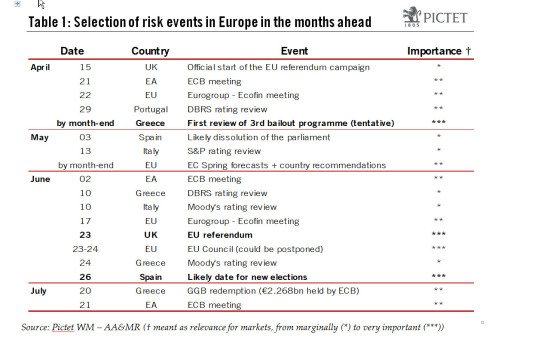

The political temperature is rising in the euro area. But in the short term at least, we believe political developments could actually boost sentiment Europe is facing a number of risk events amid a deteriorating political and social backdrop (see Table 1 below for the most important ones), including the ongoing migrant crisis, the Brexit referendum, the first review of Greece’s third bailout programme, and the prospects of new elections in Spain. There is no stable relationship between political uncertainty and economic activity, and the heterogeneity of risks makes it even more difficult to assess that relationship. Economic indicators have remained resilient, but the risk is that political fragmentation and reform fatigue lead to disappointments later this year, including weaker business confidence, consumer spending and investment. Portugal is a case in point; Spain could be next. The health of domestic demand is particularly important, and the key driver of our above-consensus forecast for euro area GDP growth this year (1.8%). Source: Pictet WM – AA&MR († meant as relevance for markets, from marginally (*) to very important (***)) Political risks loom larger: headlines and deadlines Our macro forecasts have remained broadly unchanged since the start of this year, but the balance of risks has shifted again.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Brexit, European elections, European politics, European sentiment, Greek bailout, Macroview, political instability

This could be interesting, too:

Claudio Grass writes “Inflation it is not an act of God”

Claudio Grass writes “Inflation it is not an act of God”

Dirk Niepelt writes The Economics of Brexit

Marc Chandler writes High Anxiety: China’s Covid and US Inflation

The political temperature is rising in the euro area. But in the short term at least, we believe political developments could actually boost sentiment

Europe is facing a number of risk events amid a deteriorating political and social backdrop (see Table 1 below for the most important ones), including the ongoing migrant crisis, the Brexit referendum, the first review of Greece’s third bailout programme, and the prospects of new elections in Spain.

There is no stable relationship between political uncertainty and economic activity, and the heterogeneity of risks makes it even more difficult to assess that relationship. Economic indicators have remained resilient, but the risk is that political fragmentation and reform fatigue lead to disappointments later this year, including weaker business confidence, consumer spending and investment. Portugal is a case in point; Spain could be next. The health of domestic demand is particularly important, and the key driver of our above-consensus forecast for euro area GDP growth this year (1.8%).

Source: Pictet WM – AA&MR († meant as relevance for markets, from marginally (*) to very important (***))

Political risks loom larger: headlines and deadlines

Our macro forecasts have remained broadly unchanged since the start of this year, but the balance of risks has shifted again. The ECB has reduced financial tail risks with its multi-faceted policy package. Meanwhile, systemic risks from external developments have broadly declined since the turn of the year. The focus has now returned to domestic issues, including political risks.

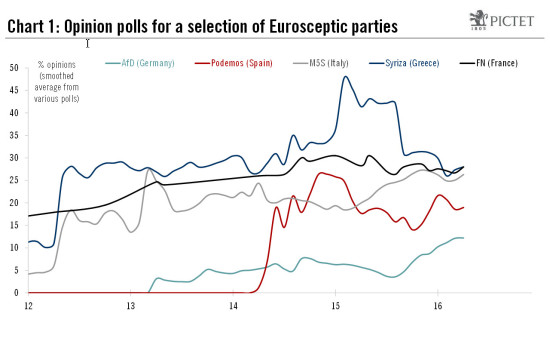

The migrant crisis and the approaching Brexit referendum in the UK, in particular, have crystallised political fragmentation risks, helping to fuel the rise of anti-establishment and Eurosceptic parties in a number of core EU countries while threatening political consensus. A UK vote for Brexit could give added impetus to Eurosceptic parties across the continent, and we think the political consequences for EU member states are being understated.

Moreover, these rising political strains come at a time when annual negotiations have started over European Commission approval of member states’ budget deficits. Spain (where 2015 deficit figures were particularly disappointing), Portugal, and, to a lesser extent Italy and France, remain under pressure to do more to reduce their deficits. The potential for a targeted short-term fiscal stimulus (or, in official jargon, more “pro-growth fiscal consolidation”) is at stake. In Greece, negotiations also include the prospects of debt relief and ECB support. In Italy, all eyes are on the banking sector. Looking ahead, political risks are growing as general elections approach in France (April-May 2017) and in Germany (by October 2017).

In this context, the euro area looks vulnerable to two types of risks. First, protracted uncertainty could weigh on sentiment and activity ahead of important political deadlines (and beyond in the event of an unfavourable outcome). Second, the currency bloc would be hit hard by any new shock, let alone a recession. Monetary policy continues to bear too much of the burden of supporting the economic recovery. A new policy approach, including international co-operation and a fiscal component alongside supportive monetary policy, is badly needed. Political fragmentation and reform fatigue, themselves rooted in disappointing growth outcomes, make such an approach more difficult to achieve.

Source: Wikipedia, Pictet WM – AA&MR

Nevertheless, our baseline scenario remains that the UK will decide to remain in the European Union, that a coalition government will be formed in Spain, and that there will be a positive conclusion to Greece’s bailout review. All these developments should provide a boost to sentiment. There are a number of additional, more fundamental, reasons for our relative optimism in the short term: euro area unemployment has been falling since mid-2013; the aggregate fiscal stance is turning accommodative for the first time in five years; and ECB support has increased steadily and should continue to boost bank credit in particular.