by Dominic Frisby of Money Week Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of ...

Topics:

GoldCore considers the following as important: Asia Pacific, Bank of England, Bitcoin, Business, Central Banks, Consumer Price, CPI, currency, Dollar, economy, Germany, Gold, Gold as an investment, Gold Bugs, Gold Standard, goldman sachs, Great Depression, International trade, M0, M1, M2, M3, Monetary Policy, Money, Money Supply, Precious Metals, Puerto Rico, Recession, Reuters, S&P 500, Silver as an investment, Sovereigns, Switzerland, U.S. Treasury, US Federal Reserve, Volatility, Zurich

This could be interesting, too:

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

investrends.ch writes «Die Nerven liegen derzeit blank»

investrends.ch writes Bitcoin fällt unter 90 000 US-Dollar

investrends.ch writes Bitcoin zieht deutlich an

by Dominic Frisby of Money Week

Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances.

There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book.

Yesterday I got an email from them, containing a “best of” – a compendium of some of the best charts from this year’s report.

I thought in today’s Money Morning, we might flick through some of them…

Commodities are very cheap compared to stocks

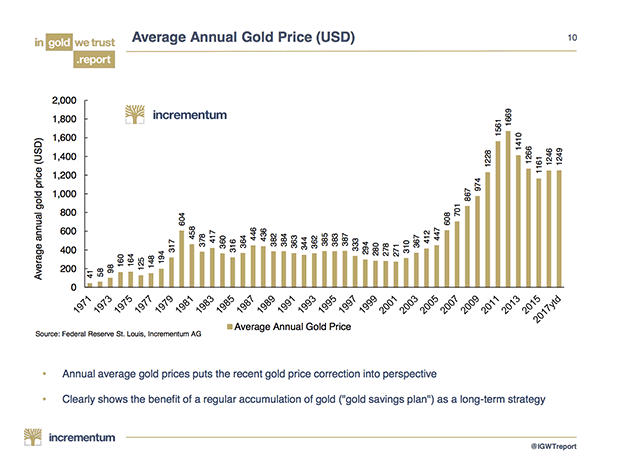

For those of you who have been, like me, despairing of the gold price these last five years, this first chart shows the average annual price of gold for each year.

Suddenly the last five years don’t feel quite as bad. In the mid-$1,200s is sort of normal (since 2008, at least).

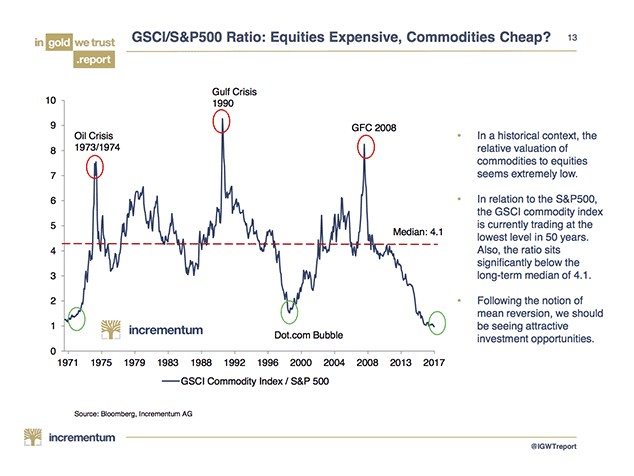

This next chart got me very excited. It shows the ratio of the Goldman Sachs commodities index to the S&P 500 – the ratio of commodities to stocks, in other words.

Commodities are as cheap on a relative basis as they were in the late 1990s and at the beginning of the 1970s. In other words, very cheap indeed.

I’m quite bullish on industrial metals and energy at present. I think such “late cycle” assets will do well in a stock bull market which is mature and, probably, a lot closer to the end than the beginning of its cycle. I don’t, however, think that commodities are the irresistible bargain they were in 1999.

The chart above, however, would suggest otherwise. It is screaming, “buy commodities, sell stocks”. The inference is that there is some inflation around the corner.

Could a US recession be around the corner?

