China is isolated on trade. No one supports its trade practices. The idea that China was going to “naturally” evolve to be more like the US, or Europe for that matter, was always fanciful and naive. The emergence of China, as Napoleon warned two centuries ago, would make the world shake. US administrations adopted a multi-prong strategy of managing the rise of China. On economic issues, the focus was on working through...

Read More »Trade Wars Have Arrived, But It’s Trade Winter That Hurts

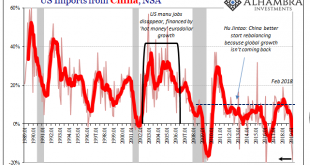

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year. In the entire series which goes back to 1988, there are only three...

Read More »A family apartment in Geneva close to twice the price of one in St. Gallen

© Rosshelen | Dreamstime.com On average, renting a 4.5 room apartment of 100 to 110 m2 costs CHF 3,820 a month in Geneva. The same apartment in the Swiss city of St. Gallen costs CHF 2,004, 52% of the price, according to a report on rents in Switzerland’s ten main cities by the price comparison website Comparis. For an apartment of this size, Geneva (3,820) is the most expensive, followed by Zurich (3,073), Lausanne...

Read More »Unrealistically Great Expectations

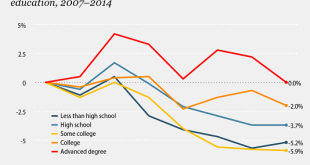

Our expectations have continued ever higher even as the pie is shrinking.. Let’s see if we can tie together four social dynamics: the elite college admissions scandal, the decline in social mobility, the rising sense of entitlement and the unrealistically ‘great expectations’ of many Americans. As many have noted, the nation’s financial and status rewards are increasingly flowing to the top 5%, what many call a...

Read More »Up to 100 Nestlé jobs in Basel at risk

Nestlé employs almost 10,000 people across Switzerland. (© Keystone / Jean-christophe Bott) Nestle is planning to restructure its operations in the Swiss city of Basel. Up to 100 jobs are threatened by cuts or moving production abroad. Some 177 people are employed at Nestlé’s Basel plant, 100 of which could be under threat over the next 18 months, the Swiss food giant announced on Thursday. The diverse range of products...

Read More »The price of some Swiss trains passes could rise significantly

© Man Nok Ip | Dreamstime.com Some travelers on Swiss trains could be in for a shock. The price of a GA travel card, an annual pass that allows unlimited travel of the Swiss Rail network, might rise 10% in 2021, according to the newspaper Le Matin. Compared to the price of other passes and tickets, the AG pass is relatively good value, according to a leaked internal document written by CH-direct, a pricing association...

Read More »The Great Unraveling Begins: Distraction, Lies, Infighting, Betrayal

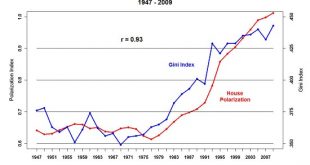

The good news is renewal becomes possible when the entire rotten status quo collapses in a putrid heap. There are two basic pathways to systemic collapse: external shocks or internal decay. The two are not mutually exclusive, of course; it can be argued that the most common path is internal decay weakens the empire/state and an external shock pushes the rotted structure off the cliff. As Dave of the X22 Report and I...

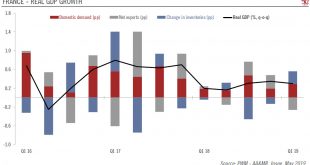

Read More »French tax cuts designed to reboot Macron’s presidency

The French government’s respond to the ‘yellow vest’ protests could provide a meaningful boost to consumer spending, mostly next year. Following a series of townhall meetings with French citizens up and down France, President Emmanuel Macron responded to social unrest with two doses of fiscal easing. The December package (worth EUR10bn) was incorporated in the stability plan sent to Brussels before Easter and is...

Read More »FX Daily, May 10: Waiting for the Other Shoe to Drop

Swiss Franc The Euro has fallen by 0.08% at 1.1372 EUR/CHF and USD/CHF, May 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Contrary to hopes and expectations, the US made good on the presidential tweet and raised the tariff on around $200 bln of Chinese goods from 10% to 25%. Trump indicated that the process that will levy a 25% tariff on the remaining Chinese...

Read More »Geneva has most expensive family flats to rent

An apartment in Geneva with a trompe-l’oeil facade (image from 2011) (Keystone / Martial Trezzini) Family apartments in Geneva are the most expensive to rent, while those in St Gallen in the east of the country are the cheapest, according to a survey of the ten biggest Swiss cities. The median monthly rent for a 4.5-room apartment (100-110 square metres) in St Gallen costs CHF2,004 ($1,971), according to a survey...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org