It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of crisis and economic weakness were everywhere. Central bankers had built their platforms on dismissing problems. “Subprime is contained” the mantra for Euro$ #1 was later replaced by “Greece isn’t a big deal” in time for Euro$ #2. Neither had anything to do with the global monetary situation, precisely

Topics:

Jeffrey P. Snider considers the following as important: 5) Global Macro, China, currencies, ECB, economy, EuroDollar, Europe, factory orders, Featured, Federal Reserve/Monetary Policy, Germany, jean-claude trichet, LTRO, Mario Draghi, Markets, newsletter, QE, real GDP, Recession, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of crisis and economic weakness were everywhere.

Central bankers had built their platforms on dismissing problems. “Subprime is contained” the mantra for Euro$ #1 was later replaced by “Greece isn’t a big deal” in time for Euro$ #2. Neither had anything to do with the global monetary situation, precisely the point.

Still, Draghi as much in the dark about it as Trichet had to show the world he was serious and therefore, supposedly, different from his predecessor. Sticking with the PIIGS theme, the new head of the ECB having just launched massive LTRO’s tried to sound reasonable about them. Sitting down for an interview in Frankfurt with the Wall Street Journal, the Italian wowed them:

You know there was a time when [economist] Rudi Dornbusch used to say that the Europeans are so rich they can afford to pay everybody for not working. That’s gone.

| This was February 2012. The implications were clear, and it would define the way in which everything would later unfold – including Draghi’s infamous promise to “do whatever it takes” to save the euro uttered a few months later.

This was all Southern Europe’s fault. A touch of German in his voice, Draghi was saying that Germany couldn’t and shouldn’t be counted on to bail out Continent. Not just in financial matters, but in overall economy, too. |

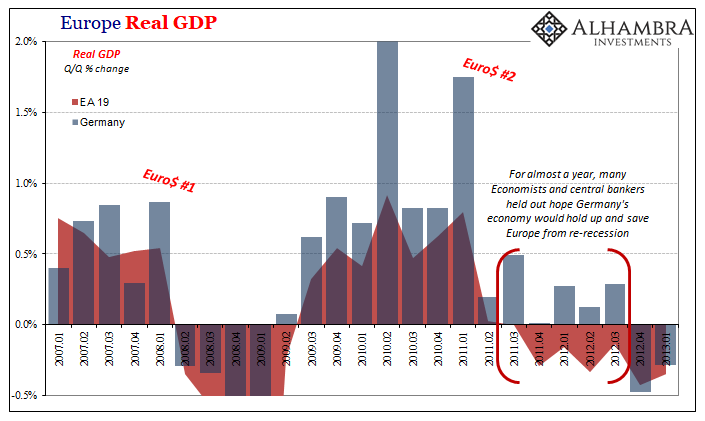

Europe Real GDP, 2007-2013(see more posts on Eurozone Gross Domestic Product, ) |

| By Q4 2011, European GDP had turned negative. It was a huge shock coming so soon after the Great (somehow global) “Recession.” Trichet, after all, had proclaimed the recovery a success despite Greece and Italy.

German GDP decelerated, too, only for much of 2012 it stayed positive and buoyed spirits and projections. Perhaps Germany’s economy itself supported by robust “global growth” could do it. Its vast factory sector was a gateway to the rest of the world, especially Asia, which didn’t have to fuss over Portugal and Ireland’s fiscal situations. |

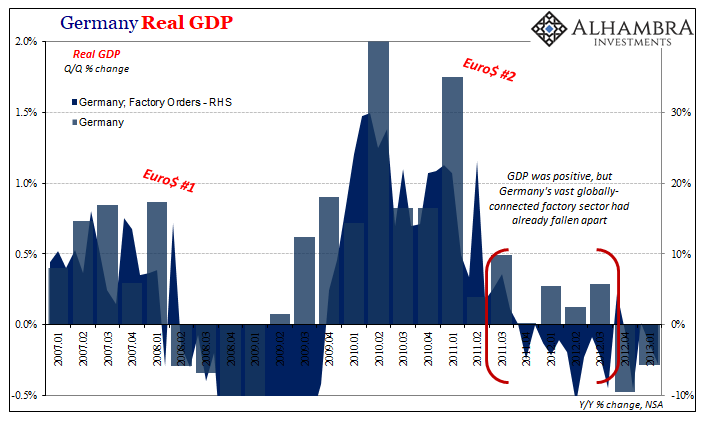

Germany Real GDP, 2007-2013(see more posts on Germany Gross Domestic Product, ) |