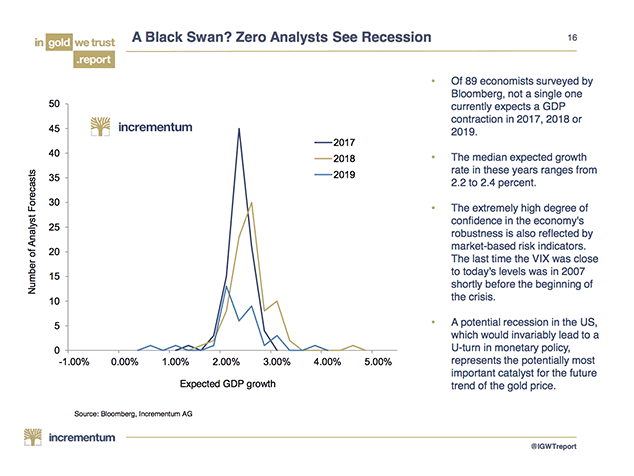

Here’s one for the contrarians: in a recent Bloomberg survey, not one economist out of 89 expects a US GDP contraction in 2017, 2018 or 2019. Meanwhile the Vix (the index of volatility) is at all-time lows. There is, in short, a heck of a lot of complacency out there.

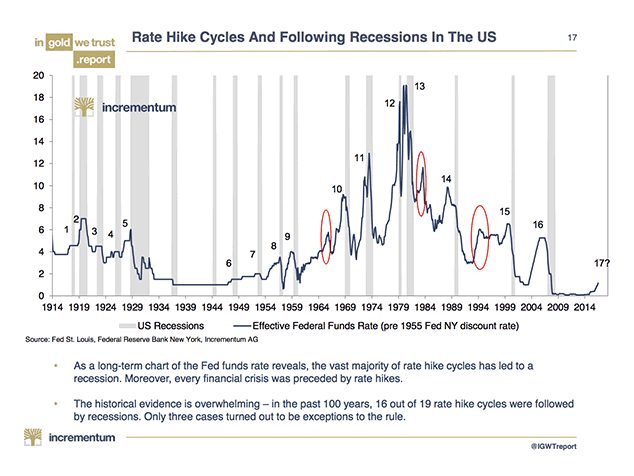

Are we now in a rate-hiking cycle? In the US we seem to be, even if interest rates now stand at only 1.25%. The Bank of England meets next week. Inflation, as judged by the Consumer Price Index (CPI) – the Bank’s target measure – came in at 3% yesterday, the last report before the Bank’s meeting. Surely even Mark Carney has to put up rates now.

That could be a significant turning point. According to this next chart, 16 of the last 19 rate rise cycles have led to recessions.

That doesn’t necessarily mean that interest-rate rises cause recessions – often it’s the over-expansion caused by the loose monetary policies which preceded the rate rises – but nevertheless there does seem to be some kind of relationship. Perhaps more rate rises could result in the recession that nobody is forecasting.

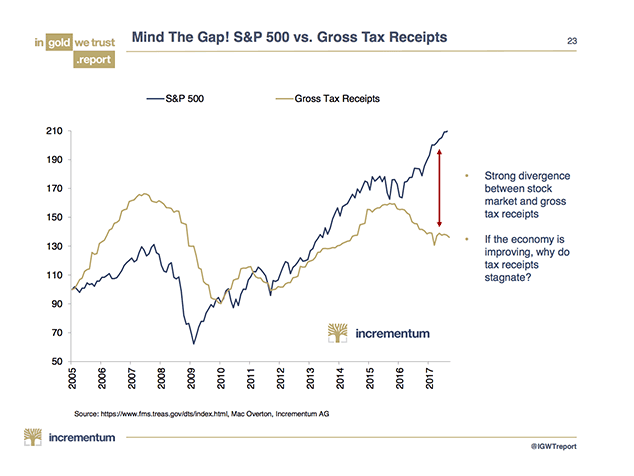

Following on from that, the next chart hints that all is not as well with the economy as we might believe. As someone who did a show at the Edinburgh Festival on tax and is now writing a book on the same subject, any cool tax charts are bound to get the blood flowing, and this is no exception.

