US business sentiment is solid, yet bank lending remains muted, making us cautious about the outlook for investment growth.US business activity seems to be continuing apace and all forward-looking indicators, in particular sentiment surveys, are flashing green. But there is an important blemish in this otherwise rosy picture: bank lending has been soft, and recent data is not showing any signs of an uptick. In September, commercial and industrial (C&I) bank lending was up 2.0% y-o-y, down from 2.4% y-o-y in August. So far this year, bank lending is up only 3.1% from last year, a marked deceleration from 8.7% average growth since 2011.To be sure, there does not seem to be any tightening in financial conditions. Corporate debt issuance, particularly of lower-quality debt, is flourishing.

Topics:

Thomas Costerg considers the following as important: Macroview, Us bank lending, US credit growth, US investment growth, US loan demand

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

US business sentiment is solid, yet bank lending remains muted, making us cautious about the outlook for investment growth.

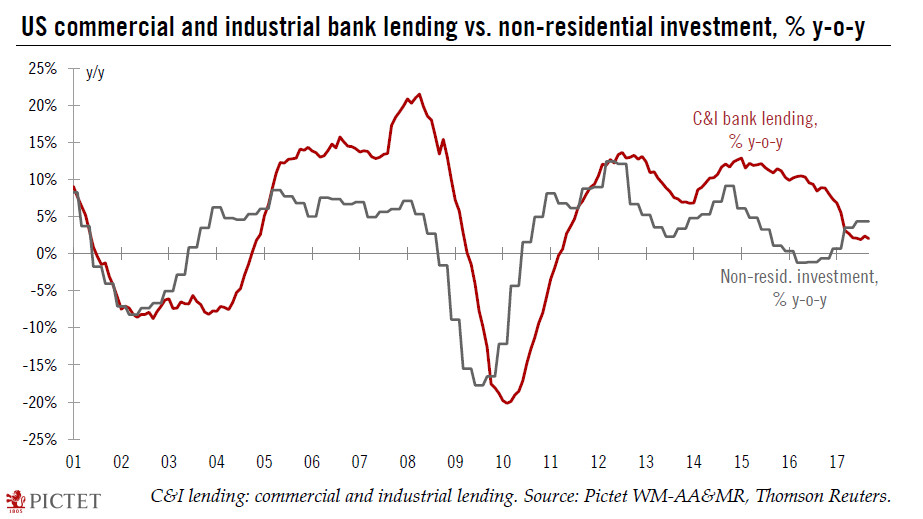

US business activity seems to be continuing apace and all forward-looking indicators, in particular sentiment surveys, are flashing green. But there is an important blemish in this otherwise rosy picture: bank lending has been soft, and recent data is not showing any signs of an uptick. In September, commercial and industrial (C&I) bank lending was up 2.0% y-o-y, down from 2.4% y-o-y in August. So far this year, bank lending is up only 3.1% from last year, a marked deceleration from 8.7% average growth since 2011.

To be sure, there does not seem to be any tightening in financial conditions. Corporate debt issuance, particularly of lower-quality debt, is flourishing. According to the Securities Industry and Financial Markets Association, investment-grade debt issuance is up 0.4% this year, while high-yield issuance is up 13.4%. There may be some replacement of bank lending with market debt going on, especially in the high-yield segment.

But banks tend to have tighter lending standards than debt-market participants anyway, so the sluggishness in lending seems also to reflect slow demand for credit, particularly among small and medium-sized firms. Meanwhile, an important source of demand for loans, the energy sector, seems to be losing momentum after a strong start to the year, as the moderation in adds to rig count since July suggests. Overall, slack bank lending growth continues to make us cautious about the outlook for US non-residential investment in 2018. Helped by the uptick in the energy sector in the first half of this year, we expect non-residential investment (13% of GDP) to increase 3.9% y-o-y this year, but growth to slip to 1.2% in 2018.