Small businesses on the precipice need only one small shove to go over the edge, and there won’t be replacements filling the fast-multiplying empty storefronts. As a generality, the average employee (including financial pundits) has no real experience or understanding of what it takes to start and operate a small business in the U.S. Government employees in the agencies that oversee and enforce regulations on small...

Read More »Switzerland’s first integrated crypto asset exchange launched

Smart Valor was launched in 2017 and is based in ‘Swiss Crypto Valley’ of Zug near Zurich. Smart Valor, the country’s first integrated cryptocurrency exchange offering custody, trading and brokerage, has gone live with nine crypto-fiat trading pairs. The assets on Zug-based platformexternal link, that was launched in 2017 as part of the Thomson Reuters Incubator, includes crypto currencies and security tokens. For the...

Read More »FX Daily, July 30: Sterling Pounded

Swiss Franc The Euro has fallen by 0.10% to 1.1037 EUR/CHF and USD/CHF, July 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The prospect of a no-deal Brexit continues to pound sterling lower. A little more than two months ago, it was testing $1.32. Two weeks ago it was around $1.25. Today it traded near $1.2120 before stabilizing. On the other hand, the 10-year...

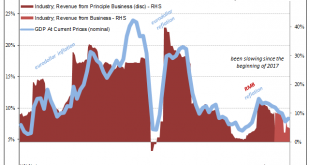

Read More »Obvious Capital Consumption, Report 28 Jul

We have spilled many electrons on the topic of capital consumption. Still, this is a very abstract topic and we think many people still struggle to picture what it means. Thus, the inspiration for this week’s essay. Enterprise Car Service Suppose a young man, Early Enterprise, inherits a car from his grandfather. Early decides to drive for Uber to earn a living. Being enterprising, he is up at dawn and drives all day....

Read More »Switzerland assists Japanese probe into Carlos Ghosn

A visitor to Switzerland: Carlos Ghosn attending the 2018 World Economic Forum, WEF, in Davos, Switzerland Canton Zurich’s public prosecutor is assisting the Japanese authorities in an inquiry related to bank accounts associated with Carlos Ghosn, the former leading auto executive. Tokyo prosecutors sent a request for legal assistance to Switzerland in January, a spokesperson for the country’s Federal Office of Justice...

Read More »China’s Big Gamble(s): Betting on QE Again?

As an economic system, even the most committed socialists had come to realize it was a failure. What ultimately brought down the Soviet Union wasn’t missiles, tanks, and advanced air craft, it was a simple thing like bread. You can argue that Western military spending forced the Communist East to keep up, and therefore to expend way too much on guns at the expense of butter. Even if that was the case, the Soviet system...

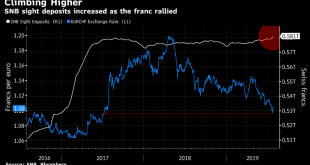

Read More »Uptick in site deposits puts the spotlight on SNB intervention in the franc

Has the SNB started to intervene The weekly site deposit data from the Swiss National Bank showed a small uptick but with some perspective, it’s a notable turn. Bloomberg highlights the bump and what looks like a bid to keep EUR/CHF above 1.10. I don’t think SNB is going to make a strong stand at 1.10 but expect them to cushion any falls in the pair unless there is a big run on risk assets. SNB Sight Deposits...

Read More »FX Daily, July 29: Prospects of a No-Deal Brexit Weigh on Sterling

Swiss Franc The Euro has fallen by 0.13% to 1.1037 EUR/CHF and USD/CHF, July 29(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Unrest in Hong Kong and disappointing earnings reports from South Korea weighed on local equity markets, and the MSCI Asia Pacific Index fell for the third consecutive session. European equities are edging higher in tentative trading....

Read More »Lucerne Considers Coach Tax, other Measures to Manage Tourist Influx

Lucerne, with its iconic Chapel Bridge, is a major tourist attraction for visitors who often don’t spend the night in the city. One of the most popular destinations in Switzerland is reviewing its tourism strategy and mulling introducing coach fees in a bid to curb traffic woes and other disruptions caused by the large number of tourists it welcomes. The vast majority of visitors to Lucerne, whose tally surpasses 9...

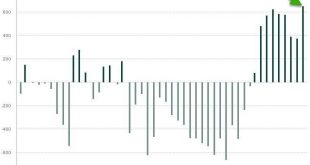

Read More »World’s Central Banks End Pact That Limited Selling Of Gold

In a surprising announcement on Friday morning, the European Central Bank said the 21 signatories of the 4th Central Bank Gold Agreement (CBGA) “no longer see the need for formal agreement” as the market has developed and matured, and as a result the signatories “decided not to renew the Agreement upon its expiry in September 2019.” For readers unfamiliar, the first CBGA was signed in 1999 to coordinate planned gold...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org