In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not. 10 year yields fell nearly 40 basis points in a matter of days as did TIPS yields. The...

Read More »Industrial Commodities vs. Gold – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Oil is Different Last week, we showed a graph of rising open interest in crude oil futures. From this, we inferred — incorrectly as it turns out — that the basis must be rising. Why else, we asked, would market makers carry more and more oil? We are grateful to Peter Tenebrarum at Acting Man and Steve Saville at The...

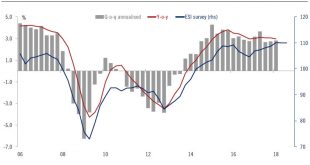

Read More »Europe chart of the week – Spanish growth

Amid domestic political uncertainty, Spanish growth remains strong. This week saw the final release of Spanish GDP growth for Q1. The economy again managed to post robust growth, the highest among the four largest euro area economies (+0.7% q-o-q versus 0.4% q-o-q for the euro area). The breakdown of figures showed that domestic demand was once again the main growth driver. The carryover effect for 2018 reached 2.8%,...

Read More »Slowdown in Middle Eastern tourists to Switzerland

The growth in tourism from the Middle East has been driven by Saudi Arabia and the Emirates After almost tripling in the last decade, the number of tourists to Switzerland from the Middle East is slowing down, with the slowdown expected to be particularly marked this summer. The growth rate of tourists from the Gulf will be zero this summer, according to forecasts by Oxford Economics and the Swiss tourist board....

Read More »More Color on Japanese Capital Flows and the Euro

The euro put in a low on May 29 a little above $1.15. That is nearly a 10.5 cent decline since the three-year high was set in mid-February. The thing that is difficult for investors and analysts to get their head around is that the speculators in the futures market, who as seen as proxies for trend-followers and momentum traders, continue to carry large euro exposure. Too many observers mistakenly focus on the net...

Read More »FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

Swiss Franc The Euro has fallen by 0.23% to 1.1526 CHF. EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are several euro options that expire today and are stacked every quarter of a cent from $1.1675 to $1.1750. The size of the options increase with the price beginning with 688 mln euros at $1.1675, then 775 euros at $1.17, 1.1 bln euros...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX put in a mixed performance Friday, and capped off an overall mixed week. Over that week, the best performers were IDR, TRY, and INR while the worst were BRL, MXN, and ARS. US yields are recovering and likely to put renewed pressure on EM FX. Stock Markets Emerging Markets, May 30 Source: economist.com - Click to enlarge Indonesia Indonesia reports May CPI Monday, which is expected to rise...

Read More »Vollgeld – Eine umfassende Analyse

Am 10. Juni stimmen wir in der Schweiz auf nationaler Ebene über die Vollgeld-Initiative ab. Diese widmet sich einer der wohl komplexesten und zugleich wesentlichsten Thematiken unserer Gesellschaft: unserem Finanzsystem. Die Idee des Vollgeldes geht weit über die Initiative in der Schweiz hinaus und ist heute in erster Linie Bestandteil der «Modern Monetary Theory». Ihren Ursprung lässt sich in das 19. Jahrhundert...

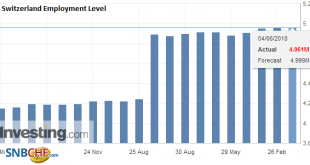

Read More »Employment barometer in the Q1 2018: Fastest growth in employment in industry for 10 years

Neuchâtel, 4 June 2018 (FSO) – In the 1st quarter 2018, total employment (number of jobs) rose by 1.6% in comparison with the same quarter a year earlier (+0.6% with previous quarter, +1.7% in full-time equivalents). The Swiss economy counted 77 000 more jobs and 11 000 more vacancies than in the corresponding quarter of the previous year. There was also an increase in the employment outlook indicator (+2.0%) and...

Read More »House Prices Down in Verbier but Up in Some other Swiss resorts

A recent report published by UBS shows real estate price changes in european mountain resorts. ©-Tatiana-Vasilieva-_-Dreamstime.com_ - Click to enlarge Over the last year, Verbier (-3.2%) and Crans Montana (-3.0%) experienced the largest price declines, while Saas Fee (+14.3%) and St. Moritz (+7.4%) climbed the most. Prices rises in the Jungfrau region (+4.8%) Gstaad (+1.5%), Flims/Laax (+2.8%), Andermatt (+1.5%),...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org