Through its asset purchase programme, the Bank of Japan owns 4% of the TOPIX’s market capitalisation and two-thirds of Japanese equity ETFs.Although it has made no major monetary policy announcement since September 2016, the Bank of Japan (BoJ) has actually been tapering its government bond purchases ever since. As a result, equity ETF purchases have steadily increased over the past year from 3% of total BoJ purchases to 9% recently, above the initial implicit target of 7%.The central bank now has a 65% share of Japanese ETFs’ assets under management. While this may look significant, it represents only about 4% of the current TOPIX market capitalisation. However, the BoJ’s involvement in ETF purchases represents a major shift in the Japanese equity market.So far in 2017, foreign investors

Topics:

Wilhelm Sissener and Jacques Henry considers the following as important: Bank of Japan asset purchases, BoJ ETF purchases, BoJ monetary policy, Japanese equity market, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Through its asset purchase programme, the Bank of Japan owns 4% of the TOPIX’s market capitalisation and two-thirds of Japanese equity ETFs.

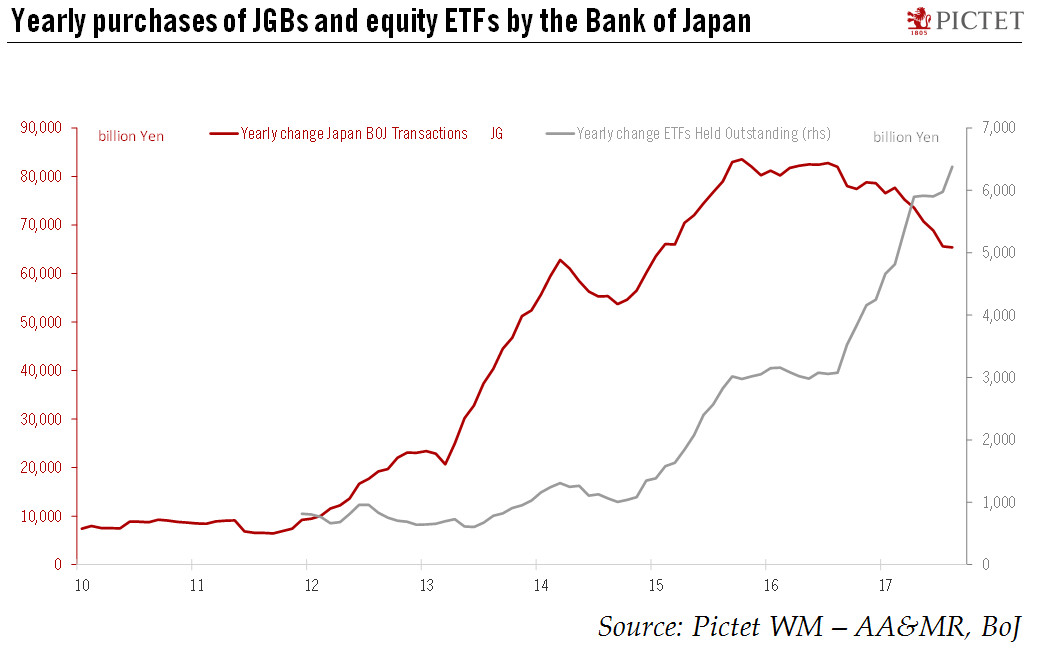

Although it has made no major monetary policy announcement since September 2016, the Bank of Japan (BoJ) has actually been tapering its government bond purchases ever since. As a result, equity ETF purchases have steadily increased over the past year from 3% of total BoJ purchases to 9% recently, above the initial implicit target of 7%.

The central bank now has a 65% share of Japanese ETFs’ assets under management. While this may look significant, it represents only about 4% of the current TOPIX market capitalisation. However, the BoJ’s involvement in ETF purchases represents a major shift in the Japanese equity market.

So far in 2017, foreign investors have, on average, been net sellers of Japanese equities. The erratic flow of foreign funds to Japan contrasts significantly with the steady flows originating in the BoJ. While foreign flows regularly turn negative, central bank flows have been constantly positive since 2013 and significantly so since Q4 2016. Over the last 12 months, the BoJ’s relative purchases have accounted for more than 100% of net inflows into Japanese equity markets.

The Japanese yen/US dollar exchange rate and the TOPIX have tended to exhibit a positive correlation. As Japanese equities are predominantly cyclical and exposed to global markets, a weak JPY tends to boost earnings and therefore equity prices. This sole relationship explains the rise in Japanese equities following the launch of Abenomics in 2013. But there has been a slight decoupling: the JPY/USD rate has essentially traded sideways since the end of 2016, while the TOPIX has continued to rise. The widening gap between the foreign exchange rate and the TOPIX coincides with intensification of the BoJ’s equity purchases.

In our central scenario for global equities in 2018, we expect valuations and currency fluctuations to exert a smaller effect on equity prices than earnings growth. Boosted by the BoJ’s support, our core scenario therefore remains constructive on Japanese equities. Low volatility levels should persist, but occasional spikes cannot be excluded.

The 22 October snap election called by Prime Minister Shinzo Abe could generate some volatility. We consider a change in government as a very small tail risk, but one that could spell the end of Abenomics and of the BoJ’s current monetary policy stance. As our scenario for Japanese equities rests on the maintenance of current BoJ policies, investors need to pay close attention to the election results.