The confidence and hubris of those directing the rest of us to race off the cliff while they watch from a safe distance is off the charts. The past decade of “recovery” and “growth” has actually been a decade of catastrophic losses for our society and nation. Here’s a short list of what we’ve lost: 1. Functioning markets. Free markets discover price and assess risk. What passes for markets now are little more than...

Read More »KOF Economic Barometer, July: Remains Practically Unchanged

The KOF Economic Barometer only slightly moved in July. Compared to its June value, it decreased by 0.2 to 101.1 points. The current Barometer value still stands slightly above the long-term average of 100 points; it thus indicates a slightly above-average economic development in Switzerland in the coming months. In July, the KOF Economic Barometer fell slightly to 101.1 points from 101.3 in June (101.7 in the initial...

Read More »FX Daily, July 30: Equities, Bonds, and the Dollar Start Week Softer

Swiss Franc The Euro has fallen by 0.03% to 1.159 CHF. EUR/CHF and USD/CHF, July 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The week’s big events lie ahead. It is seen as the last important week before the dog days of summer when many participants will take holidays. The BOJ’s two-day meeting concludes tomorrow. Speculation that the BOJ is looking for ways to...

Read More »Valuing Gold In A World Awash With Dollars

In this article I point to the pressures on the Fed to moderate monetary policy, but that will only affect the timing of the next cyclical credit crisis. That is going to happen anyway, triggered by the Fed or even a foreign central bank. In the very short term, a tendency to moderate monetary policy might allow the gold price to recover from its recent battering. Unlike the last credit crisis when the dollar rose...

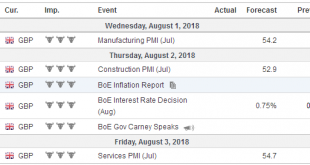

Read More »FX Weekly Preview: Three Central Bank Meetings and US Jobs data

The week ahead sees three major central bank meetings and the US employment report. It will likely be the most important work before a hiatus that runs through the end of August. Of course, and perhaps more than ever, market participants are well aware that the US President’s communication and penchant for disruption is a bit of a wild card. That said, the equity market has learned to take individual company references...

Read More »Economiesuisse warns of economic dangers of vote against foreign judges

© Nattanan726 | Dreamstime.com The business and industry association Economiesuisse says the up-coming vote on 25 November 2018 on self-determination puts the Swiss economy at risk. The Swiss People’s Party led initiative entitled: Federal law instead of foreign judges, aims to cement the primacy of Swiss law over international law by adding a clause to Switzerland’s constitution. The Federal Council, Switzerland’s...

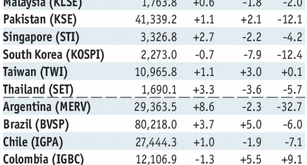

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX. Stock Markets Emerging Markets, July 25 - Click to enlarge South Africa South Africa reports June money, loan, and budget data Monday. June...

Read More »Geneva set to vote on maintaining public spending in the face of company tax reform

© Rosshelen | Dreamstime.com An initiative entitled: zero losses, was filed this week in Geneva. It aims to ring fence current public spending in the face of future company tax reform. The initiative gathered 9,147 signatures, more than the 7,840 required. Under pressure from the OECD and the EU, Switzerland is being forced to make major changes to its tax system. Currently, some multinationals benefit from special...

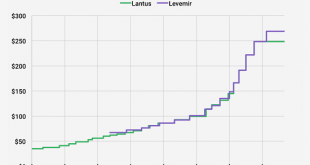

Read More »Here’s How Systems (and Nations) Fail

These embedded processes strip away autonomy, equating compliance with effectiveness even as the processes become increasingly counter-productive and wasteful. Would any sane person choose America’s broken healthcare system over a cheaper, more effective alternative? Let’s see: the current system costs twice as much per person as the healthcare systems of our developed-world competitors, a medication to treat infantile...

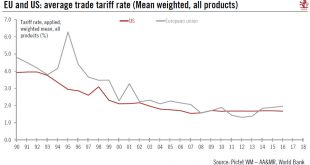

Read More »Ceasefire in US/EU tariff dispute

The two sides have agreed to discuss lowering barriers to transatlantic trade, helping to de-escalate tensions. While positive, the US’s dispute with China still needs watching. US President Trump and EU Commission President Juncker this week struck an unexpected deal to de-escalate the trade dispute between the EU and the US. Importantly, Trump agreed to put his threat of tariffs on EU cars on hold as bilateral trade...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org