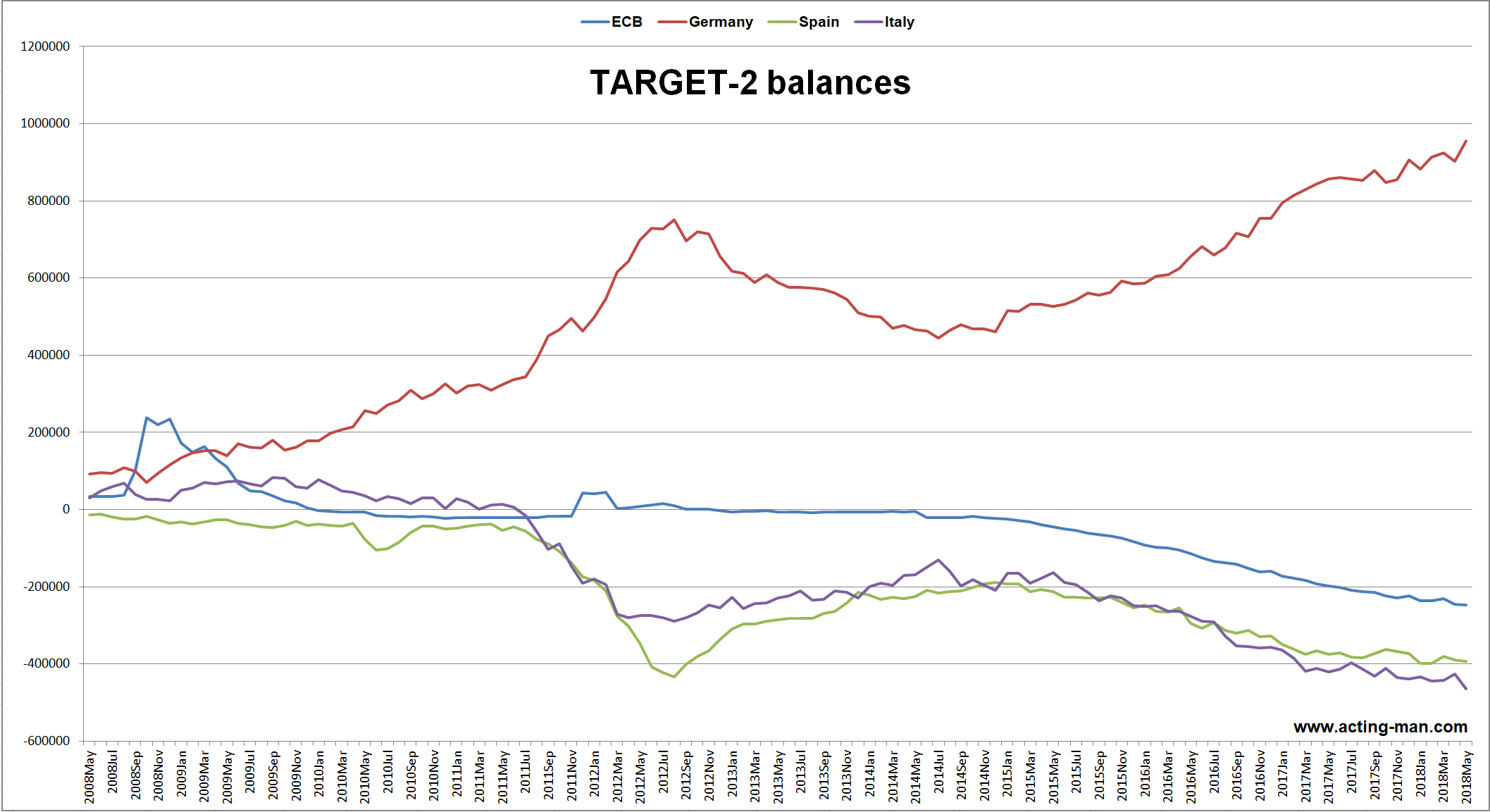

Capital Flight vs. The Effect of QE Mish recently discussed the ever increasing imbalances of the euro zone’s TARGET-2 payment system again in response to a few articles which played down their significance. He followed this up with a nice plug for us by posting a comment we made on the subject. Here is a chart of the most recent data on TARGET-2 available from the ECB; we included the four largest balances, namely those of Germany, Italy, Spain and the ECB itself. TARGET-2 is a settlement system without a settlement mechanism – which is a major difference between the euro-system and the Federal Reserve system, which settles internal payment imbalances by transferring gold certificates. In our comment posted by

Topics:

Pater Tenebrarum considers the following as important: 2) Swiss and European Macro, Central Banks, Featured, Mario Draghi, newsletter, Target 2

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Capital Flight vs. The Effect of QEMish recently discussed the ever increasing imbalances of the euro zone’s TARGET-2 payment system again in response to a few articles which played down their significance. He followed this up with a nice plug for us by posting a comment we made on the subject. Here is a chart of the most recent data on TARGET-2 available from the ECB; we included the four largest balances, namely those of Germany, Italy, Spain and the ECB itself. TARGET-2 is a settlement system without a settlement mechanism – which is a major difference between the euro-system and the Federal Reserve system, which settles internal payment imbalances by transferring gold certificates. In our comment posted by Mish we inter alia explained the mechanics of TARGET-2, so there is no need to rehash them here. Just one additional remark on the structure of the system: TARGET-2 claims and liabilities of National Central Banks (NCBs) are against the euro-system, not directly against each other. |

TARGET 2 Balances euro system until May 31 |

| During the euro area sovereign debt crisis the growing imbalances served as a very good barometer of capital flight from the periphery (and demonstrated how it was surreptitiously “funded”, or rather, masked). We concede that those who say that these imbalances don’t matter are at least partially correct as long as the euro zone does not break apart. Just like stock market overvaluation or the growing corporate debt-berg, it is one of the many things that don’t matter until they do.

