Summary:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationHeadline volatility on equity markets remains low, and given robust economic and earnings growth we are still constructive on equities, particularly the euro area and Japan. We are neutral on the US, selective on Swiss stocks, and underweight the UK.However, there are signs of pressure, notably in forex markets, and headline volatility could rise in the coming months. Moreover, geopolitical risk remains elevated, and we are keeping protection in portfolios against downside risk.Low correlations and a pick-up in disruptive M&A mean a good environment for active management.EM local-currency bonds continue to look tempting, since we remain sceptical about US fiscal stimulus. However, it is important to

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationHeadline volatility on equity markets remains low, and given robust economic and earnings growth we are still constructive on equities, particularly the euro area and Japan. We are neutral on the US, selective on Swiss stocks, and underweight the UK.However, there are signs of pressure, notably in forex markets, and headline volatility could rise in the coming months. Moreover, geopolitical risk remains elevated, and we are keeping protection in portfolios against downside risk.Low correlations and a pick-up in disruptive M&A mean a good environment for active management.EM local-currency bonds continue to look tempting, since we remain sceptical about US fiscal stimulus. However, it is important to

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management’s latest positioning in fast-evolving markets.

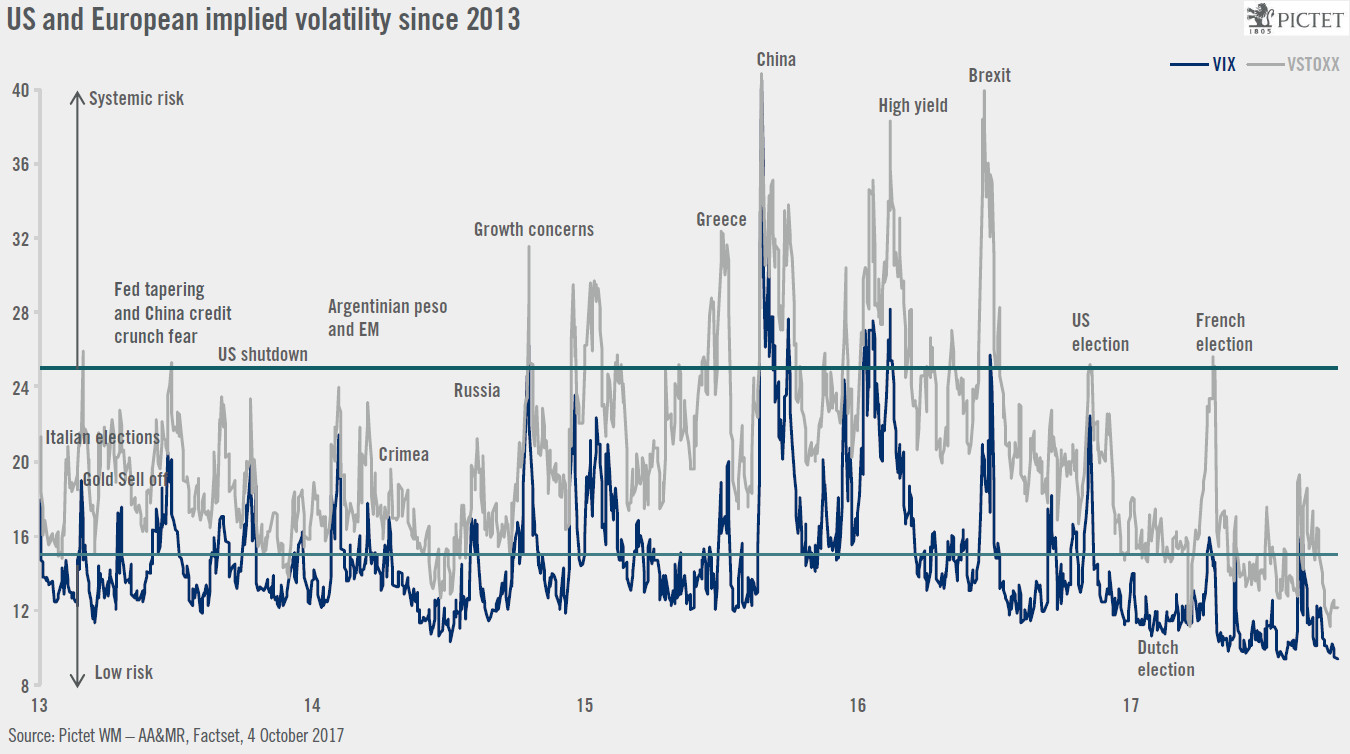

- Headline volatility on equity markets remains low, and given robust economic and earnings growth we are still constructive on equities, particularly the euro area and Japan. We are neutral on the US, selective on Swiss stocks, and underweight the UK.

- However, there are signs of pressure, notably in forex markets, and headline volatility could rise in the coming months. Moreover, geopolitical risk remains elevated, and we are keeping protection in portfolios against downside risk.

- Low correlations and a pick-up in disruptive M&A mean a good environment for active management.

- EM local-currency bonds continue to look tempting, since we remain sceptical about US fiscal stimulus. However, it is important to avoid exposure to EM currencies of countries with large current-account deficits.

Commodities

- We see the current equilibrium oil price at USD55/b, and our scenario is for it to remain around this level over the next 12 months – slightly above current prices.

Equities

- September was another strong month for DM equities. Economic and earnings growth should be sufficient to prolong the equities rally even without a US fiscal stimulus. We expect high-single-digit earnings growth in Europe next year and low-double-digit in the US.

- However, earnings growth is better distributed in Europe than the US, where the tech sector is playing a dominant role.

Currencies

- The USD’s recent rebound is likely to continue in the final months of 2017. However, we continue to expect a gradual weakening of the dollar in 2018, and estimate an EUR/USD rate of 1.24 for end-2018.

- Yields on core sovereign bonds rose in September, in line with our year-end target for of 2.5% for the 10-year US Treasury yield and 0.7% for the German Bund. As we still expect yields to rise, we would stay underweight core sovereign bonds and short duration.

- Pockets of opportunity remain in credit markets. We continue to prefer euro corporate credit over US, notably bonds not eligible for the ECB’s corporate sector purchase programme (CSPP).

- We expect US high yield spreads to widen, from 385 bp at the end of August to around 420 bp by the end of 2017.

Alternatives

- Our outlook for hedge funds remains positive, as monetary and political developments should work in favour of most strategies.

- Valuations, competition and capital inflows remain high in private equity, but there are still good opportunities for attractive returns.