The S&P 500 may be rising – but gross tax revenues aren’t. The amount of tax being paid, whether on a personal or corporate level, is indicative of how much people are earning and how much economic activity is taking place. Tax receipts are in decline. The omens are not good.

You could draw the same chart for net corporate tax receipts. The pattern is the same.

It’s another hint that the economy is not faring quite as well as the stockmarket suggests it is.

What if gold were money again?

Finally some charts for the hard money advocates.

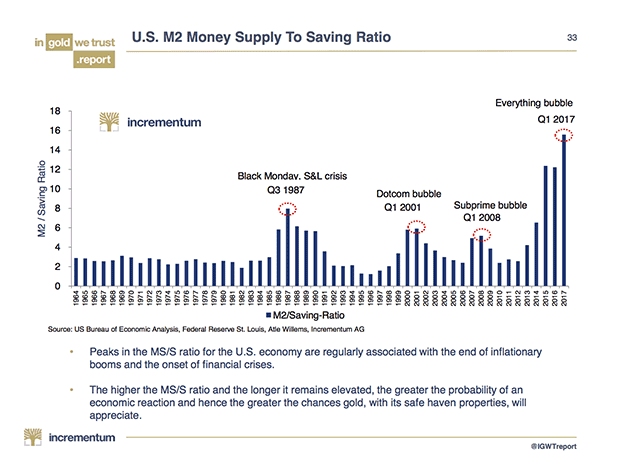

The first shows, basically, the ratio of the money supply – ie, the amount of money that has been printed – compared to savings. The higher the blue bar, the less money is being saved.

If the narrative of this chart is believed, this is not going to end well – although I stress that you could have made the same point in 2014, 2015 and 2016 , so perhaps we will be making the same observation for another three years.

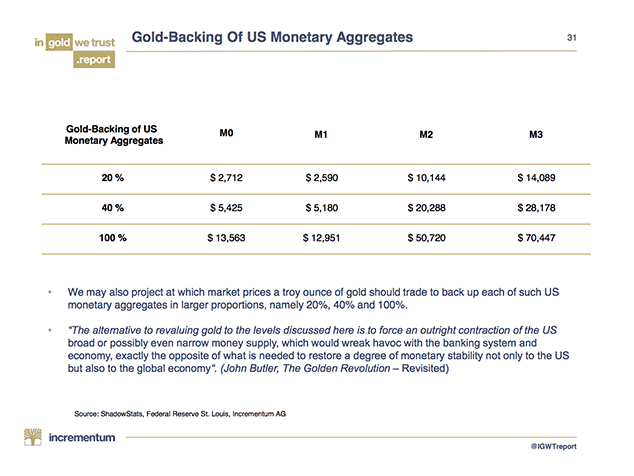

Lastly, some simultaneously sensible yet ridiculous projections of the gold price in the future.

During the 1980 Iranian hostage crisis, gold went to $850 an ounce – for a day. On that day – 21 January – the US dollar was, effectively, fully backed by gold. At $850 an ounce, the market value of the 260 million ounces of gold owned by the US and mostly stored in Fort Knox (don’t mention the audit) reached $221bn. Yet only some $160bn paper dollars were in issue.

So US gold was actually worth 140% of US paper. So low was confidence in the dollar (indeed all paper money at the time), that the US had, in a way, been put back onto a gold standard. One Zurich banker declared: “The US Treasury is once again solvent, thanks to the high price of gold”.

Many gold bugs – including yours truly at one stage – were waiting for that day to come again. Because money supply and debt are so high, central banks will lose control, confidence will be lost and gold will soar as a result.

I now see such a scenario as most unlikely – though I stress it has happened many times before, so there’s no reason it can’t happen again. And in such a light, we consider the table below.

There are all sorts of different measures of money supply.

M0 and M1 are basically cash and other money equivalents that are easily convertible into cash. M2 is M1 plus short-term time deposits in banks and money market funds. M3 is M2 plus longer-term time deposits and money market funds. The exact definitions vary from country to country.

The following table shows what price gold would be if it were equivalent to 20%, 40% or 100% of the various measures of US money.

