Swiss Franc The Euro has risen by 0.03% at 1.1455 EUR/CHF and USD/CHF, November 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar has fallen against nearly every currency. It had been moving lower at the start of the week, but what seems like a correction broadened and deepened following the US midterm election. The outcome was largely in line with...

Read More »‘Lighthouse’ Planned for Swiss Mountain Top

The Titlis is a popular tourist destination in central Switzerland. with up to 2,000 visitors a day. (Source: Herzog & De Meuron) Plans have been presented to upgrade a popular tourist destination on a mountain top in central Switzerland. As part of the CHF100 million ($100 million) project on the Titlis, a building made of steel and glass will be added to the existing tower for technical installations on 3,028...

Read More »Euro and Yen Outlook

Broadly speaking, the risk is that the dollar’s cyclical advance is not complete. The drivers will likely remain in place through at least the middle of next year. Additional gradual interest rate hikes by the Federal Reserve and a favorable policy mix underpin the dollar. The Federal Reserve projects four rate hikes between now and the end of next year. Quarterly rate hikes through the middle of next year are the...

Read More »Is This “The Most Important Election of our Lives” or Just Another Distraction?

The problem isn’t polarization; the problem is neither flavor of the status quo is actually solving any of the nation’s most pressing system problems. As I write this at 5 pm (Left Coast) November 6, the election results are unknown. While various media are trumpeting this as “the most important election of our lives,” the less eyeball-catching, emotion-triggering reality is this election is nothing but another...

Read More »FX Daily, November 6: US Goes to the Polls

Swiss Franc The Euro has fallen by 0.04% at 1.1452 Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is narrowly mixed against the major currencies today, largely consolidating its recent losses. Equities are mixed. In Asia, Japan, Australia, and Hong Kong equities gained around 1%, while most other bourses were softer. In Europe, the Dow Jones Stoxx 600 is little changed in late morning...

Read More »Builders Resume Street Protests

The demonstration in Lausanne was the latest in a series of regional protests against plans by the employers in the building sector. (Keystone) Construction workers have continued their protests against worsening labour conditions in Switzerland. An estimated 4,000 people took to the streets of Lausanne on Monday in the latest stage of a series of short regional strikes underway since mid-October. The trade unions have...

Read More »Talking Turkey

Turkey’s economic challenges arise from the imbalances created during the economic boom that saw poverty halved between 2002 and 2011, extensive urbanization, and integration in the world economy through trade and capital flows. The dramatic economic changes saw the rise of Erdogan, who was re-elected as President for a second term in June. His party (AKP) is joined by the Nationalists (MHP). The imbalances, amidst a...

Read More »Wizard’s First Rule, Report 4 Nov 2018

Terry Goodkind wrote an epic fantasy series. The first book in the series is entitled Wizard’s First Rule. We recommend the book highly, if you’re into that sort of thing. However, for purposes of this essay, the important part is the rule itself: “Wizard’s First Rule: people are stupid.” “People are stupid; given proper motivation, almost anyone will believe almost anything. Because people are stupid, they will believe...

Read More »Pushing Past the Breaking Point

Schemes and Shams Man’s willful determination to resist the natural order are in vain. Still, he pushes onward, always grasping for the big breakthrough. The allure of something for nothing is too enticing to pass up. Systems of elaborate folly have been erected with the most impossible of promises. That prosperity can be attained without labor. That benefits can be paid without taxes. That cheap credit can make...

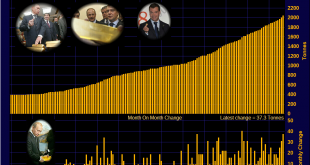

Read More »Does the recent spate of Central Bank gold buying impact demand and price?

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org