Core PCE, the Fed's favoured inflation gauge, remained stable 1.6% in April Read full report here As widely expected, core Personal Consumption Expenditure (PCE) inflation in the US came in at 1.6% in April, the same rate as in March. Overall, we continue to believe that year-on-year (y-o-y) PCE core inflation — a key price measure for the Fed — will end this year at around 1.9%, i.e. only slightly higher than the average rate registered so far this year (1.7%). The marked pick-up in...

Read More »The ECB seeks balance between caution and confidence

Macroview Signs that inflation is picking up should not prevent ECB heads from striking a dovish tone when they meet in Vienna on 2 June Read full report here The next ECB meeting on 2 June in Vienna will be all about communication. Mario Draghi will need to strike a fine balance between confidence and cautiousness. While we expect the first upward revision to ECB staff projections since Quantitative Easing (QE) started in March 2015, including a rise in its forecast for 2018 HICP...

Read More »US improving, but constraints on Fed rate hikes

The domestic economy is picking up, but downbeat manufacturing and inflation data may still be factors in Fed policy decisions After a habitually disappointing first-quarter GDP figure of 0.5% (first estimate, to be revised on May 27), we expect a significant pick-up in US GDP to about 2.5% in the second quarter, not least because of strong consumer spending, which, according to our estimates, could grow by 3.0% in Q2 2016. Admittedly, consumer spending in the first quarter was...

Read More »Eurogroup deal relieves pressure on Greece

The deal should help Greek banks and bonds, but major questions on Greek debt relief were postponed and Greece’s economy remains in the doldrums Read full report here In the early hours of May 25, the Eurogroup, made up of euro area finance ministers, reached an agreement on Greece. The agreement will see the disbursement of the second tranche of loans (EUR 10.3bn) as part of Greece’s third bailout programme. In addition, a road map was drawn up that opens the way to debt relief after...

Read More »Does Q1 mark start of upward earnings revisions?

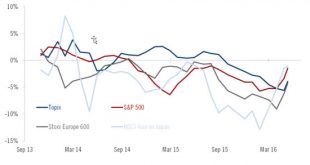

In 2016, we could see upward revisions in earnings expectations as the year progresses. But while earnings may be improving, we believe equity markets hold limited upside potential Read full report here The first quarter results season is almost over, and has been marked by positive surprises from Europe and, less so, the US, while Japanese earnings appear to have suffered from the strength of the yen. US and European net earnings came out 1.4% and 11.2% ahead of expectations, respectively,...

Read More »Purchasing Manager Indices signal modest downside risks to near-term euro growth

Flash estimates for euro area composite PMI eased slightly in May, pointing to a slowdown in economic growth after a strong first quarter Read full report here Following a strong performance in Q1, when real GDP expanded by 0.5% q-o-q (2.1% in annualised terms), the euro area economy was expected to slow down a gear to more sustainable levels of growth. The flash purchasing manager indices (PMI) released on May 23 may signal just that, although mixed news at the national level—with...

Read More »Accommodative European policy mix helps offset political upheaval

Against the backdrop of a charged political climate, greater flexibility on debt and deficit rules plus ECB largesse are helping national economies We are entering a period of heightened political risk across many countries in Europe, marked by the progress of populism, as seen in the surge of support for non-mainstream parties. Not only do we have the Brexit referendum on June 23, but three days later there will be a re-run of the Spanish general election. We still expect strong Spanish...

Read More »Surprisingly hawkish FOMC minutes unsettles observers

Macroview Although the probability of a June/July rate hike by the Fed has increased, the minutes also highlighted downside risks still facing the US economy Read full report here The minutes of the April Federal Open Market Committee meeting published on 18 May surprised by their hawkish tone. The key phrase that unsettled observers was that should conditions continue to improve, “it likely would be appropriate for the Committee to increase the target range for the federal funds rate...

Read More »How much would Brexit cost the world economy?

On 23 June, the British will decide whether to stay in the European Union or not. Using econometric models, we can attempt to measure the impact a vote to leave the EU would have on global and European growth, as well as on equities and bonds Read full report here The relatively small size of the UK economy (2.4% of world GDP) means the global impact of Brexit would be almost negligible in strictly economic terms, according to global-VAR models of the kind used by central banks to assess...

Read More »Core U.S. retail sales surge

Macroview Strong April figures and revisions to March and February numbers mean sonsumer spending is on course to rise around 3% in second quarter Full report April US retail sales The US retail sales report for April was very encouraging, with core retail sales increasing strongly month on month (m-o-m) in April, while the figures for February and March figures were revised upward. Consumer spending growth should approach a strong rate of 3.0% q-o-q annualised in Q2. According to the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org