Keith had two more in-depth, ideaful interviews. Keith was interviewed on the Jason Stapleton Program. Keith had a lively discussion with Peter Bell and Mickey Fulp, the Mercenary Geologist. Related posts: Gold to Enter New Bull Market – Charles Nenner An Inquiry into Austrian Investing: Profits, Protection and Pitfalls The Great Gold Upgrade, Report...

Read More »Jim Rogers – Making China Great Again! (Video)

We are delighted to announce a very special guest for our next episode of the Goldnomics Podcast, due for release later this week. We recently had the opportunity to speak with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the...

Read More »An Inquiry into Austrian Investing: Profits, Protection and Pitfalls

Incrementum Advisory Board Discussion Q3 2018 with Special Guest Kevin Duffy “From a marketing perspective it pays to be overconfident, especially in the short term. The higher your conviction the easier it will be to market your investment ideas. I think the Austrian School is at a disadvantage here because it’s more difficult to be confident about your qualitative predictions and even in terms of investment advice it...

Read More »Jim Rogers and the World’s New Reserve Currency

Today we’re bringing you another clip from our upcoming Episode of the Goldnomics Podcast with the legendary investor and “Adventure Capitalist”, Jim Rogers. In this clip Jim tells us what he thinks about the long-term safe-haven status of the US dollar and what he sees as the future for the Euro currency. Jim also give us his opinion on what he suspects might be the currency to emerge as the only viable but necessary...

Read More »The Yin and Yang of the US-China Relationship

Chimerica always seemed like an oversimplification of a complex and dialectic relationship between the US and China. However, it did express an underlying truth, that China’s rise over the last 40 years has been predicated on Deng Xiaoping’s political and economic reforms and, importantly, the world of free-trade (a reduction in tariff barriers to trade) promoted by the United States. America seems to hold two seemingly...

Read More »FX Daily, August 10: The Dollar Muscles Higher as Turkey Melts Down

Swiss Franc The Euro has fallen by 0.81% to 1.1355. Even more than the dollar, the Swiss Franc has muscled today. EUR/CHF and USD/CHF, August 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has surged. The main impetus comes from the dramatic slide in the Turkish lira. After moving above TRY5.0 yesterday, it reached TRY6.30 today before stabilizing a...

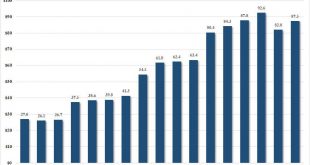

Read More »The Swiss National Bank Now Owns $87.5 Billion In US Stocks After Q2 Tech Buying Spree

In the second quarter of 2018, one in which the global economy was shaken by the rapid escalation of Trump’s trade war, and in which central banks were one after another hinting at their own QE tapering and rate hiking intentions to follow in the Fed’s footsteps, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using “money” that was freshly...

Read More »The Stock Market is Stretched to Double Tech-Bubble Extremes

By Joe Ciolli – BusinessInsider.com Leuthold Group has sounded the alarm on a valuation metric that shows the S&P 500 is twice as expensive as it was at the peak of the tech bubble. This development could have large implications for stock investors of all types, particularly value traders who make their living by finding discounts in the market. With the stock market within shouting distance of an all-time high,...

Read More »Traffic jams cost Swiss more than just time

In 2015, the cost of time lost due to delays caused by heavy vehicles, like freight trucks, was CHF444 million. Various costs related to traffic jams totalled CHF1.9 billion ($1.9 billion) in 2015, up 7% from 2010, according to the Swiss Office for Spatial Development. In a statementexternal link released on Wednesday (link in French, German and Italian), the office said that costs stemming from wasted time accounted...

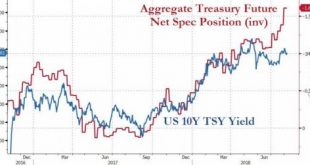

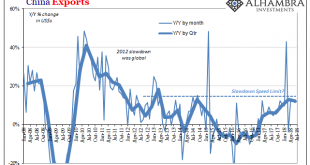

Read More »What Chinese Trade Shows Us About SHIBOR

Why is SHIBOR falling from an economic perspective? Simple again. China’s growth both on its own and as a reflection of actual global growth has stalled. And in a dynamic, non-linear world stalled equals trouble. Going all the way back to early 2017, there’s been no acceleration (and more than a little deceleration). The reflation economy got started in 2016 but it never went anywhere. For most of last year, optimists...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org