If Italy were to leave the currency union and readopt the lira, it is said that the Bank of Italy would be forced to immediately settle its liabilities with the ECB. We are not quite sure how it would be expected do so in practice and how it can actually be forced to do so. Last we looked, the ECB didn’t have an army, so it cannot possibly threaten to invade Italy for a spot of retaliatory plundering. Moreover, since five countries participating in the TARGET-2 system are not members of the currency union (Bulgaria, Croatia, Denmark, Poland and Romania), why should it not be possible for a country that leaves the currency union to remain a member of the payment system? And if so, why should it settle its TARGET-2 related liabilities? |

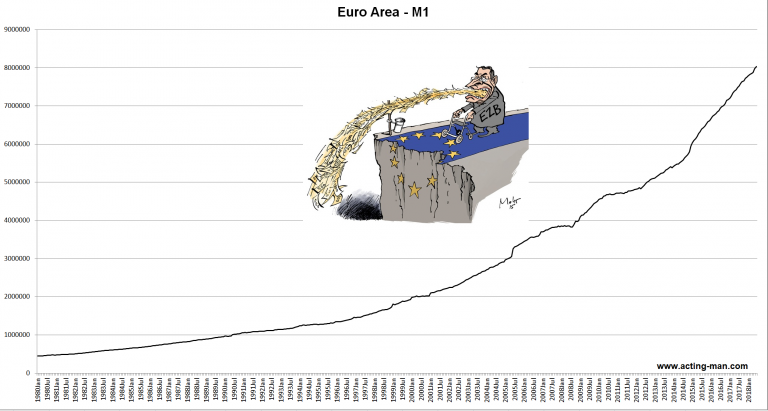

Euro Area - M1, 1980-2018The euro area’s narrow money supply M1 has more than doubled in the past decade. A large part of this expansion is the direct result of QE. This is why we say that the assertion that TARGET-2 liabilities that are created in the course of QE “don’t matter” is not entirely correct even if one assumes that the euro area will remain intact. After all, it can hardly be expected that printing such vast amounts of additional money will be without consequences. |

| There is one important aspect of the recent growth of TARGET-2 imbalances we didn’t mention in our comment. Whenever ECB chief Mario Draghi is asked about these imbalances at ECB press conferences, he likes to point out that they are these days largely related to QE or the “asset purchase program” (APP – apparently the euphemism “quantitative easing” was thought to require a euphemism of its own) and hence are no reason for concern.

Obviously, the chart shown above should immediately make one wonder why the ECB itself is sporting a growing TARGET-2 liability. Does it owe money to itself now, and if so, why? The ECB is a supranational entity and in terms of the payment system it is treated as if it were a country of its own. Most of the debt purchases under the QE program are conducted by NCBs – in particular, every NCB is tasked with buying sovereign bonds issued by its own country of domicile. However, the ECB is also engaged in direct bond purchases, and these create TARGET-2 liabilities as they necessarily involve the flow of central bank money from the ECB to various NCBs in whose jurisdictions it buys bonds. If the NCBs concerned have a positive TARGET balance, total TARGET balances will increase*. As Draghi notes in his press conferences, roughly 40% to 50% of the purchases under the APP are from non-resident institutions (which may in turn act on behalf of their customers). Most of the trading with such institutions takes place in the largest financial centers in Europe, with Frankfurt in Germany a particularly active one. Consider for instance a London-based subsidiary of a US bank that settles trades in Italian bonds through a correspondence bank located in Frankfurt. If the Bank of Italy purchases Italian government bonds from this entity, central bank money will flow from Italy to Germany (i.e., from a country with a TARGET-2 liability to one with a claim) and the securities will be delivered to the Bank of Italy. Total TARGET balances will increase, and so will the claims of the BuBa and the liabilities of the Bank of Italy. |

|

| Indeed, the chart above shows that TARGET-2 claims and liabilities initially decreased when the crisis subsided after 2012 and started to climb again around the time the APP began. So far, so good – it is certainly fair to assume that the APP is the main driver of the growing imbalances ever since.

One could also say: as long as the APP is underway, it is actually difficult to tell to what extent a rising TARGET-2 balance is driven by QE or by capital flight. For instance, it inter alia seems likely that recent political upheaval in Italy has given fresh impetus to capital flight from there. In fact, the political situation in Italy was fraught with uncertainty ever since the resignation of the Renzi government, and the growth of Italy’s TARGET-2 liabilities has accelerated since then. However, there is another important point which Mr. Draghi neglects to mention when he insists that growing TARGET-2 imbalances are merely an APP-related technicality. |

It is certainly true that when the Bank of Italy purchases Italian government bonds in Frankfurt from international banks which access TARGET-2 through the BuBa, the above mentioned effects on claims and liabilities in the payment system will arise – but why do they just continue to grow?

Why are the sellers of these bonds not using the proceeds to purchase other investment assets in Italy? Or putting it differently: What does this represent, if not capital flight?

It seems to us it doesn’t really matter that the purchases are conducted under the APP – if no offsetting capital flows into Italy take place subsequently, it still means that someone got out of Dodge and decided not to return.

Footnotes:

* The total TARGET-2 balance increases if central bank money flows from a country with a liability to a country with a claim, and decreases if money flows in the opposite direction. By contrast, flows between two countries with claims (or two countries with liabilities) change the composition, but not the value, of the total TARGET-2 balance.

Charts by: acting-man.com, data source: ECB

Tags: central banks,Featured,Mario Draghi,newsletter,TARGET-2