Following months of cajoling by the White House, the Federal Reserve finally cut its benchmark interest rate. However, the reaction in equity and currency markets was not the one President Donald Trump wanted – or many traders anticipated. The Trump administration wants the Fed to help drive the fiat U.S. dollar lower versus foreign currencies, especially those of major exporting countries. Instead, the U.S. Dollar...

Read More »FX Daily, August 2: End of Tariff Truce Trumps Jobs

Swiss Franc The Euro has fallen by 0.40% to 1.0929 EUR/CHF and USD/CHF, August 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The market was finding its sea legs after being hit with wave and counter-wave following the FOMC decision, and more importantly, Powell’s attempt to give insight into the Fed’s thinking. Trump’s tweet than signaled an end to the tariff...

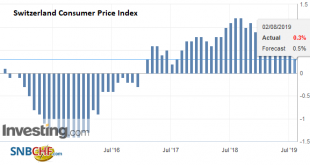

Read More »Swiss Consumer Price Index in July 2019: -0.3 percent YoY, -0.5 percent MoM

02.08.2019 – The consumer price index (CPI) fell by 0.5% in July 2019 compared with the previous month, reaching 102.1 points (December 2015 = 100). Inflation was 0.3% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The decrease of 0.5% compared with the previous month can be explained by several factors including falling prices for clothing and footwear...

Read More »UBS To Start Charging Rich Clients With Negative 0.75 percent Interest Rate

For years, European banks were leery of passing on the ECB’s negative -0.40% deposit rate to their clients for fears of deposit flight and other unintended consequences, in the process being forced to “eat” the difference and impacting their interest income. However, after five years of NIRP, and with the ECB set to unleash even more negative rates in the immediate future, one bank has finally taken a stand: according...

Read More »Glencore suffers $350m hit as cobalt prices decline

Congolese diaspora protesting against Glencore last summer. Glencore has taken a $350 million hit because of falling cobalt prices as the problems facing its African copper business continue to pile up. The Switzerland-based miner and commodity trader has been grappling with a string of issues in the Democratic Republic of Congo, where it operates two copper mines, and in Zambia, where it owns another asset. Dozens of...

Read More »FX Daily, August 1: Mid-Course Correction Sends Greenback Higher

Swiss Franc The Euro has fallen by 0.15% to 1.0989 EUR/CHF and USD/CHF, August 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve delivered the first rate cut since the Great Financial Crisis but couched it in terms of a mid-course correction rather than the start of a larger easing cycle. By doing so, Fed chief Powell cast the cut in less...

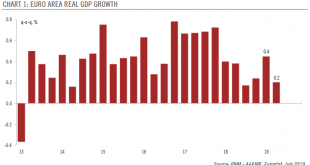

Read More »DATA ADDS TO THE CASE FOR ECB ACTION IN SEPTEMBER

Slowing economic momentum in the euro area means that we are lowering our GDP forecasts for this year. The euro area economy grew by 0.2% q-o-q in Q2, down from 0.4% in Q1. While 0.2% is still a decent pace of growth, concerns about the economy in the second half of the year have increased. Recent data have shown that the industrial slump has started to leave some marks on the domestic economy. Tentative signs of...

Read More »Nestlé invests CHF99 million in factory expansion in Indonesia

The ground breaking ceremony of Nestlé’s fourth production plant in Indonesia in 2013. The Swiss food giant has announced plans to invest CHF99 million (around $100 million) to expand three factories in Indonesia. The goal is to increase Nestlé’s production capacity in the country by 25%, according to a company announcement on Wednesday. The recipients of the funds will be three production plants in Karawang (West...

Read More »FX Daily, July 31: Sterling Steadies, Attention Shifts to FOMC

Swiss Franc The Euro has fallen by 0.15% to 1.1026 EUR/CHF and USD/CHF, July 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After a shellacking in recent days, sterling has stabilized though there is not much of a bounce to speak of, suggesting the adjustment to the risk of a no-deal Brexit may not be complete. After the S&P 500 posted back-to-back...

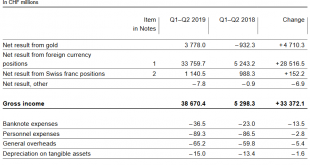

Read More »SNB reports a profit of CHF 38.5 billion for the first half of 2019.

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org