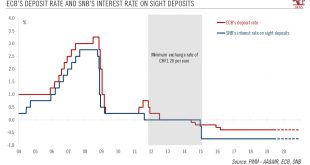

The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates. At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit,...

Read More »Oil prices are reeling

The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts. The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession. Business sentiment has been...

Read More »Weekly view – Dovish murmurs

The CIO office’s view of the week ahead.ECB president Mario Draghi has gone as dovish as possible without cutting rates, saying for the first time that he is prepared to cut interest rates and redeploy quantitative easing before he leaves the bank this autumn. Any interest rate rise in Europe will not happen until the second half of 2020 at the earliest, he suggested. As global uncertainty around trade remains elevated, the outlook for large exporting economies like Germany looks every more...

Read More »Oil prices are reeling

The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts.The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession.Business sentiment has been deteriorating for some time. By May, the world Purchasing Manager Index for...

Read More »House View, June 2019

Pictet Wealth Management's latest positioning across asset classes and investment themesAsset allocationWe have turned tactically underweight on global equites, including US equities, given elevated valuations, mixed economic data and rising trade tensions. We remain neutral on euro area equities, where valuations are generally more reasonable than in the US. We have also moved from an overweight to neutral stance on Asian emerging-market equities.At the same time as we remain focused on...

Read More »Why has euro inflation stayed so low?

Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020. The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y. While this reflects volatility stemming from the date of Easter this year, one can...

Read More »A dovish Fed could become even more so

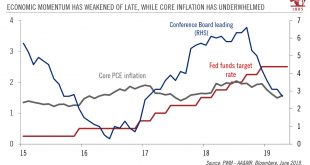

Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months. We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts: 1) a continuation of President Trump’s pro-tariff stance...

Read More »Why has euro inflation stayed so low?

Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020.The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y. While this reflects volatility stemming from the date of Easter this year, one can legitimately ask why inflation remains so low in the euro area, with the underlying...

Read More »ECB preview – so close, yet so far away

The European Central Bank’s meeting on 6 June is unlikely to result in major policy changes, but instead will focus on risk assessment and TLTRO-III. The press conference could set the stage for a policy response should downside risks materialise.Long story short, the ECB should continue to err on the side of caution, while preparing for dovish contingencies, which could range from the easy to the scary. The easy plan would follow if risks to the outlook remain firmly tilted to the downside....

Read More »A dovish Fed could become even more so

Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months.We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts: 1) a continuation of President Trump’s pro-tariff stance (with the risk of dampening business sentiment and therefore investment); 2)...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org