Despite the lowering of global economic prospects, oil prices could rise to USD 50/b by early 2017. On April 12, the International Monetary Fund (IMF) published its World Economic Outlook survey, containing its economic forecasts for 2016 and 2017. The IMF revised downward its global growth forecast for 2016 by 0.2%. In a recent post we presented our macro-econometric model, which showed a stable long-term relationship between oil price, global economic growth and the US dollar. Based on this relationship and the IMF’s latest growth forecast, the oil price could rise towards USD 50/barrel in 2017. Slower economic growth in 2016 and 2017 Ahead of the IMF/World Bank spring gathering of the world’s top economic policymakers in Washington on April 15, the IMF lowered its world GDP growth forecast from 3.4% to 3.2% for 2016 and from 3.6% to 3.5% for 2017. The IMF justified the growth downgrade by mentioning several adverse factors such as the slowdown and rebalancing in China, further declines in commodity prices, falls in the volume of cross-border investment and trade, declining capital flows to emerging markets and geopolitical tensions. Does lower economic growth mean lower oil price? Lower global economic growth in 2016 could mean lower demand for energy, including oil. Our model shows that a decline in world growth from 3.4% to 3.

Topics:

Jean-Pierre Durante considers the following as important: Macroview, Oil, oil price equilibrium, oil prices, US 50/b

This could be interesting, too:

Marc Chandler writes Greenback Returns Better Bid

Douglas R. Terry, CFA writes Macro: Sep CPI stuck at 3.7% YOY

Marc Chandler writes The Dollar and Oil Steady After Yesterday’s Advance

Marc Chandler writes Dollar Comes Back Bid

Despite the lowering of global economic prospects, oil prices could rise to USD 50/b by early 2017.

On April 12, the International Monetary Fund (IMF) published its World Economic Outlook survey, containing its economic forecasts for 2016 and 2017. The IMF revised downward its global growth forecast for 2016 by 0.2%.

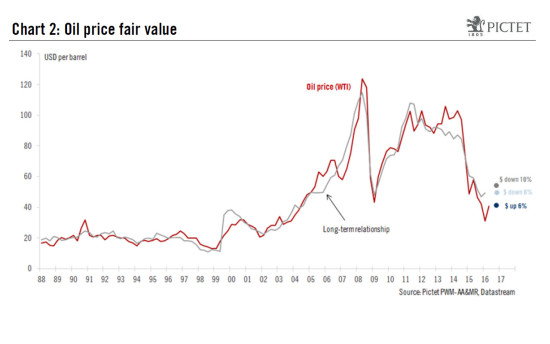

In a recent post we presented our macro-econometric model, which showed a stable long-term relationship between oil price, global economic growth and the US dollar. Based on this relationship and the IMF’s latest growth forecast, the oil price could rise towards USD 50/barrel in 2017.

Slower economic growth in 2016 and 2017

Ahead of the IMF/World Bank spring gathering of the world’s top economic policymakers in Washington on April 15, the IMF lowered its world GDP growth forecast from 3.4% to 3.2% for 2016 and from 3.6% to 3.5% for 2017. The IMF justified the growth downgrade by mentioning several adverse factors such as the slowdown and rebalancing in China, further declines in commodity prices, falls in the volume of cross-border investment and trade, declining capital flows to emerging markets and geopolitical tensions.

Does lower economic growth mean lower oil price?

Lower global economic growth in 2016 could mean lower demand for energy, including oil. Our model shows that a decline in world growth from 3.4% to 3.2% in 2016 would subtract close to USD 2 a barrel from the price equilibrium, which we estimated in our March 4 Flash Note at USD 49/b for the beginning of 2017.

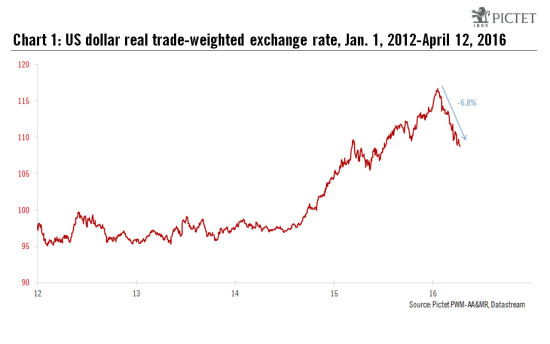

However, in the meantime, the US dollar has weakened substantially – by 6.8% in real trade-weighted terms between 20 January and 12 April. A weaker US dollar tends to support oil prices as it represents an improvement in most oil-importing countries’ terms of trade, thus potentially boosting oil consumption globally.

So, the weaker US dollar observed since the beginning of the year could compensate for the negative impact of weaker growth. A US dollar that remained at the same level as in mid-April for the rest of the year could add close to USD 5 to oil’s current equilibrium price.

Our model still points to USD 50/b oil in 2017

To sum up, analysts are lowering their outlook for global growth in 2016. Weaker economic growth should imply weaker oil demand and thus weaker the oil price equilibrium. However, this is compensated for by the recent weakening of the US dollar.

All in all, using the IMF’s updated growth forecasts for 2016, our macro-econometric model points towards oil at USD 50 per barrel in early 2017, the same level we foresaw in March. This does not take into account geopolitical factors that will continue to influence the spot price. Nonetheless, price equilibrium of USD 50 per barrel should continue to spur oil prices over a 12-month horizon.