Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group. In the US, the Federal Reserve “raised rates” for the first time in a decade on the same day they released industrial production figures...

Read More »Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them. At Janet...

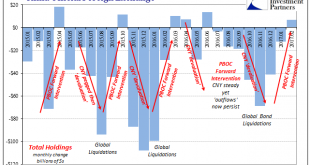

Read More »China And Reserves, A Straightforward Process Unnecessarily Made Into A Riddle

The fact that China reported a small increase in official “reserves” for February 2017 is one of the least surprising results in all of finance. The gamma of those reserves is as predictable as the ticking clock of CNY, in no small part because what is behind the changes in those balances are the gears that lie behind face of the forex timepiece. Yet, each and every time the delta pushes positive there is the same...

Read More »Their Gap Is Closed, Ours Still Needs To Be

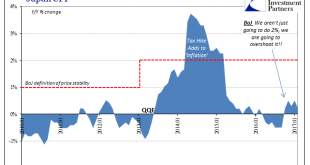

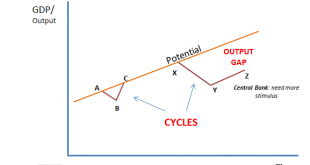

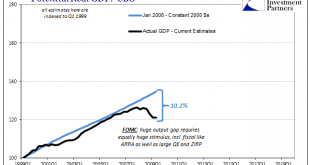

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great...

Read More »Bi-Weekly Economic Review

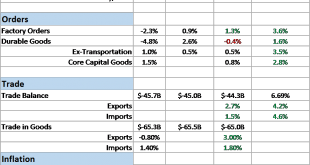

Economic Reports Scorecard The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the...

Read More »The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto. After all, no matter where in the world you buy one, a Big Mac...

Read More »Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017’s ‘known unknowns’ suggest a year of more mayhem awaits… Here’s a selection of key events in the year ahead (and links to Bloomberg’s quick-takes on each). January Donald Trump will be sworn in as U.S. president on Jan. 20.QuickTakes: Immigration Reform, Free Trade and Its Foes, Supreme Court, Oil Sands, Confronting Coal, Climate Change,...

Read More »As Central Bankers Spin

Posted with permission and written by Tim Taschler, Sprott Global I know that I resemble the old guy in this cartoon, standing by helplessly as I watch central bankers experiment with the global economy. Bubbles are blown, again, in several asset classes. Negative interest rates have become an acceptable concept, as if they are just words and have no real economic meaning. Stock markets trade based on the next set...

Read More »S&P Futures Rise Propelled By Stronger Dollar; Europe At 1 Year High As Yen, Bonds Drop

It appears nothing can stop the upward moment of equities heading into the year end, and as has been the case for the past few weeks, US traders walk in with futures higher, propelled by European stocks which climbed to their highest in almost a year, while the dollar rose and bonds and gold fell, failing again to respond to a series of geopolitical shocks following terrorist attacks in Ankara, Berlin and Zurich. The yen tumbled after the Bank of Japan maintained its stimulus plan even as the...

Read More »How Trump Can Bring Outside-the-Box Thinking to Bear on the Fed

The Fed operates in secret, creates inflation, and bails out Wall Street. - Click to enlarge President-elect Donald Trump will soon have the opportunity to put his stamp on the Federal Reserve. And that is making the elite body of central bankers nervous. On the campaign trail, Trump harangued Fed chair Janet Yellen for pumping up financial markets with cheap money – accusing the Obama appointee of being politically...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org