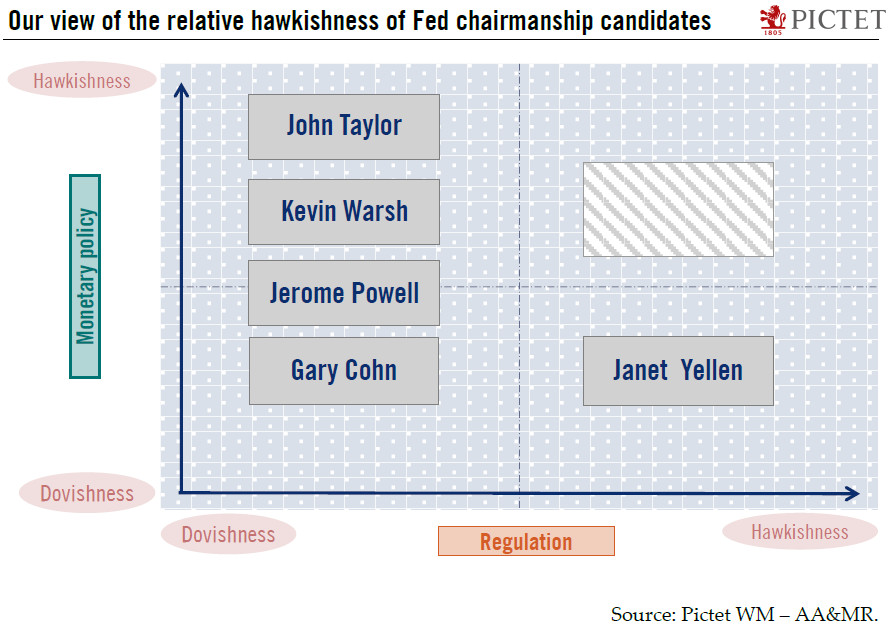

Markets are speculating about the potential hawkishness of the Fed’s next chairperson, but we doubt there will be any ‘regime change’ in monetary policy.The Trump White House has reportedly narrowed the list of candidates for the role of Fed Chair to five people, and a decision could be announced in the coming days.The initial market reaction could be guided by the perceived hawkishness of any nominee compared with Janet Yellen. John Taylor and Kevin Warsh are perhaps the most hawkish of the five names on the short list. Gary Cohn and Jerome Powell are seen as more ‘middle-of-the-road’ pragmatists. At this stage, uncertainty remains high about who will get the job; it may be down to a question of personal chemistry with Trump.Taylor and Warsh would probably be seen by market participants

Topics:

Thomas Costerg considers the following as important: Fed appointments, Fed candidates, Fed chairmanship, Fed hawkishness, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Markets are speculating about the potential hawkishness of the Fed’s next chairperson, but we doubt there will be any ‘regime change’ in monetary policy.

The Trump White House has reportedly narrowed the list of candidates for the role of Fed Chair to five people, and a decision could be announced in the coming days.

The initial market reaction could be guided by the perceived hawkishness of any nominee compared with Janet Yellen. John Taylor and Kevin Warsh are perhaps the most hawkish of the five names on the short list. Gary Cohn and Jerome Powell are seen as more ‘middle-of-the-road’ pragmatists. At this stage, uncertainty remains high about who will get the job; it may be down to a question of personal chemistry with Trump.

Taylor and Warsh would probably be seen by market participants as the two short-listed with the most potential to engender a ‘break’ with current Fed policy and to bring about faster and steeper rate hikes. Taylor argues that the Fed under Yellen has shown too much discretion in its rate setting and has not taken sufficient account of the data, resulting in excessive deviation (in a dovish direction) from monetary policy guidelines, including his own ‘Taylor rule’. We think Warsh would be mellower than his current hawkish writings suggest, in part because we think it could be difficult and time-consuming to change the current policy regime.

Despite their hawkish image, we do not think Warsh or Taylor would materially alter the course of Fed policy. We would probably not rush to change our Fed funds rate forecasts if either of them were nominated. Indeed, we believe their hawkishness could well be diluted if they get the role—but the risks of policy dogmatism (and of a hawkish shift) are higher with Taylor than with Warsh.

Yellen is in the running for reappointment; she probably ticks many boxes for the role and it is customary for Fed presidents to be reappointed for a second term, even if the presidential administration changes. But she faces resistance among the Trump staff. She could stay on as ‘acting’ Chair if Trump delays his decision—for instance if he is side-tracked by other, more pressing matters.

Our scenario calls for two additional quarter-point rate hikes, one in December 2017 followed by another in March 2018. But a more hawkish Chair would raise the risk of an additional hike in 2018.