There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces. In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply. By pumping up new stores of money (first by revaluing gold and attracting overseas inflows) after serious and sustained deflation it was believed that restored inflation, or reflation, was the necessary predicate for full recovery. It never really happened that way, though, even as gold poured in and economic as well as

Topics:

Jeffrey P. Snider considers the following as important: 1937, currencies, Dollar, economy, eurdollar futures, EuroDollar, Featured, Federal Reserve, Federal Reserve/Monetary Policy, Inventory, Markets, missing money, Monetary Policy, Money Supply, newslettersent, The United States, Total business sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces.

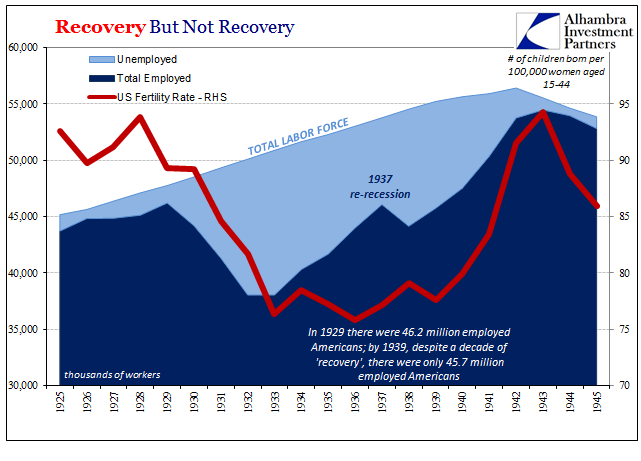

In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply. By pumping up new stores of money (first by revaluing gold and attracting overseas inflows) after serious and sustained deflation it was believed that restored inflation, or reflation, was the necessary predicate for full recovery. It never really happened that way, though, even as gold poured in and economic as well as asset prices rose. The economy during the Great Depression didn’t ever get back to the trend of the twenties despite all that effort, and therefore left far too many out of the reflation for it to become recovery. The re-recession in 1937 had a lot to do with that, as the BIS wrote in close observation within its 8th Annual Report issued early in 1938:

|

US Recovery, 1925 - 1945 |

| How many times have we heard over the past ten years, starting in 2008, of the fear of inflation that was not imminent? It seems ingrained in the institution to believe itself far more relevant and powerful than it ever really is at any one time.

The US was “gorged with gold” and seemingly moving in reflation up until 1937; and then disaster, as the Fed forced its inflation fears where they didn’t belong, misreading reflation as sufficient for recovery. |

World Gold, Apr 1935 - Oct 1938 |

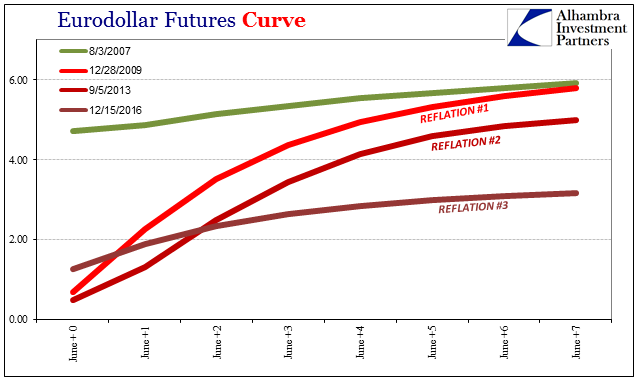

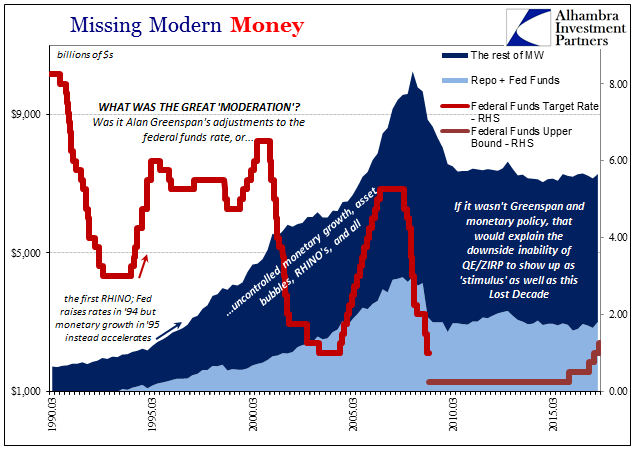

| The current state of the global economy is such that it has been subject to now three possible reflation attempts because of two additional monetary disruptions; almost like a pair of 1937’s, though as the initial crash not of nearly the same magnitudes. The difference in the 2010’s as opposed to the 1930’s is that the Fed was not the cause this time.

