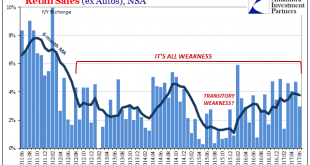

Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January. The economy in 2017 is not...

Read More »Keine Finanzkrise mehr zu unseren Lebzeiten?

Alles im grünen Bereich, sagt die US-Notenbankchefin: Janet Yellen in London am 27. Juni 2017. Foto: Frank Augstein (Keystone) Zehn Jahre sind seit dem Ausbruch der globalen Finanzkrise vergangen. Im Frühjahr 2007 frassen sich erste Verluste aus dem amerikanischen Subprime-Hypothekenmarkt durch die Bankenwelt, im August 2007 kam es zu einem ersten dramatischen Liquiditätsschock im Finanzsystem. Ein gutes Jahr später, im September 2008, stand die Finanzwelt – und mit ihr die gesamte...

Read More »Keine Finanzkrise mehr zu unseren Lebzeiten?

Alles im grünen Bereich, sagt die US-Notenbankchefin: Janet Yellen in London am 27. Juni 2017. Foto: Frank Augstein (Keystone) Zehn Jahre sind seit dem Ausbruch der globalen Finanzkrise vergangen. Im Frühjahr 2007 frassen sich erste Verluste aus dem amerikanischen Subprime-Hypothekenmarkt durch die Bankenwelt, im August 2007 kam es zu einem ersten dramatischen Liquiditätsschock im Finanzsystem. Ein gutes Jahr später, im September 2008, stand die Finanzwelt – und mit ihr die gesamte...

Read More »Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

The following article by David Haggith was first published on The Great Recession Blog: We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%. Tech stocks nosedived while others rose to create new highs. Is this a one-off, or has a...

Read More »Less Than Nothing

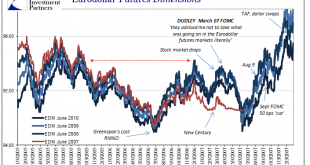

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs. It has been this way from the beginning, even before the beginning as if that was possible. The Great Financial Crisis has no official start date, but we...

Read More »Hopefully Not Another Three Years

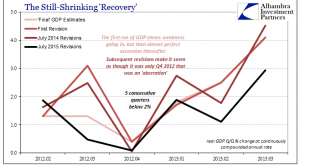

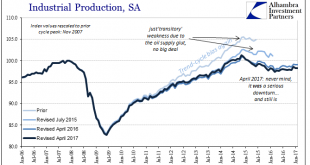

The stock market has its earnings season, the regular quarterly reports of all the companies that have publicly traded stocks. In economic accounts, there is something similar though it only happens once a year. It is benchmark revision season, and it has been brought to a few important accounts already. Given that this is a backward looking exercise, that this season is likely to produce more downward revisions...

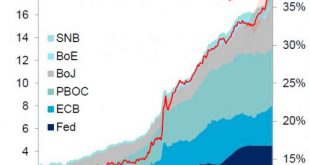

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More »Noose Or Ratchet

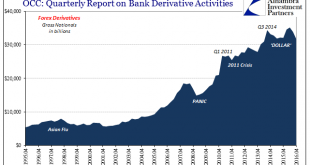

Closing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks. As expected, data compiled by the Office of Comptroller of the Currency (OCC) shows the same negative tendencies...

Read More »Defining Labor Economics

Economics is a pretty simple framework of understanding, at least in the small “e” sense. The big problem with Economics, capital “E”, is that the study is dedicated to other things beyond the economy. In the 21st century, it has become almost exclusive to those extraneous errands. It has morphed into a discipline dedicated to statistical regression of what relates to what, and the mathematical equations assigned to...

Read More »Now You Tell Us

As we move further into 2017, economic statistics will be subject to their annual benchmark revisions. High frequency data such as any accounts published on or about a single month is estimated using incomplete data. It’s just the nature of the process. Over time, more comprehensive survey results as well as upgrades to statistical processes make it necessary for these kinds of revisions. There is, obviously, great...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org