In the event of some kind of fiat crisis akin to that of 1980, the numbers start getting pretty big. 140% of M1 – the intraday 1980 number – would give us a gold price somewhere near $18,000. Nice work if you can get it. Although I imagine bitcoin will get to $18,000 long before gold does.

But this all makes the assumption that, at some stage, prevailing attitudes to gold – that it is an analogue relic in a digital world – will change. And that it will be ascribed some kind of value as money in extremis. I’m not so sure that day will ever happen, or at least not in the near term. Others will disagree.

In any case, the main takeaways from the charts are then that both gold and commodities are cheap, relative to both money supply and to stockmarkets; and that, based on tax receipts, contrarian forecasting and rate cycles, some kind of contraction is more likely than many think.

Food for thought, I think you’ll agree.

News and Commentary

Gold prices hold firm as dollar sags (Reuters.com)

Dollar Gains, Treasuries Fall on U.S. Tax Hopes (Bloomberg.com)

Asia-Pacific stocks start lower, edge back into positive territory (MarketWatch.com)

Trump leaning toward Powell for Fed chair, officials say (Politico.com)

Gold purchases on Moscow Exchange won’t change reserves’ outlook - Russia (Reuters.com)

How one of the first big property bubbles led to the Great Depression (MoneyWeek.com)

Warning of 'ecological Armageddon' after dramatic 75% plunge in insect numbers (Yahoo News)

S&P 500 Is Now Overvalued On 18 Of 20 Metrics (ZeroHedge.com)

2 Charts Show S&P A Bubble and Risk of Crash (ZeroHedge.com)

China’s Greater Bay Area gets a big green light (StansBerryChurcHouse.com)

Gold Prices (LBMA AM)

20 Oct: USD 1,280.25, GBP 974.27 & EUR 1,084.76 per ounce

19 Oct: USD 1,283.40, GBP 975.64 & EUR 1,087.42 per ounce

18 Oct: USD 1,280.65, GBP 972.53 & EUR 1,090.47 per ounce

17 Oct: USD 1,289.70, GBP 973.47 & EUR 1,097.02 per ounce

16 Oct: USD 1,305.15, GBP 981.08 & EUR 1,107.03 per ounce

13 Oct: USD 1,293.90, GBP 972.88 & EUR 1,093.73 per ounce

12 Oct: USD 1,294.45, GBP 977.96 & EUR 1,092.26 per ounce

Silver Prices (LBMA)

20 Oct: USD 17.08, GBP 12.96 & EUR 14.46 per ounce

19 Oct: USD 17.03, GBP 12.93 & EUR 14.40 per ounce

18 Oct: USD 16.95, GBP 12.86 & EUR 14.42 per ounce

17 Oct: USD 17.11, GBP 12.96 & EUR 14.55 per ounce

16 Oct: USD 17.41, GBP 13.09 & EUR 14.75 per ounce

13 Oct: USD 17.20, GBP 12.94 & EUR 14.55 per ounce

12 Oct: USD 17.20, GBP 13.06 & EUR 14.50 per ounce

Recent Market Updates

- How Gold Bullion Protects From Conflict And War

- Silver Bullion Prices Set to Soar

- Brexit UK Vulnerable As Gold Bar Exports Distort UK Trade Figures

- Puerto Rico Without Electricity, Wifi, ATMs Shows Importance of Cash, Gold and Silver

- U.S. Mint Gold Coin Sales and VIX Point To Increased Market Volatility and Higher Gold

- Global Outlook – Mad, Mad, Mad, MAD World: News in Charts

- Young Guns of Gold Podcast – ‘The Everything Bubble’

- London House Prices Are Falling – Time to Buckle Up

- Perth Mint Gold Coins Sales Double In September

- Survey shows UK and US Pensions Crisis is Imminent

- Gold Investment In Germany Surges – Now World’s Largest Gold Buyers

- Yahoo Hacking Highlights Cyber Risk and Increasing Importance of Physical Gold

- Safe Haven Silver To Outperform Gold In Q4 And In 2018

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.