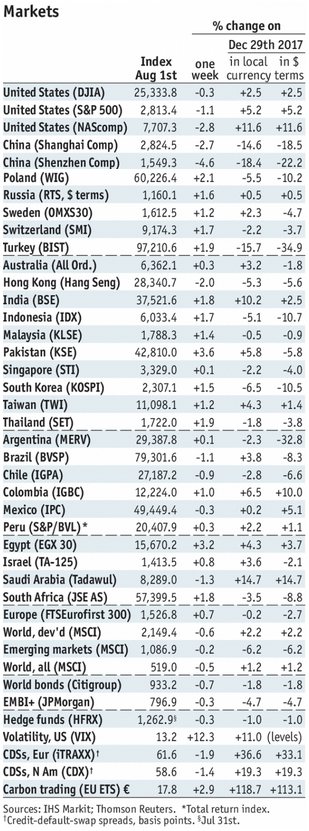

Stock Markets EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW. Stock Markets Emerging Markets, August 01 - Click to enlarge Czech Republic The Czech Republic reports June industrial and construction output and retail sales Monday. June trade will be reported Tuesday. It then reports July CPI Thursday, which is expected to rise 2.3% y/y vs. 2.6% in June. If so, it would move inflation back towards the 2% target.

Topics:

Win Thin considers the following as important: 5) Global Macro, Brazil, Chile, China, Czech Republic, emerging markets, Featured, Hungary, Malaysia, Mexico, newsletter, Peru, Philippines, Russia, South Africa, Taiwan, Thailand, Turkey, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW. |

Stock Markets Emerging Markets, August 01 |

Czech RepublicThe Czech Republic reports June industrial and construction output and retail sales Monday. June trade will be reported Tuesday. It then reports July CPI Thursday, which is expected to rise 2.3% y/y vs. 2.6% in June. If so, it would move inflation back towards the 2% target. Next policy meeting is September 26. After hiking two straight meetings, it may pause then. PhilippinesThe Philippines reports July CPI Tuesday, which is expected to rise 5.5% y/y vs. 5.2% in June. If so, it would be the highest since April 2009 and further above the 2-4% target range. June trade will be reported Wednesday. The central bank meets Thursday and the market is nearly evenly split between a 25 or 50 bp hike. We lean towards 25 bp. Q2 GDP will be reported Thursday and is expected to grow 6.7% y/y vs. 6.8% in Q1. RussiaRussia reports July CPI Tuesday, which is expected to rise 2.6% y/y vs. 2.3% in June. If so, it would be the highest since October 2017 but still below the 4% target. However, the ruble remains vulnerable and so we think the easing cycle is over for now. Next policy meeting is September 14, no change is expected then. June trade will be reported Friday. HungaryHungary reports June IP Tuesday. It then reports July CPI Wednesday, which is expected to rise 3.3% y/y vs. 3.1% in June. If so, it would be the highest since January 2013 and closer to the top of the 2-4% target range. Central bank minutes will also be released that same day. Next policy meeting is August 21. June trade will be reported Thursday. TaiwanTaiwan reports July CPI Tuesday, which is expected to rise 1.5% y/y vs. 1.3% in June. July trade will also be reported that day, with exports expected to rise 5.6% y/y and imports by 8.3% y/y. The central bank does not have an explicit inflation target. However, low price pressures should allow it to remain on hold at its next quarterly policy meeting in September. BrazilBrazil COPOM releases its minutes Tuesday. The bank tilted a bit dovish at that meeting, viewing the recent rise of inflation as transitory. We disagree and believe that COPOM will have to tilt more hawkish in the coming months. Next policy meeting is September 19. July IPCA consumer inflation will be reported Wednesday, which is expected to rise 4.43% y/y vs. 4.39% in June. June retail sales will be reported Friday, which are expected to rise 2.5% y/y vs. 2.7% in May. |

