Who President Trump ultimately picks as the next Federal Reserve Chairman doesn’t really matter. Unless he goes really far afield to someone totally unexpected, whoever that person will be will be largely more of the same. It won’t be a categorical change, a different philosophical direction that is badly needed. Still, politically, it does matter to some significant degree. It’s just that the political division isn’t...

Read More »Non-Transitory Meandering

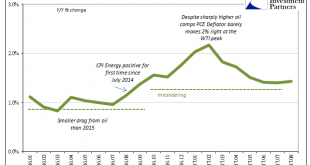

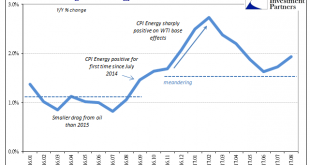

Monetary officials continue to maintain that inflation will eventually meet their 2% target on a sustained basis. They have no other choice, really, because in a monetary regime of rational expectations for it not to happen would require a radical overhaul of several core theories. Outside of just the two months earlier this year, the PCE Deflator has missed in 62 of the past 64 months. The FOMC is simply running out of...

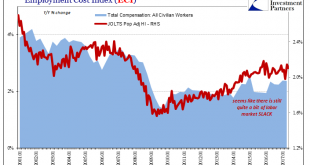

Read More »Die Lösung des Lohnrätsels

Der IWF hat Interessantes herausgefunden: Präsidentin Janet Yellen. Foto: Joshua Roberts (Reuters) Janet Yellen fragte sich diese Woche, ob sie und ihre Kollegen in der US-Notenbank den Zusammenhang zwischen dem Arbeitsmarkt und der Inflation nicht grundsätzlich falsch beurteilen. Obwohl in den USA wieder nahezu Vollbeschäftigung herrsche, ziehe die Teuerung einfach nicht an. Die Arbeitslosenrate ist in den letzten zehn Jahren kräftig gefallen, aber trotzdem steigen die Löhne kaum....

Read More »Bi-Weekly Economic Review: As Good As It Gets

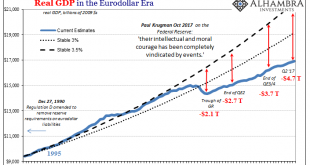

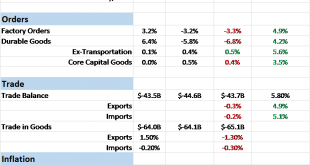

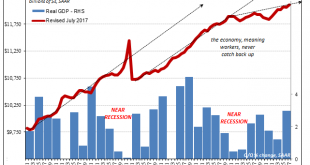

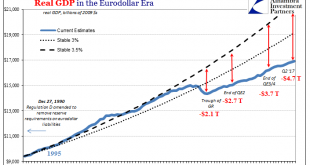

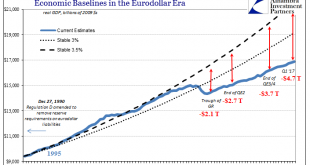

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble...

Read More »The CPI Comes Home

There seems to be an intense if at times acrimonious debate raging inside the Federal Reserve right now. The differences go down to its very core philosophies. Just over a week ago, Vice Chairman Stanley Fischer abruptly resigned from the Board of Governors even though many believed he was a possible candidate to replace Chairman Yellen at the end of her term next year. His letter of resignation only cited “personal...

Read More »When You Are Prevented From Connecting The Dots That You See

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being...

Read More »Das verflixte siebte Jahr

Wird sie mit ihrer Zinserhöhung womöglich eine weitere Krise auslösen? Fed-Präsidentin Janet Yellen. (Foto: Chip Somodevilla/Getty Images) In den letzten dreissig Jahren fand immer im siebten Jahr der Dekade eine grössere Finanzkrise statt. Ist das blosser Zufall, oder steckt dahinter eine Regelmässigkeit, die wir ernst nehmen müssen? Auf den ersten Blick haben die Finanzkrisen nichts Gemeinsames, denn sie gehören unterschiedlichen Typen an. Die Krise von 1987 bestand in einem...

Read More »Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession. Dudley was at that moment, however, undaunted. His eye was cast toward the unemployment rate and that was nothing but encouraging no matter the...

Read More »Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions. Therefore, if inflation behaves as it is supposed to after so many...

Read More »Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook. On the campaign trail, candidate Trump was very harsh on Janet Yellen. Now six months into his...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org