Vergangene Woche stellte Philipp Hildebrand, der frühere Präsident des Direktoriums der Schweizerischen Nationalbank (SNB), nun Vize-Präsident von Blackrock, auf Bloomberg ein Positionspapier vor. Verfasst hat er dieses zusammen mit anderen Autoren wie Stanley Fischer, ehemaliger stellvertretender Vorsitzender der US Federal Reserve (FED). Hildebrands Vorschlag: Geld- und Fiskalpolitik sollen miteinander verschmelzen. Den Bürgerinnen und Bürgern soll Geld direkt...

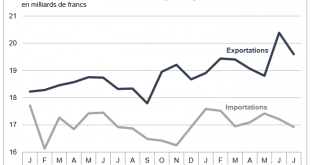

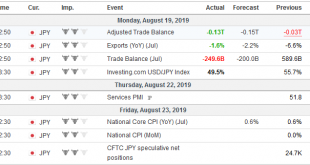

Read More »Swiss Trade Balance July 2019: foreign trade decelerates in July 2019

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »USD/CHF technical analysis: 50 percent Fibo. limits upside to 0.9835/37 resistance-confluence

USD/CHF seesaws near two-week high amid overbought RSI conditions. A confluence of six-day-old rising trend-line, 4H 200MA adds to the resistance. The USD/CHF pair’s one-week-old recovery seems to fade as the quote seesaws near 0.9814 during the Asian session on Tuesday. Not only repeated failures to cross 50% Fibonacci retracement of current month declines but overbought conditions of 14-bar relative strength index (RSI) also increases the odds of its pullback....

Read More »That Can’t Be Good: China Unveils Another ‘Market Reform’

The Chinese have been reforming their monetary and credit system for decades. Liberalization has been an overriding goal, seen as necessary to accompany the processes which would keep the country’s economic “miracle” on track. Or get it back on track, as the case may be. Authorities had traditionally controlled interest rates through various limits and levers. It wasn’t until October 2004, for example, that the upper limit on lending rates was rescinded. In August...

Read More »Deflation Is Everywhere—If You Know Where to Look, Report 18 Aug

At a shopping mall recently, we observed an interesting deal at Sketchers. If you buy two pairs of shoes, the second is 30% off. Sketchers has long offered deals like this (sometimes 50% off). This is a sign of deflation. Regular readers know to wait for the punchline. Manufacturer Gives Away Its Margins We do not refer merely to the fact that there is a discount. We are not simply arguing that Sketchers are sold cheaper—hence deflation. That is not our approach....

Read More »FX Daily, August 19: China’s Rate Reform Helps Markets Extend End of Last Week Recovery

Swiss Franc The Euro has risen by 0.27% to 1.0879 EUR/CHF and USD/CHF, August 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: China announced some changes in its interest rate framework that is expected to lead to lower rates. This helped lift equity markets, which were already recovering at the end of last week from the earlier drubbing. Chinese and Hong Kong shares led the regional rally with 2-3% gains....

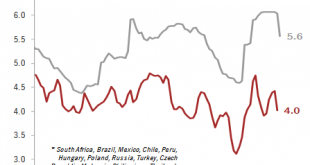

Read More »Emerging market sovereign debt update: yields are falling

Yields have fallen significantly in the EM sovereign bond space in local currency; USD movements will be key to watch for going forward. Yields have fallen impressively in the emerging market (EM) sovereign bond space in local currency, reaching 5.3% on 16 August, near their all-time low of 5.2% (in May 2013). This downward movement has been partly driven by the recent policy rate cuts of some EM central banks. The stabilisation of inflationary pressures thanks to a...

Read More »FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends. To be sure, the end is conceivable but it seems beyond which the...

Read More »Swiss groundwater quality threatened by pollution

Switzerland need to act to ensure the safety of its drinking water supplies in future. Pollution from agriculture, former industrial sites and landfills is threatening Switzerland’s groundwater reserves, according to a detailed study of water quality. The water quality studyexternal link from the Federal Office for the Environmentexternal link (FOEN), released on Thursday, said groundwater faces the greatest pressures in areas of high farming activity. It stated that...

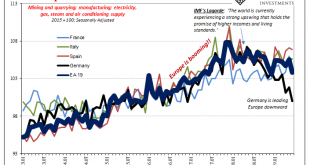

Read More »Some Brief European Leftovers

Some further odds and ends of European data. Beginning with Continent-wide Industrial Production. Germany is leading the system lower, but it’s not all just Germany. And though manufacturing and trade are thought of as secondary issues in today’s services economies, the GDP estimates appear to confirm trade in goods as still an important condition and setting for all the rest. The weakness is persisting and intensifying – particularly after May 2019. Europe...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org