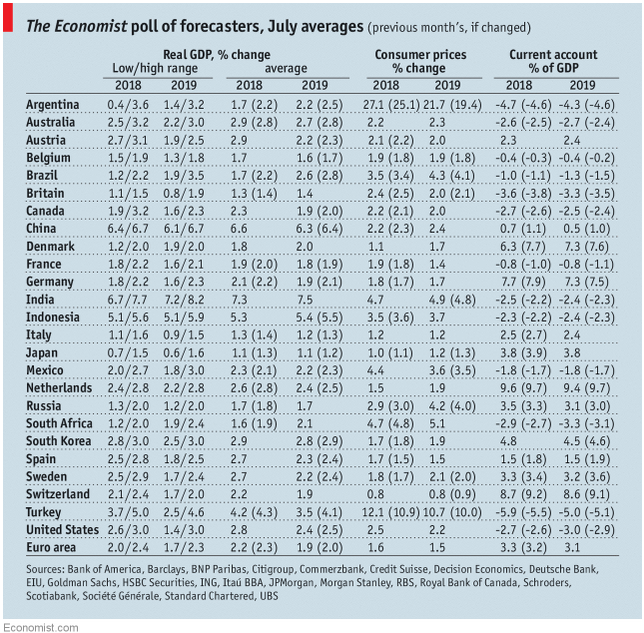

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2018 Source: economist.com - Click to enlarge |

South Africa

South Africa reports June manufacturing production Tuesday, which is expected to rise 2.5% y/y vs. 2.3% in May. The economy remains sluggish, but SARB is unlikely to cut rates as long as the rand remains vulnerable. Indeed, we believe it has a hawkish bias due to the rand’s vulnerability. Next policy meeting is September 20, no change is expected then.

Chile

Chile reports July trade Tuesday. It then reports July CPI Wednesday, which is expected to rise 2.7% y/y vs. 2.5% in June. If so, it would be the highest since April 2017 but still in the bottom half of the 2-4% target range. Central bank minutes will also be released that same day. The bank has signaled the first hike will likely be in Q4. We agree as the recovery is getting more robust.

China

China reports July trade Wednesday, with exports expected to rise 10% y/y and imports by 17% y/y. It then reports July CPI and PPI Thursday. CPI is expected to rise 2.0% y/y and PPI by 4.5% y/y. At this point, the central bank is more concerned about boosting growth than it is about containing inflation.

Thailand

Bank of Thailand meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose 1.5% y/y in July, matching the cycle high but still near the bottom of the 1-4% target range. The economy is firming but the central bank has signaled that it’s in no hurry to hike rates.

Mexico

Mexico reports July CPI Thursday, which is expected to rise 4.79% y/y vs. 4.65% in June. The central bank delivered a dovish hold last week, signaling that it views the recent rise of inflation as temporary. We disagree and believe that Banxico will have to tilt more hawkish in the coming months. Next policy meeting is October 4. June IP will be reported Friday.

Peru

Peru central bank meets Thursday and is expected to keep rates steady at 2.75%. CPI rose 1.6% y/y in July, the highest since October 2017 but still in the bottom half of the 1-3% target range. We think the easing cycle has ended.

Malaysia

Malaysia reports June IP and manufacturing sales Friday. Policymakers are concerned about downside risks to growth. CPI rose only 0.8% y/y in June. While Bank Negara does not have an explicit inflation target, low price pressures should allow it to remain on hold for the rest of 2018. Next policy meeting is September 5, no change is expected then.

Turkey

Turkey reports June current account data Friday, which is expected at -$2.98 bln. If so, the 12-month total would narrow for the first time since August 2017. However, we think the lira remains vulnerable due to both economic and political factors. Next policy meeting is September 13, but an intra-meeting move seems likely after Friday’s CPI report.

Tags: Brazil,Chile,China,Czech Republic,Emerging Markets,Featured,Hungary,Malaysia,Mexico,newsletter,Peru,Philippines,Russia,South Africa,Taiwan,Thailand,Turkey,win-thin