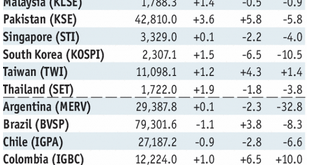

Stock Markets EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW. Stock Markets Emerging Markets, August 01 - Click...

Read More »CEO of Baselworld steps down

Kamm was director of the MCH Group which organises the world’s largest watch fair in Basel since 2003. (Keystone) The head of the world’s largest watch and jewellery trade show, the Swiss-based Baselworld, has handed in his resignation amid a row over the departure of several exhibitors. The MCH Group announced that CEO Peter Kamm would resign from his position “in view of the fundamental transformation phase in...

Read More »Swiss court blocks French request for UBS banking data

“It’s not concrete enough to suspect all French with a UBS account” when looking for tax evaders. Pictured here: UBS on Bahnhofstrasse in Zurich (Keystone) Switzerland’s Federal Administrative Court has ordered the Federal Tax Administration (FTA) not to provide France with details about 40,000 UBS bank clients with French addresses. In May 2016, the French tax authorities requested administrative assistance from the...

Read More »Great Graphic: Is Something Important Happening to Oil Prices?

Oil prices are weaker for the third straight day and are off in four of the past five sessions, the poorest run in two months. Supply considerations may threaten a year-old trend line. OPEC and non-OPEC, essentially Saudi Arabia and Russia are making good on their commitment to boost output, and US oil inventories unexpectedly rose. Saudi output appears to have risen by about 230k barrels per day. Production in Nigeria...

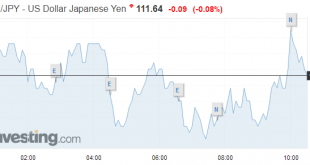

Read More »FX Daily, August 03: Greenback Remains Firm Ahead of Jobs, JGBs Stabilize, Italian Debt Moves into Spotlight

Swiss Franc The Euro has fallen by 0.19% to 1.1503 CHF. EUR/CHF and USD/CHF, August 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trading at the upper end of its recent ranges against the euro and sterling. The euro finished below $1.16 yesterday for the first time since the end of June and has not been able to resurface that level so far today. We...

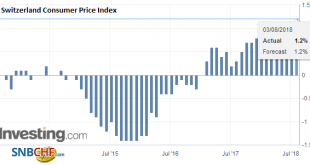

Read More »Swiss Consumer Price Index in July 2018: +1.2 percent YoY, -0.2 percent MoM

Neuchâtel, 3 August 2018 (FSO) – The consumer price index (CPI) fell by 0.2% in July 2018 compared with the previous month, reaching 101.8 points (December 2015=100). Inflation was 1.2% compared with the same month of the previous year. These are the results from the Federal Statistical Office (FSO). The 0.2% drop compared with the previous month can be explained by several factors including falling prices for clothing...

Read More »Fed Looks to September

There was little doubt in the market’s collective mind that the Federal Reserve, which hiked rates in July, would stand pat today. It did not disappoint. The statement itself was almost identical. Growth was said to be “strong” instead of “solid,” for example, a nuance to be lost on most observers. It recognized that the unemployment rate stabilized after falling. Most notable is what is not included. The June minutes...

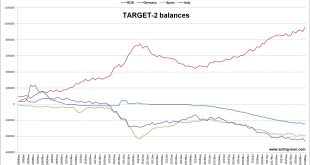

Read More »TARGET-2 Revisited

Capital Flight vs. The Effect of QE Mish recently discussed the ever increasing imbalances of the euro zone’s TARGET-2 payment system again in response to a few articles which played down their significance. He followed this up with a nice plug for us by posting a comment we made on the subject. Here is a chart of the most recent data on TARGET-2 available from the ECB; we included the four largest balances, namely...

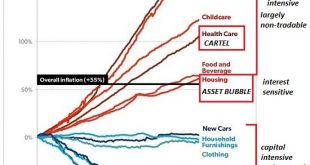

Read More »The 21st Century Misery Index: Labor’s Share of the Economy and Real-World Inflation

Isn’t it obvious that those at the top of the wealth-power pyramid don’t want us to know how much ground we’ve lost while they’ve gorged on immense gains? In the late 1970s and early 1980s, an era of stagflation, the Misery Index was the unemployment rate plus inflation, both of which were running hot. Now those numbers are at 50-year lows: both the unemployment rate and inflation are about as low as they can go,...

Read More »IT made compulsory for upper secondary pupils

This upper secondary school in Glarus already has IT lessons Computer science has become obligatory at Swiss upper secondary schools, as the country seeks to plug its information technology (IT) skills gap. These schools (Gymnasium/lyceé/liceo), whose pupils typically go on to university, have until the school year 2022/3 to introduce the compulsory lessons, under a regulation change that came into force on August 1....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org