Though they are now making the same noises on inflation that is not imminent, and even adjusting monetary policy for it (maybe, they don’t really know), that’s not what started the secondary monetary event in 2011 nor the tertiary aftershock in 2014-16. The simple reason the Fed could screw up so badly in the thirties is that gold was money and bank reserves at the base of effective currency supply. Raising reserve requirements had the unintended and unanticipated effect of offsetting (and then some) those gold inflows as banks rebuilt their liquidity margins by holding even more reserves idle. This time in the 21st century, the Fed doesn’t know what money is let alone where bank reserves might play any role. Whether it expands its balance sheet or contracts it, neither matters and it has played out exactly that way. And so each of the so far three reflations haven’t actually been reflation by all that much; certainly nowhere near enough to be sufficient boost to create recovery. |

Eurdollar Futures, June 2010 - 2017(see more posts on eurodollar futures, ) |

In market terms, investors really caught on this last time. Curves in particular showed that despite a turnaround of sorts in the second half of 2016 there really wasn’t a whole lot of faith that it would amount to anything more; and more so that it was as likely to quickly fade as to continue in acceleration to recovery. As I wrote of it back in January at the outset of 2017:

More and more, that’s exactly what we find of this year. There was some rebound, even reflation (oil, in particular) in the second half of 2016, but little more than that continuing on in 2017. The curves are proven right to be suspicious, not that that is surprising. |

US Total Business Sales, Jan 2009 - 2017(see more posts on Total business sales, ) |

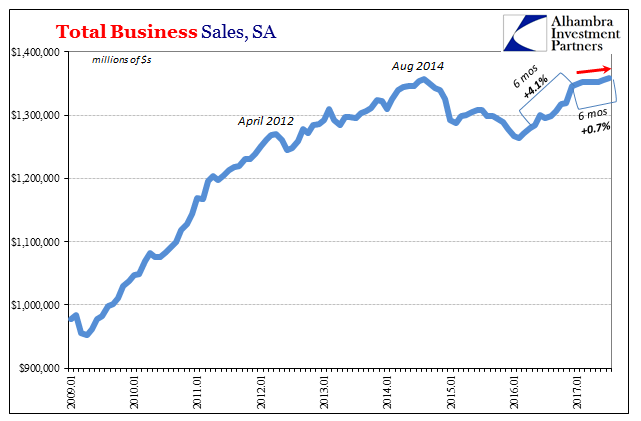

| Total Business Sales, a broad measure of the goods economy that unlike GDP does count all sales on all levels of the supply chain (more consistent with how the real economy operates), grew almost robustly toward the end of last year. In the six months up to and including January 2017, sales grew by 4%, a more than 8% annual rate that if it had continued would be close to a recovery pace. |

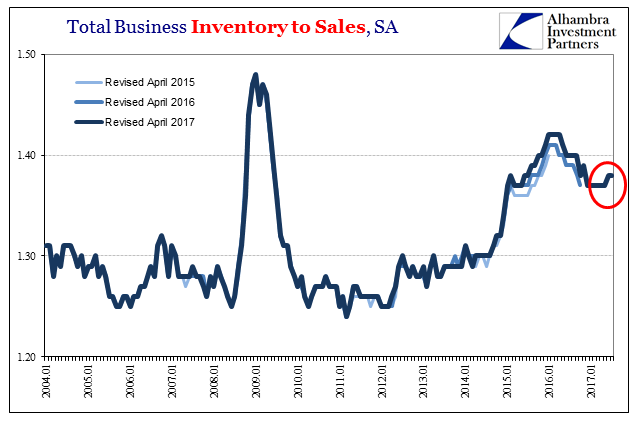

US Total Business Inventory to Sales, Jan 2004 - 2017 |

| Instead, they have leveled off remarkably since, coinciding with the turn in oil prices. In the last six months (through July 2017), total business sales are up not even 1%. That’s a pre-recessionary rate of growth, something far more concerning than comforting; neither reflation nor close to recovery. |