| As with most central bank projections, however, these amounted to subjective hope predicated on managing expectations. Nowhere was there sound let alone rational analysis. Germany’s factory sector was itself already in recession alongside most of Europe. GDP in the country might’ve stayed positive, but every indication for convergence to the downside was available early in the year 2012.

It wasn’t until November that officials admitted the whole of Europe was in trouble, not just the Southern region. Sticking to the premise that it was PIIGS anyway who eventually dragged down the north, Draghi and the rest committed much the same error as Trichet. They never figured out what was really wrong and therefore never really fixed it. |

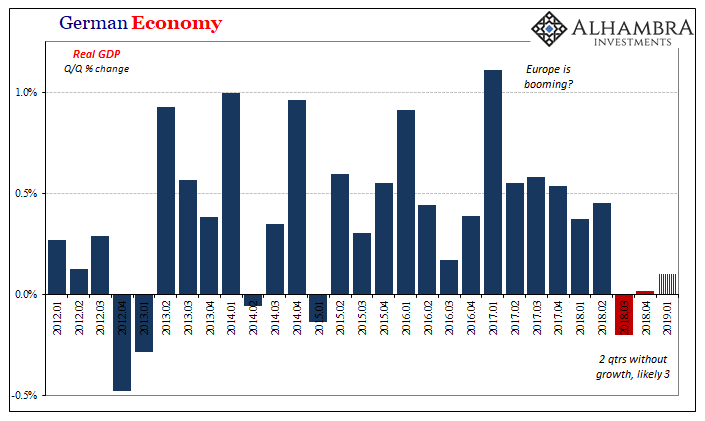

German Economy, 2012-2019 |

| Here we are all over again, only with the roles somewhat reversed. In 2018 and now 2019, it’s Germany which is leading toward the downside. This isn’t to say that the South is a towering pillar of economic strength; far from it. In terms of relative weakness, right now the German economy is near the top.

According to DeStatis, the German government’s number crunching agency, Real GDP growth was negative in Q3 and basically flat in Q4. Current expectations are that output accelerated a little in Q1 2019, maybe as much as 0.1% growth (DeStatis will report next week on Q1). It’s not the specific expectation but the trend – slowly getting better, from autumn and winter gray back into spring and summer green. |

