We continue to forecast a gradual pick-up in the pace of economic expansion from 1.5% in 2015 to 1.8% in 2016, largely led by domestic demand. Read the full report here According to Markit’s preliminary estimates, the euro area composite PMI decreased slightly from 53.1 in March to 53.0 in April. Nevertheless, the employment component improved in both the manufacturing and services sectors. Looking at forward-looking components, the manufacturing new export orders and new business...

Read More »The ECB focuses on policy implementation and reaffirms its independence

Takeaways from the press conference following the ECB's policy meeting of 21 April 2016 Read the full report here The 10 March ECB meeting was all about bold action and strong signals. The main message from the 21 April meeting was one of continuity, consistency and cohesion. The ECB’s assessment of economic conditions has not changed materially in the past few weeks, with the view that existing and upcoming policy measures will help to push inflation higher over the medium-term. In the...

Read More »Navigating through rollercoaster markets

Macroview As growth fails to attain a stronger trajectory and deflation remains a threat, the credibility of central banks has begun to suffer. Yet we remain relatively upbeat on prospects for world growth although we expect continued volatility in some asset classes. April insights from Pictet Wealth Management's Asset Allocation & Macro Research team The current decline in US profit margins would usually herald a recession. The continued decline in earnings expectations is a concern,...

Read More »Banking crisis? What banking crisis?

In spite of the various pressures facing banks, the ECB's latest Bank Lending Survey points to continued improvement in loan conditions. The hope must be that ECB policies will continue to facilitate bank lending in the months ahead Read the full report here The ECB’s April Bank Lending Survey (BLS), conducted among 141 banks between 11 and 30 March 2016 and released today, revealed a net easing of credit conditions for companies for the eighth consecutive quarter. The demand for loans...

Read More »ECB policy meeting: different things to worry about

While we expect the ECB to remain on hold at its next policy meeting on April 21, a number of issues are coming steadily into focus Read the full report here The ECB is facing a complex, albeit not completely negative, macro-financial environment following its impressive policy package announcement on 10 March. Nevertheless, barring some new shock, beyond some fine-tuning measures, the ECB should remain on hold at its next policy meeting on 21 April. Instead, we expect different aspects...

Read More »Euro Area Politics: It’ll Be Alright on the Night

The political temperature is rising in the euro area. But in the short term at least, we believe political developments could actually boost sentiment Europe is facing a number of risk events amid a deteriorating political and social backdrop (see Table 1 below for the most important ones), including the ongoing migrant crisis, the Brexit referendum, the first review of Greece’s third bailout programme, and the prospects of new elections in Spain. There is no stable relationship between...

Read More »Oil prices should rise gradually

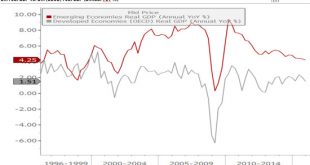

Despite the lowering of global economic prospects, oil prices could rise to USD 50/b by early 2017. On April 12, the International Monetary Fund (IMF) published its World Economic Outlook survey, containing its economic forecasts for 2016 and 2017. The IMF revised downward its global growth forecast for 2016 by 0.2%. In a recent post we presented our macro-econometric model, which showed a stable long-term relationship between oil price, global economic growth and the US dollar. Based on...

Read More »Despite March disappointment, we remain upbeat on US spending

Although US core retail sales increased only slightly in March and consumer spending growth was probably modest in Q1 overall, we remain sanguine on household spending for the rest of the year. According to the US Department of Commerce, nominal total retail sales fell by 0.3% m-o-m in March, well below consensus expectations (+0.1%). However, February’s number was revised up slightly, from -0.1% to +0.0%. In March, total retail sales were dented by a 2.1% m-o-m fall in nominal auto...

Read More »In the April issue of ‘Perspectives’

Interesting times for China, some scepticism about the recent market rebound, and prospects for private equity investing are some of the themes in the April edition of 'Perspectives', out now in English In the April issue of Perspectives, Christophe Donay, head of macroeconomic research at Pictet, argues that the Chinese fiscal and monetary authorities still have plentiful resources to ensure that China achieves a growth rate of 6.5-7.0% this year and next. But China will sooner or later...

Read More »Commodity stress abates, but concerns persist

The worst of the market turmoil is behind us, but the upside for equities looks limited After large market swings in the first quarter, our baseline scenario for 2016 remains intact: we continue to see an absence of momentum for financial markets due to a lack of earnings growth, limited upside due to already rich valuations, and recurring spikes in volatility. In this environment, an active tactical asset allocation is key, in order to boost returns by playing the ups and downs of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org