Alhambra Investments CEO Joe Calhoun shares his opinions of the economy and market based on the most recent economic reports. Related posts: Monetary Policy Assessment of 20 September 2018 Monthly Macro Monitor – September FX Daily, September 12: Dollar Chops in Narrow Ranges Global Asset Allocation Update – September 2018 Monthly Macro...

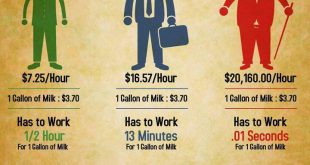

Read More »Why Are Wages So Low, Report 23 Sep 2018

Last week, we talked about the capital consumed by Netflix—$8 billion to produce 700 shows. They’re spending more than two thirds of their gross revenue generating content. And this content has so little value, that a quarter of their audience would stop watching if Netflix adds ads (sorry, we couldn’t resist a little fun with the English language). So it is with wry amusement that, this week, Keith heard an ad for an...

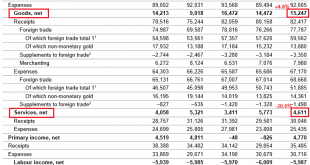

Read More »Swiss Balance of Payments and International Investment Position: Q2 2018

Current Account Key figures: Current Account: Up 27.0% against Q1/2018 to 22.1 bn. CHF of which Goods Trade Balance: Up 4.8% against Q1/2018 to 15.2 bn. of which the Services Balance: Minus 20.6% to 4.6 bn. of which Investment Income: Plus 107.7% to 10.7 bn. CHF. Current Account Switzerland Q2 2018(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account,...

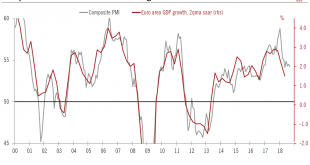

Read More »Business Indicators Present a Contrasting Picture of the Euro Area

The services sector is proving resilient, but manufacturing disappoints. Euro area flash composite PMI dipped slightly to in September and came in slightly below consensus expectations. Activity in services picked up and weakened further in manufacturing, which continued its decline since the start of the year, falling to 53.3 in September from 54.6 in August. New export orders failed to grow for the first time since...

Read More »Thousands demonstrate in Bern for equal pay

Demonstrators gather in front of parliament in Bern (Keystone) A national rally in favour of equal pay and against discrimination has taken place in the Swiss capital, attracting some 20,000 people, according to organisers. Unions, political parties and supporting organisations said in the run-up to the rally on Saturday that although equality was enshrined in the constitution 37 years ago and the law had been in force...

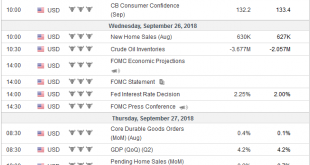

Read More »FX Weekly Preview: Next Week’s Drivers

It is a testament to the Federal Reserves communication and the evolution of investors’ understanding that we can say that the rate hike that the central bank will deliver is not as important as what it says. A rate hike is a foregone conclusion. According to the CME’s model, there is about an 85% chance of December hike discounted as well. The effective Fed funds rate is 1.92% with the target range of 1.75%-2.00%. The...

Read More »The Four Disastrous Presidential Policies That Are Destroying the Nation

The nation is failing as a direct consequence of these four catastrophic policies. It’s admittedly a tough task to select the four most disastrous presidential policies of the past 60 years, given the great multitude to choose from. Here are my top choices and the reasons why I selected these from a wealth of policy disasters. 1. President Johnson’s expansion of the Vietnam War, which set the stage for President Nixon’s...

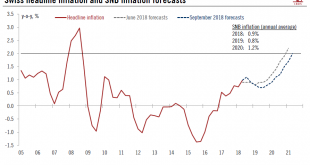

Read More »Cut to Swiss inflation forecast

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019. At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged. Also unchanged from the last quarterly meeting in June was the central bank’s assessment of the Swiss franc as “high valued” and its characterisation...

Read More »Swiss CEOs still the best-off in Europe

Swiss boardrooms: more than just a nice view. (© KEYSTONE / CHRISTIAN BEUTLER) A report on the salaries of CEOs across Europe has found that Switzerland once again tops the table, ahead of Great Britain and Germany. The report also discovers that salaries have risen over the past year. CHF8.7 million ($9.05 million): this was the median compensation of bosses of top companies in Switzerland in 2017, according to this...

Read More »When Does This Travesty of a Mockery of a Sham Finally End?

Credit bubbles are not engines of sustainable employment, they are only engines of malinvestment and wealth destruction on a grand scale. We all know the Status Quo’s response to the global financial meltdown of 2008 has been a travesty of a mockery of a sham–smoke and mirrors, flimsy facades of “recovery,” simulacrum “reforms,” serial bubble-blowing and politically expedient can-kicking, all based on borrowing and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org