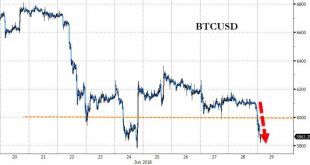

Bitcoin has tumbled back below $6,000 in early Asia trading and the rest of the crypto space is following suit. No imediate catalyst for the move – aside from technical pressure – but tougher AML rules in South Korea and US Congress being told Bitcoin is a threat to the US election may have sparked it earlier in the week and this is follow-through. Bitcoin can’t catch a bid off the weekend’s $6,000 slump… BTC/USD,...

Read More »What’s so special about crypto?

Towards the end of 2017, Bitcoin — and with it other cryptocurrencies — experienced a real hype. Within a few months, prices shot through the ceiling. The euphoria was ginormous and in hindsight pure madness. With the new year, the disillusionment arrived. The market capitalization of all cryptocurrencies fell by more than half and prices plunged. This somewhat harsh consolidation was expected to bring the crypto world...

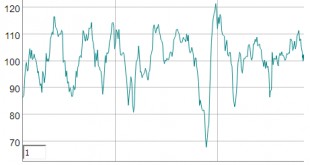

Read More »KOF Economic Barometer: Economic Outlook Improves Slightly

The KOF Economic Barometer rose again in June for the first time in three months. It increased by 1.7 points to 101.7 points, stopping its downward tendency in spring. The current Barometer value is now slightly above the long-term average of 100.0. Thus, the KOF Economic Barometer indicates a slightly above-average economic development in Switzerland. The tailwind for the Swiss economy is no longer as strong as during...

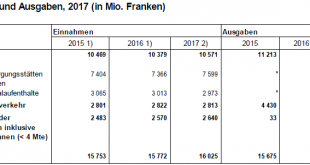

Read More »Tourism Balance of Payments Slightly Negative in 2017

Neuchâtel, 28 June 2018 (FSO) – For the second consecutive year, the tourism balance of payments was negative in 2017. This means that expenditure by Swiss residents during visits abroad exceeded the expenditure of non-residents during their stay in Switzerland. In an economic climate still marked by a strong franc, the tourism balance of payments was CHF -122 million, according to initial estimates from the Federal...

Read More »Swiss Town Tests Blockchain-Based Voting

On 25 June 2018, the city of Zug, the town at the heart of Switzerland’s crypto valley, started testing a voting system based on blockchain technology. ©-Denis-Linine-_-Dreamstime.com_ - Click to enlarge During the trial, which runs until 1 July 2018, around 200 voters will cast non-binding municipal votes on mock questions in a trial designed to identify any bugs in a system built by the company Luxsoft and the...

Read More »Bitcoin: les causes de la chute historique sous la barre des 6 000$.

juin 27, 2018 par LHK Bitcoin : les causes de la chute historique sous la barre des 6 000$. 2 articles de Adrien Pittore/ Entreprise news Bitcoin Horrific CrashesLes soldes ne commencent que mercredi. Et pourtant, la valeur du Bitcoin, plus généralement des cryptomonnaies, a accusé un sacré coup de rabais jeudi 21 juin. Alors qu’il était plutôt bien stabilisé, le cours du Bitcoin s’attaquait à la barre symbolique...

Read More »London House Prices Fall 1.9 percent In Quarter – Bubble Bursting?

London house prices down 1.9 per cent in Q2 (yoy) London house prices still 50% above 2007 bubble peak (see chart) Brexit and weak consumer confidence to blame say experts Little sign that U.K. property “weakness” is likely to change London property bubble appears to be bursting Editors Note: The London property bubble appears to be in the early stages of bursting. House prices are falling with reports of falls of as...

Read More »Geneva set to vote on world’s highest minimum wage

In May 2014, Switzerland voted against a minimum wage of CHF 22 an hour. At some point voters in the canton of Geneva will get to vote on a similar initiative, which would apply only in the canton. Similar to the federal vote, which was rejected by 76.3% of Swiss voters, the plan calls for a minimum hourly wage of CHF 23 ($US 23.40). Based on a 40-hour week, this works out at around CHF 4,000 per month. Vote organisers...

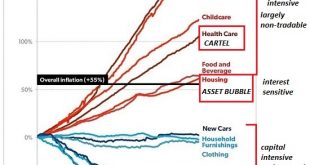

Read More »Make Capital Cheap and Labor Costly, and Guess What Happens?

Employment expands in the Protected cartel-dominated sectors, and declines in every sector exposed to globalization, domestic competition and cheap capital. If you want to understand why the global economy is failing the many while enriching the few, start with the basics: capital, labor and resources. What happens when central banks drop interest rates to near-zero? Capital becomes dirt-cheap. It becomes ludicrously...

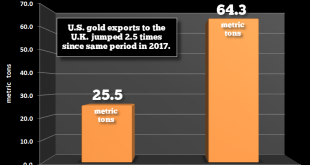

Read More »Gold Exports To London From U.S. Surge 152 percent In 2018

Gold Exports To London From U.S. Surge 152% In 2018 – U.S. gold exports to UK (primarily) London jumped over 150% from 25.5 metric tons to 64.3 mt in the first four months of 2018 (yoy)– Largest countries receiving U.S. gold exports are China/ Hong Kong, Switzerland and the UK – U.S. gold exports to London (UK) alone nearly as much as total U.S. gold production – Gold flowing from weak hands in West to strong hands in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org