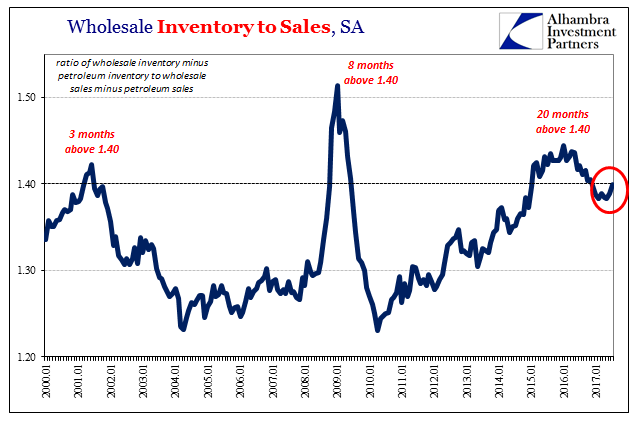

US Wholesale Inventory to Sales, Jan 2000 - 2017 |

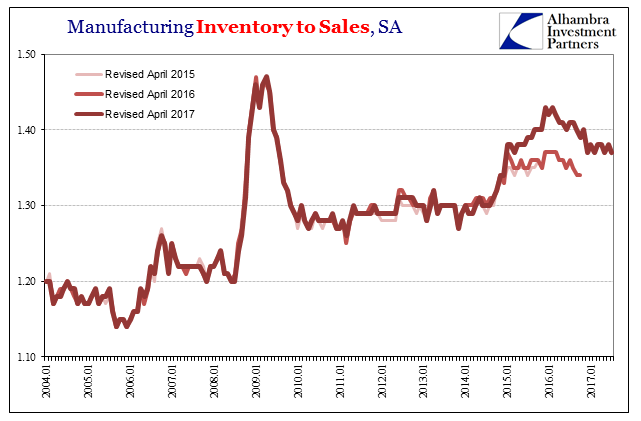

| The reason it is more like pre-recession is inventory. Inventories all throughout the supply chain remain very high. Without inventory liquidations there really can’t be enough momentum from inventory restocking to get into pre-recovery, reflation or otherwise. |

US Manufacturing Inventory to Sales, Jan 2004 - 2017 |

| If inventory levels become a further impediment to growth at the margins, that would mean more cyclical “headwinds” than are already evident. |

US Retailer Inventory to Sales, Jan 2004 - 2017 |

| Many will surely blame the Fed for what is shaping up to be more disappointment from the unresolved depths of the last disappointment. That’s just not the case, as the Fed is irrelevant and for once nearly off the hook (except by being irrelevant it is a form of dereliction). There won’t be an explosion of growth and inflation because there never was reflation, or at least any that was sufficient and of sufficient duration to do more than get people’s hopes up. |

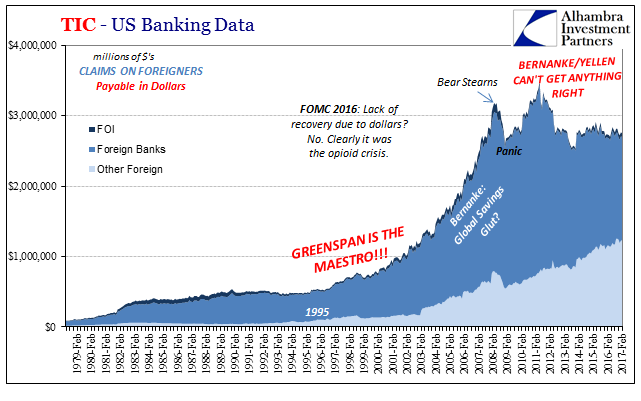

US Banking Data, Feb 1979 - 2017 |

| Unlike stocks, the bond or eurodollar market is discounting the future as it is, rather than looking for imminent inflation that won’t ever be. In the thirties, it took the Fed to further spoil a world gorged with gold, to completely undo positive money growth and any potential that might have created. In the teens, there is no money growth in the first place because the Fed failed in its duties a long, long time ago. |

Missing Modern Money, March 1990 - 2017(see more posts on missing money, ) |

Tags: 1937,currencies,dollar,economy,eurdollar futures,EuroDollar,Featured,Federal Reserve,Federal Reserve/Monetary Policy,Inventory,Markets,missing money,Monetary Policy,Money Supply,newslettersent,Total business sales