After a sharp rise in the construction of rental units, vacancy rates are rising, and slowing rent growth could weigh on inflation metrics.The US has witnessed a striking boom in the construction of rental residential units in recent years. This can in part be explained by the rising allure of downtown living among millennials and ageing baby boomers alike. The boom can also be explained by the lingering effects of the subprime crisis, and the restrained access to mortgage credit that has...

Read More »Euro area: solid growth, but inflation still under par

GDP figures confirming a strong and steady expansion have yet to turn up in core inflation data.According to preliminary Eurostat estimates, euro area real GDP increased by 0.6% q-o-q in Q3, slowing marginally from an upwardly-revised 0.7% in Q2. A breakdown by expenditure components will not be released until 14 November, but domestic demand was likely the key driver in the euro area’s solid momentum.At a country level, France and Spain are the first of the big four euro area economies to...

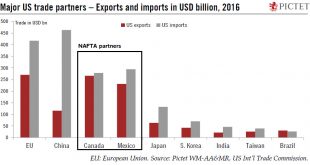

Read More »NAFTA update — Calling Trump’s bluff

We see little risk of NAFTA falling apart in the near term, but question marks remain about the US’s commitment to free trade in the longer term.NAFTA renegotiation talks, which have hit a wall as a result of the US’s blatantly mercantilist and protectionist approach, will resume in mid-November in Mexico against the backdrop of some heavy-handed anti-dumping initiatives by the US authorities, with the slapping of punitive trade tariffs on some Canada-manufactured airplanes in October still...

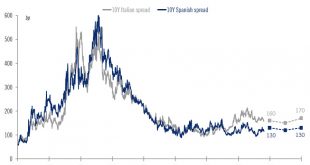

Read More »Italian and Spanish bonds relatively immune to politics

While political risks have fallen marginally in Italy, political tensions have intensified in Spain. But, as things stand, we do not think that political risk in either country will lead to a systemic crisis.Italy and Spain have been at the centre of market attention again in recent weeks. Italian politics have livened up as we move towards the general election next spring 2018, while the threat of Catalan independence has placed the spotlight on Spain. But we expect only a slight widening...

Read More »Downward pressure on Swiss franc could fade in 2018

While its persistent weakness leads us to change our short-term forecast for the franc, our outlook for the currency next year remains unchanged.The Swiss franc remains weak, notably against the euro, despite geopolitical tensions, elevated political uncertainty in Spain and some euro weakness relative to the US dollar. This means that the unattractiveness of the franc (based on its high valuation and low yield) outweighs its defensive features.In the short term, given interest rates...

Read More »Limited market reaction to Catalan developments

Markets remain sanguine ahead of Catalan elections in December, but continuing uncertainty could hurt investor sentiment.On 27 October, the Catalan parliament voted for a unilateral declaration of independence. The same day, the Spanish senate approved the terms of application of Article 155 of the constitution, allowing Madrid to impose direct rule on Catalonia. Prime Minister Mariano Rajoy called a snap election in Catalonia for 21 December, earlier than any dates that had so far been...

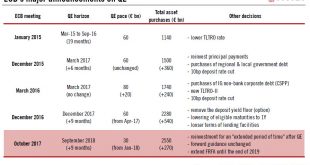

Read More »ECB QE composition – some degree of constructive ambiguity

The ECB has hinted it intends to remain flexible when it comes to the composition of future asset purchases, with a chance that corporate bonds will play a bigger role.Arguably, the most important aspect of last week’s ECB quantitative easing (QE) announcement was that the programme will remain open-ended. As we have long suggested, the pledge to extend asset purchases beyond September 2018 can only be credible if there are enough German Bunds for the ECB to buy. Bund scarcity could be...

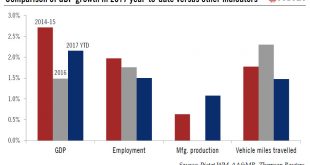

Read More »The U.S. economy is doing fine

US GDP growth in the third quarter was good, and momentum may be firmer than we expected. There are upside risks to our 2018 growth forecast.US GDP grew 3.0% q-o-q SAAR in Q3 2018, pushing up the y-o-y print to 2.3%. In a word, the US economy is doing fine, although it still lacks sparkle. The impact of August hurricanes was barely perceptible. IT investment was particularly solid, rising 8.6% y-o-y, and consumer spending growth was tepid (up 2.6% y-o-y), with some softness in...

Read More »A buoyant euro area labour market

Leading indicators point to an acceleration in already strong job creation in the quarters ahead.Recent economic crises took a heavy toll on the employment level in the euro area, with almost five years of uninterrupted employment losses. Between its pre-crisis peak in the first quarter of 2008 and the second quarter of 2013, euro area employment levels fell by 3.6%, or more than 5.5 million.However, since hitting a low point in the second quarter of 2013, euro area employment has shown...

Read More »Bend it like Draghi

The ECB’s announcement on bond purchases leads us to expect its QE programme to end by Q1 2019, with a hike of the main refi rate in September that year.The European Central Bank’s (ECB) decisions today were in line with our and consensus expectations, including a slower pace of asset purchases (rescaled from EUR60bn to EUR30bn per month), a longer and open-ended extension (until September 2018, or beyond if necessary), and stronger forward guidance (committing to keeping policy rates at...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org