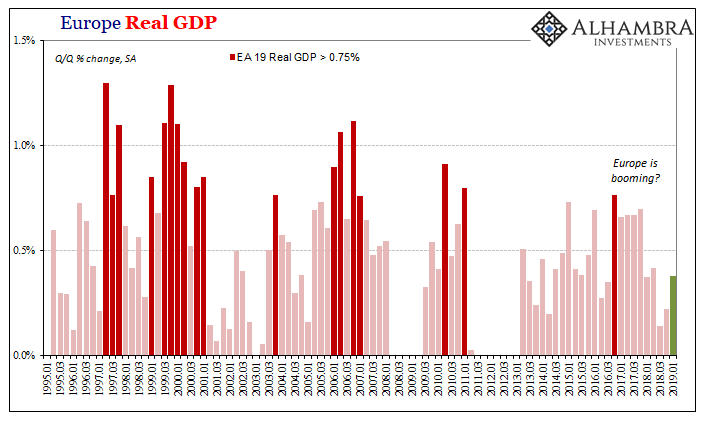

Europe Real GDP, 1995-2019 |

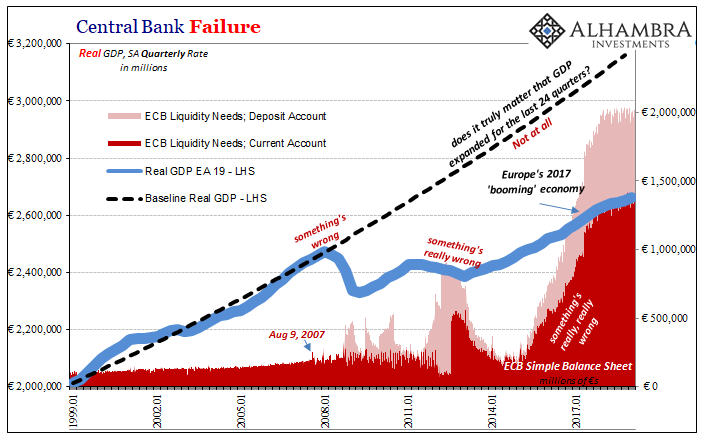

| The season for these green shoots gained a little more color when last week EuroStat reported Q1 2019 GDP for the whole of Europe came in at 0.379% quarter over quarter. It seems to confirm the idea that the soft patch was just that; a transitory combination of one-off factors lazily dissipating so that the boom can eventually resume (next year, perhaps).

For that to happen, though, Europe needs to resolve Germany’s weakness. Mario Draghi as much as any other central banker is counting on “global growth” to resynchronize on the plus side. German problems suggest it would be wise not to. |

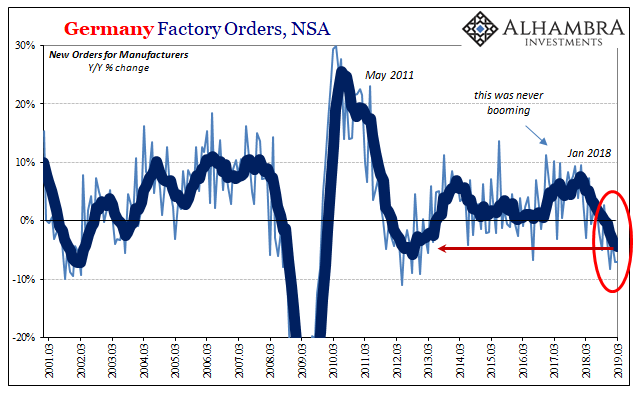

Germany Factory Orders, NSA 2001-2019 |

| While GDP may be positive again in Q1, maybe like 2012 for a few quarters thereafter, German industry is still under pain of severe contraction. DeStatis reports today that unadjusted factory orders, a leading indication, were 7.2% less in March 2019 than in March 2018 (which were 3% less than in March 2017).

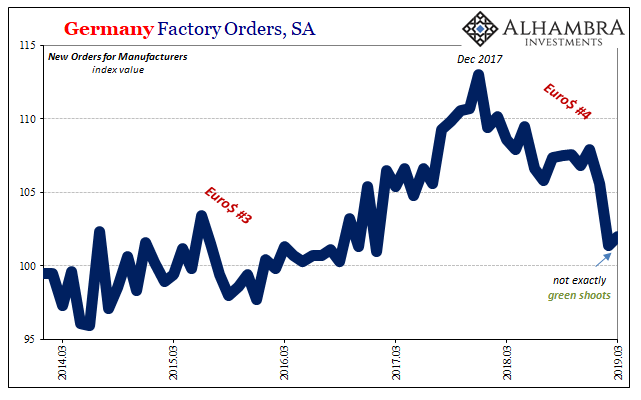

It was the fifth consecutive month of contraction, four of them at rates consistent with 2012’s Europe-wide recession. Seasonally-adjusted, factory orders were a tiny sliver higher in March than in February, not at all the same thing as green shoots considering the steep drop in them starting last December. |

Germany Factory Orders, SA 2014-2019 |

| Does Europe’s economy rebound without Germany? Can the German economy contribute without its factories? What is the global economy really like?

The bond market version including expected rate cuts in the United States is not nearly as far-fetched as many claim; nearly all those claims beginning with central bank models, forecasts, and “analysis.” Central bankers have had it all wrong all along. Lumbering toward his own looming retirement, Mario Draghi has fully proved himself no different than Trichet. |

Central Bank Failure, 1999-2017 |

Tags: currencies,ECB,economy,EuroDollar,Europe,factory orders,Featured,Federal Reserve/Monetary Policy,Germany,jean-claude trichet,LTRO,Mario Draghi,Markets,newsletter,QE,real GDP,recession