Recent signals suggest that the ECB is likely to announce next week the extension its asset purchases for nine months, at a reduced pace of EUR30bn. We expect corporate bonds to form a bigger part of total purchases.Recent ECB communication has been remarkably consistent in signalling a ‘slower for longer’ QE extension into 2018. In light of these signals, we expect the ECB to announce at its 26 October meeting that asset purchases will be extended for nine months, until at least September 2018, at a reduced pace of EUR30bn per month, compared with the present rate of EUR40bn.The Governing Council will, of course, discuss a range of alternative options. The ECB’s emphasis on “patience and persistence” means that an even longer QE extension, at a rate of EUR20-25bn for 12 months, looks

Topics:

Frederik Ducrozet considers the following as important: ECB asset purchase programme, ECB exit strategy, ECB monetary policy, ECB quantitative easing, ECB tapering, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

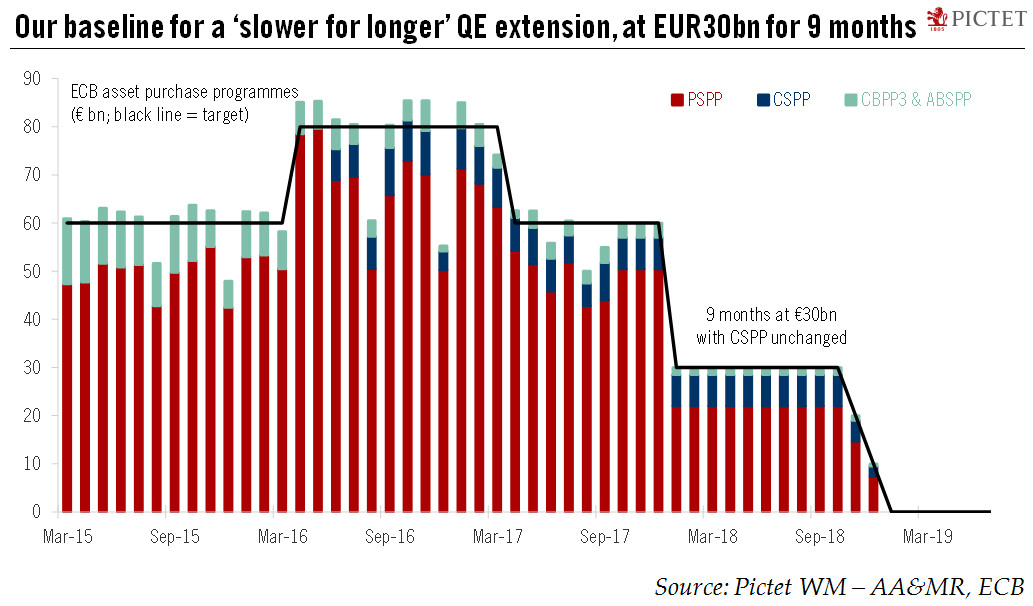

Recent signals suggest that the ECB is likely to announce next week the extension its asset purchases for nine months, at a reduced pace of EUR30bn. We expect corporate bonds to form a bigger part of total purchases.

Recent ECB communication has been remarkably consistent in signalling a ‘slower for longer’ QE extension into 2018. In light of these signals, we expect the ECB to announce at its 26 October meeting that asset purchases will be extended for nine months, until at least September 2018, at a reduced pace of EUR30bn per month, compared with the present rate of EUR40bn.

The Governing Council will, of course, discuss a range of alternative options. The ECB’s emphasis on “patience and persistence” means that an even longer QE extension, at a rate of EUR20-25bn for 12 months, looks more likely than a six-month extension at EUR40bn (as per our initial baseline).

Stronger forward guidance is a given, but the ECB’s credibility will depend both on the duration of the QE programme and on the extent to which bond scarcity is being addressed. We continue to expect corporate bonds purchases to represent a larger share of the programme in the future.

ECB communication continuity should be reflected in a commitment to keep policy rates low until “well past” the end of QE, to reinvest bond proceeds for longer, and to retain the option of increasing QE if needed. We are maintaining our forecast of a first refi rate hike in Q3 2019, but reckon that a one-off deposit rate hike is now unlikely in 2018.