© Brad Calkins | Dreamstime.com Historically, Switzerland has offered certain foreign companies special preferential tax deals in order to attract them. In response to international pressure, the current system is to be phased out replacing preferential tax rates with lower universal ones in the hope that these companies will stay. The central challenge is how to cover the tax revenue lost when companies taxed at the...

Read More »How To Create Your Own Personal Gold Standard And Currency Reserve

Via The Daily Bell, Did you know that for 99.2% of recorded human history, money was backed by a gold standard? And only for the last 47 years has the world largely moved away from the gold standard. It is easy to feel like we are on top of the world in 2018. Technology has never been better or more easily accessible. The standard of living is rapidly rising. But does that mean we should dispense with 5,000 years of...

Read More »Ueli Maurer hat recht: Der Erste, der einsieht, dass die SNB sich hoffnungslos verrannt hat

„An der Grenze des Erträglichen“ – so beurteilt Bundesrat und Finanzminister Ueli Maurer die Bilanz der Schweizerischen Nationalbank (SNB). Als ehemaliger Präsident des Zürcher Bauernverbandes ist Maurer zu einer Milchbüchlein-Rechnung fähig. Als Inhaber des eidgenössischen Buchhalter-Diplomes kann er auch eine Bilanz beurteilen. Eine Milchbüchlein-Rechnung und einfachste Bilanzkenntnisse genügen, um zu erkennen, dass...

Read More »“Stock Markets Look Ever More Like Ponzi Schemes”

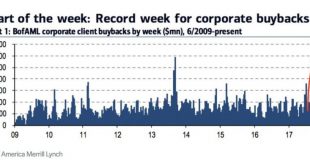

Authored by Richard Murphy via Tax Research UK blog, The FT has reported this morning that: Debt at UK listed companies has soared to hit a record high of £390bn as companies have scrambled to maintain dividend payouts in response to shareholder demand despite weak profitability. They added: UK plc’s net debt has surpassed pre-crisis levels to reach £390.7bn in the 2017-18 financial year, according to analysis from Link...

Read More »US Vs China – Is It ‘Art Of The Deal’ Or Economic Warfare?

While monetary tightening remains the main risk for global stock markets, the threat of a trade war continues to dominate the headlines… THE DONALD’S DEALMAKING The question raised by Donald Trump’s trade agenda with China remains, in essence, extremely simple. It is whether The Donald is engaged in a typical ‘Art of the Deal’ negotiation, where he can suddenly turn on a dime and declare a ‘win’, or whether he is...

Read More »Mining giant Glencore faces US corruption probe

The DoJ is investigating Glencore’s activities in DRC, Nigeria and Venezuela. Swiss commodities mining and trading giant Glencore has been subpoenaed by the United States Department of Justice (DoJ) in relation to its activities in Nigeria, the Democratic Republic of Congo (DRC) and Venezuela. A statementexternal link from the Baar-based company said the DoJ has demanded “documents and other records with respect to...

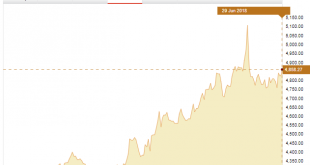

Read More »Gold’s Price Performance: Beyond the US Dollar

With the first half of 2018 now drawn to a close, much of the financial medias’ headlines and commentary relating to the gold market has been focusing on the fact that the US dollar gold price has moved lower year-to-date. Specifically, from a US dollar price of $1302.50 at close on 31 December 2017, the price of gold in US dollar terms has slipped by approximately 3.8% over the last six months to around $1252.50, a...

Read More »FX Daily, July 03: Markets Trying to Stabilize

Swss Franc The Euro has risen by 0.03% to 1.1565 CHF. EUR/CHF and USD/CHF, July 03(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets are trying to stabilize. US equities recovered from early losses yesterday but this was not enough to stop Asian equities from extending recent losses. The MSCI Asia Pacific Index slipped 0.2% for the sixth...

Read More »Swiss intercity trains in for a makeover

The Swiss railway system ranks as the best in Europe. The intercity IC2000 trains feature double-storeyed coaches. (Keystone) The Swiss Federal Railways is revamping its intercity IC2000 fleet at a cost of approximately CHF300 million ($302 million). The first completely renovated trains will be put back into operation in early 2019. The 341 wagons should be fit for another 20 years on the rails after their makeover....

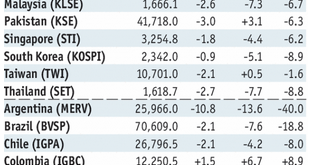

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX ended Friday mixed, capping off a mostly softer week. TRY, MXN, and RUB were the top performers and the only ones up against USD, while ARS, CLP, and BRL were the worst. Looking ahead, US jobs data on Friday pose some risks to EM, coming on the heels of a higher than expected 2% y/y rise in PCE. China will also remain on the market’s radar screen, with the first snapshots of June economic activity...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org