward MXN19.20. The dollar has not traded above its 100-day moving average against the peso in four months. It is found a touch below MXN19.18 today. Brazil’s central bank left rates on hold yesterday as widely expected. Today it reports retail sales. Look for yesterday’s real gains to be pared.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,China Consumer Price Index,China New Loans,Featured,newsletter,Trade,U.S. Trade Balance