Although US core retail sales increased only slightly in March and consumer spending growth was probably modest in Q1 overall, we remain sanguine on household spending for the rest of the year. According to the US Department of Commerce, nominal total retail sales fell by 0.3% m-o-m in March, well below consensus expectations (+0.1%). However, February’s number was revised up slightly, from -0.1% to +0.0%. In March, total retail sales were dented by a 2.1% m-o-m fall in nominal auto sales—not a big surprise as previously published data on unit car sales (real) had shown a sharp monthly decline (-5.5% m-o-m). Meanwhile, sales of building materials increased further (+1.4%), while nominal sales at fuel stations bounced back by +0.9% m-o-m on the back of higher gasoline prices. Control sales rose by only 0.1% m-o-m in March As usual, it is important to look at what has happened to control (core) sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, March’s numbers were also rather disappointing. Core sales rose by a mere 0.1% m-o-m, below consensus expectations of a 0.4% rise. However, February’s number was revised up from +0.0% to +0.1%, and January’s reading up from +0.2% to +0.3%. Actually, the cumulative upward revision amounted to 0.

Topics:

Bernard Lambert considers the following as important: Macroview, US consumer spending, US economy, US retail sales

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

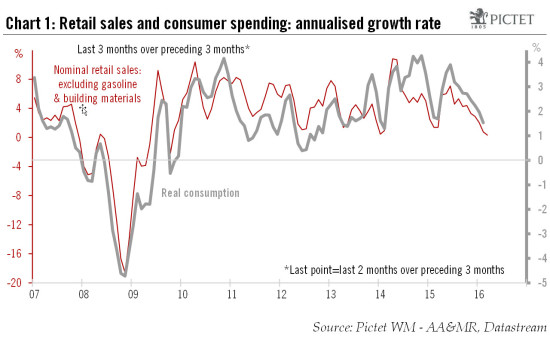

Although US core retail sales increased only slightly in March and consumer spending growth was probably modest in Q1 overall, we remain sanguine on household spending for the rest of the year.

According to the US Department of Commerce, nominal total retail sales fell by 0.3% m-o-m in March, well below consensus expectations (+0.1%). However, February’s number was revised up slightly, from -0.1% to +0.0%. In March, total retail sales were dented by a 2.1% m-o-m fall in nominal auto sales—not a big surprise as previously published data on unit car sales (real) had shown a sharp monthly decline (-5.5% m-o-m). Meanwhile, sales of building materials increased further (+1.4%), while nominal sales at fuel stations bounced back by +0.9% m-o-m on the back of higher gasoline prices.

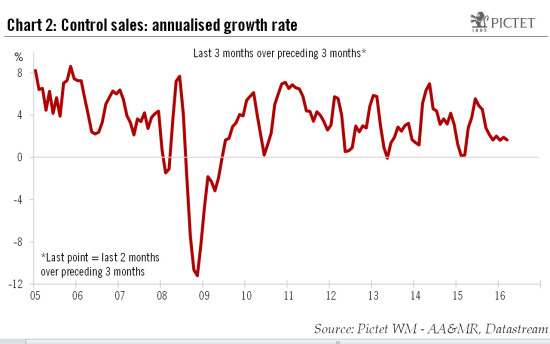

Control sales rose by only 0.1% m-o-m in March

As usual, it is important to look at what has happened to control (core) sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, March’s numbers were also rather disappointing. Core sales rose by a mere 0.1% m-o-m, below consensus expectations of a 0.4% rise. However, February’s number was revised up from +0.0% to +0.1%, and January’s reading up from +0.2% to +0.3%. Actually, the cumulative upward revision amounted to 0.3 percentage points, not a negligible figure. Nevertheless, the end result was that core retail sales grew by ‘only’ 1.9% q-o-q annualised in Q1 2016, following +1.6% in Q4 2015.

Soft consumer spending growth in Q1

What consumer spending growth should be expected for Q1 overall? According to available statistics, between Q4 15 and January-February, real consumer spending in the US grew by ‘only’ 1.5% (see our Flash Note published on 5 April). Today’s numbers point to a slight upward revision to this growth rate. However, as we have seen, core retail sales grew only slightly in March and auto sales fell heavily. By consequence, our forecast that household spending will show growth of 2.2% q-o-q annualised in Q1 probably looks slightly too high. Something modestly below 2.0% seems currently more plausible.

This downward revision to consumption growth—together with soft data on US business inventories for February (also published on April 13)—clearly puts our forecast for Q1 GDP (+1.5% q-o-q annualised) at risk, and potentially also our yearly forecast for 2016 (+2.0%). However, we will wait for official GDP data for Q1 to be published in two weeks’ time (28 April) before adjusting our forecasts.

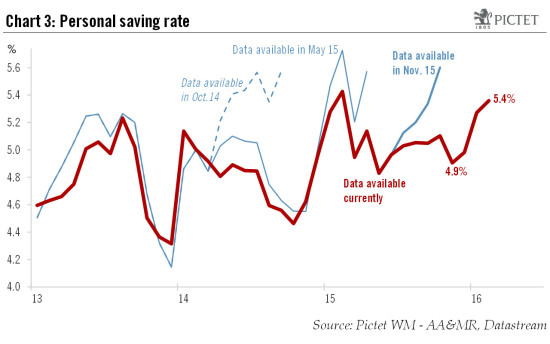

The soft reading for consumer spending growth recorded last quarter is quite surprising. US employment grew by 1.9% q-o-q annualised in Q1 and, thanks to the sharp fall in gasoline prices, real disposable income grew by 3.4% annualised between Q4 and January-February. The softness in spending growth therefore had as a corollary a sharp increase in the savings rate, which rose from 4.9% of disposable income in November 2015 to 5.4% in February 2016. Admittedly, this jump in the savings rate may have been the consequence of international uncertainties and stress in the financial markets at the beginning of this year. However, most measures of consumer confidence were more or less unchanged on average in Q1 2016 compared with Q4 2015. Another possibility is that this jump in the US savings rate is a temporary phenomenon linked to the time lag one often sees between a drop in car fuel prices and its impact on overall consumer spending. Or the rise in the savings rate could be just statistical noise. The savings rate could even be revised down, as it has been in the past (see chart 3).

In summary, we don’t want to overreact to the latest soft household spending numbers. With such robust growth in real household income, consumer spending growth in Q1 may well be revised up by the statisticians and may pick up noticeably in the current quarter.

We remain optimistic on US consumer spending

Overall, we remain sanguine on household spending for the rest of the year. Employment growth is likely to slow somewhat but should nevertheless remain healthy, while wage increases are likely to pick up gradually. The marked rebound in crude oil prices in recent weeks has been followed by a rise in prices at the fuel pump. After seasonal adjustments, gasoline prices probably rose by around 4% in March and will likely increase by another 5% in April. However, this has to be set beside the 4.8% decline in US car fuel prices in January and massive 13.0% fall in February. Moreover, as mentioned above, cheaper energy prices usually has a gradual, lagged positive effect on household consumption. A good part of the windfall from past declines in oil prices has still not been spent by US consumers. In other words, the savings rate currently appears high, and may well decline over the coming months. The consequence of all this is that we continue to expect healthy consumer spending growth in the US over the coming months.